Skrill is an electronic money system. The business was founded in 2001. It allows people to make simple, secure, and quick money transfers and payments through the Internet — from international money transfers to shopping, gaming, trading, and betting. It is the best and secure way to pay for items on Baxity Store — a relible reseller of vouchers, prepaid, gift and gaming cards.

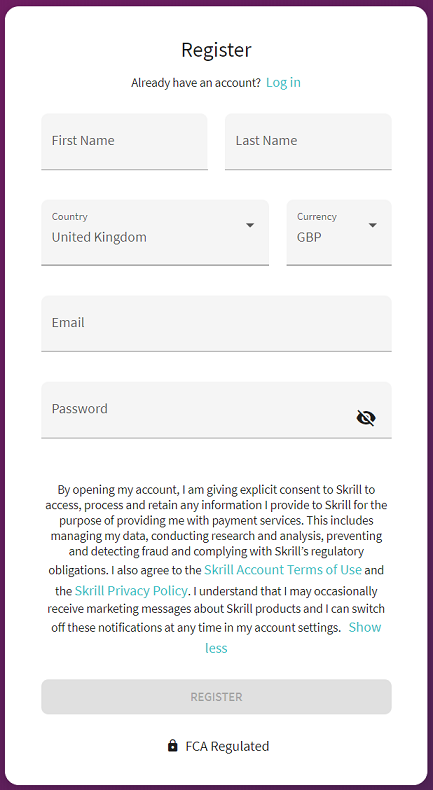

Skrill Account Registration

Opening a Skrill account is free. All you need to create an account is a working phone number and e-mail address. You will need to pass the verification process and make a deposit with the amount of $5 as you are an ordinary user. If you are registering through Baxity.com, you shouldn’t make a deposit for verification. And then your account will be up and running.

- To ensure the link works correctly, turn off VPN or private mode on your browser, and also clear your cookies and cache before clicking on the link.

- To create a new Skrill account, click here.

- During registration, you’ll be asked to fill in your personal information on the first form. We suggest you insert all your real data that are in your documents. Notice that you will be asked to confirm your address with the extract from your bank account or your paid utility bill, where it is stated your address.

- Enter your first name — the name you choose to identify with by law.

- Enter your last name — your family name, as stated in the document that you will provide for verification.

- Select your country.

- Select the currency in which you’d like to send and receive money on Skrill. Choose the currency that you will really use for your deposit. Otherwise, you pay extra money for currency exchange (all about Skrill fees).

- Please enter your correct e-mail address. Make sure it is a working e-mail address as you’ll have to confirm it’s yours. We suggest using the e-mail that you rarely utilize because this is safer.

- Set a password. It must be at least eight characters long and contain at least 1 letter and 1 number or symbol.

- Read Skrill’s Account Terms of Use and the Skrill Privacy Policy before clicking Register.

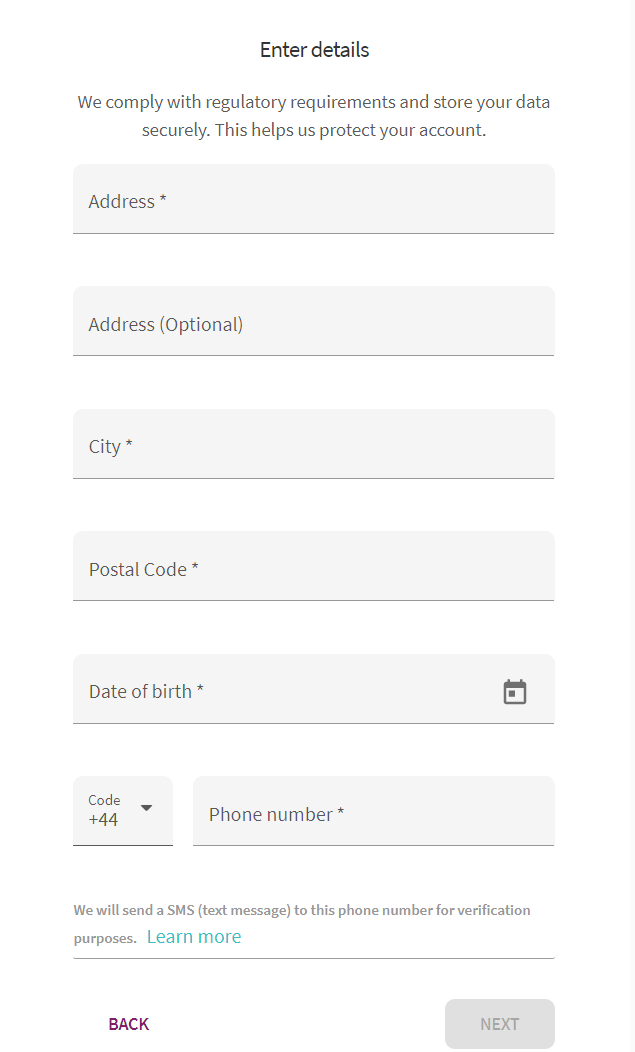

4. After clicking Register, you’ll be asked to fill in some information as regulations demand Skrill ask them. Boxes ticked with an asterisk are mandatory, so you have to complete them.

- Use your real address as you’ll need to have to confirm it during Skrill account verification.

- The second address box is for those who have a second address, but it’s optional.

- Enter the city in which you reside.

- Fill in your postal code in the next box.

- Enter your date of birthday, month, and year.

- Lastly, enter your phone number with your country’s code on the left-hand side. Then click next.

5. After that, you’ll be asked to secure your account by entering your current phone number to receive an SMS (text message) for verification purposes. Don’t forget to set your country’s code, then click continue.

6. A six-digit code will be sent to your phone number. After you input it, you click continue, and your Skrill account is all set.

7. Why should you register on Skrill with our link? Well, because you will enjoy more benefits like you shouldn’t make a deposit of €5 for your signup for going through the process of verification.

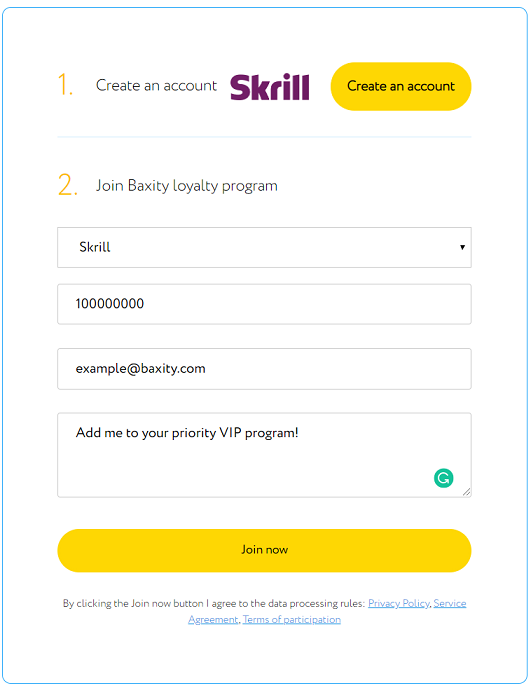

8. You can further enjoy more privileges from us when you join our loyalty program. In our loyalty program, you can receive the Bronze account when you deposit €3000 Silver on a deposit of €5000, and Gold on a deposit of €15,000. To enjoy this program, visit the page, and send us a request. Fill out the form as follows:

- Ensure the payment system selected is Skrill.

- Enter your Skrill Account ID, which can be found at the top right corner of your screen after you log into your account.

- Add a comment if you want and click Join Now, and you’re good to go.

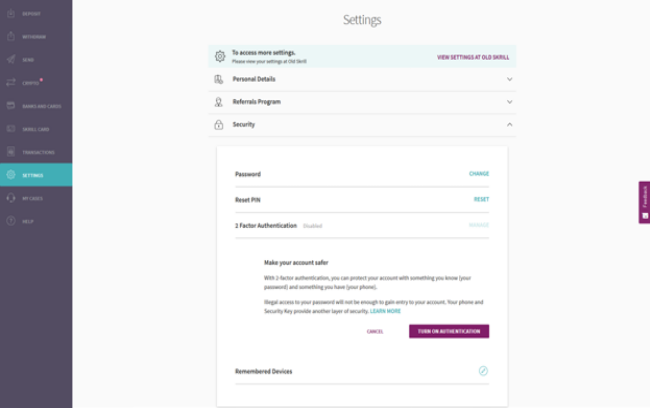

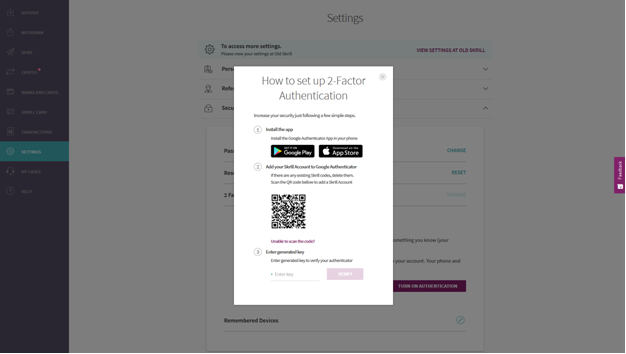

How to Enable Two-Factor Authentication

Two-factor authentication or 2FA is an extra security measure that requires something only the user has on them — it could be a mobile phone or a token. Using a password and e-mail together with a 2FA will significantly reduce the risk of intruders gaining access and stealing your data or identity. To enable two-factor authentication of Skrill:

- Log into your Skrill account, click on Settings at the left side of your screen, and then click on Security.

- Please scroll down to 2 Factor Authentication, click on it, and then click TURN ON AUTHENTICATION.

- The next step will require you to install the Google Authenticator app from the Google Play Store or Apple app store on your mobile device.

- Open Google authenticator from your mobile device and scan the code displayed on your screen.

- When scanning is completed, fill in the code in the box labelled Enter Key and then click Verify to finalize the setup.

With the 2 Factor Authenticator activated, you’ll be required to enter the code generated from the Google Authenticator app during login into My Account, Wallet Checkout, or Skrill mobile applications.

Registration of 2nd Currency Account

Only Skrill VIPs with Silver, Gold, or Diamond accounts are allowed to open multiple accounts in different currencies. If you are a Skrill VIP user and you wish to open another Skrill account but in a different currency, follow the steps below:

- Click here and use a new e-mail to create a new account.

- After completing the registration form, select a different currency as a secondary account.

- Contact the Skrill VIP Team with the e-mail address of the new account and the e-mail address of the old account to link them up.

- After the accounts have been linked, you’ll be able to add the same bank accounts and credit cards to all linked accounts.

- Now you can apply for a second currency Skrill Card of the international payment system MasterCard. For instance, if you have EUR currency card, now you could order it in GBP.

Process of Switching Account Currency

The primary currency of a Skrill account can’t be changed unless you close your current Skrill account and then open a new one. Even though this process works, the disadvantage of this is that you would not see your old transaction history. Also, you may not be able to use some information you previously had registered. Nevertheless, the process of switching account currency allows you to be able to hold your balance in different fiat currencies as well as exchange them within your wallet. There are three variants:

1. All new Skrill accounts already have the option of multi-currency

- Login to your Skrill account and click Deposit. You have to deposit with a credit card in the currency of your choice.

- Select a payment option of your choice.

- As soon as you deposit the money through the payment option, it will appear in your primary Skrill account, which will activate the multi-currency feature.

- When you want to make a transaction, you can choose the currency in which you wish to send money.

- Money that is received will go into the current currency account, and if you don’t have one yet, it will go to your primary account.

2. VIP Silver accounts allow you to create an additional account in another currency without verification. You can learn more about Skrill VIP benefits on our website.

3. You can request the withdrawal of the amount to your bank account in the currency that differs from the currency of your account:

- Ensure there is enough balance on your account, then select Withdrawal.

- Select the account in the other currency you’d want to withdraw.

- Enter the amount, then click Next.

- Confirm the details, then click Confirm, and you’re done. You’ll get a confirmation e-mail telling you the transaction details and a second e-mail when the funds have been sent.

We have detected a similar account profile in our system. Please get in touch with customer support if you would like to have this account activated. If you have forgotten your original credentials for your active account, please retrieve your password below.

I have encounter the above problem, may i known how to resolve it?

Dear Koh, in this case, you need to contact Skrill customer support so that they can keep the account you want to use active and block the other account.

I’m a bit confused about the currency to use as my primary currency on the new Skrill account I wanted to create. I’m a Nigerian but I’m thinking of using pounds as my primary currency. Would it be possible or have negative effect on my account?

When selecting your primary currency on Skrill, it’s essential to consider your location and the currencies you frequently deal with. While using pounds as your primary currency is possible, it’s important to note potential exchange rate fluctuations and conversion fees, especially if most of your transactions are in Nigerian currency. Contacting Skrill customer support will provide you with accurate information and guidance tailored to your specific situation, ensuring you make an informed decision about your primary currency selection.

cool, good information, i will use you to sign up for skrill soon but i first have question about benefits. You say I get good access to vip programs quicker, but why is VIP good? What do levels offer me? Will plain account be okay, or is high vip necessary?

Dear Farhan18, thank you for your feedback! Getting VIP status isn’t the required action, however, VIP statuses allow you to reduce fees and to increase transaction limits in Skrill. If you sign up for Skrill account via our special link you will pass verification rapidly and get VIP status on more favourable terms. You can learn more about it here: https://baxity.com/skrill-vip-program

My skrill account has money but I can’t withdraw for almost an year av been trying.am not happy with your services

Dear Tetty Omondi, we deeply regret you that you faced such problem using Skrill! Withdrawal of funds is available only for verified customers. So to have the opportunity to withdraw funds from Skrill, firstly you have to verify your Skrill account. The case is that Skrill has quite strict Terms of use and verification requirements. We can’t influence that, unfortunately. Here you can find the detailed instruction on Skrill account verification: https://baxity.com/skrill-verification

If the document you submitted meets all the necessary requirements, but it was still not accepted by Skrill, you can try to send this document for verification again. Sometimes the same document is not accepted for the first time.

If you have any problems concerning the verification process or if you run into any further issues, please, contact us via our live chat, and we will be happy to help you in solving your problem.

Hi, I am considering making skrill account. Could you answer my question though? You say there is multi-currency account, but what Saudi Riyal? I am travelling to Europe soon and I want to spend my money without huge conversion fees.

Dear Maha, thank you for your question! You can create Skrill account in Saudi Riyal (SAR), but when making transactions via bank account (deposits, withdrawals) and transfers between Skrill account keep in mind, please, that if the currencies are different the conversion fee will be applied. I would give you more information concerning this issue if you told me what kind of transfers in Skrill you are going to make mostly. By the way, you can reduce fees in Skrill by receiving VIP status in Skrill. You can get VIP status on more favourable terms registering Skrill account via our special link.

Oh is so good to know I can make SAR account! I will remember the conversion fees info, thanks for telling me. and 2 answer your question, I will use atms, pay for food, hotel, and fun things to do. How much VIP can reduce conversion fee?

You mentioned the ATM withdrawals, so the case is that Skrill Prepaid MasterCard is available only for EEA countries residents, the same referred to Skrill Virtual Prepaid Mastercard. Here are the conversion fees according to VIP status of the account:

3.99 % regular accounts;

3.79 % VIP Bronze;

2.89 % VIP Silver;

2.59 % VIP Gold;

1.99 % VIP Diamond.

Hmmm, fee goes under 3% for VIP Silver, wow!! That is really good amount, is low, yes? i am sad tho that the card is not sending to Saudi Arabia… Maybe I make an account anyway for other transfers. i realy hope skrill prepaid card moves to more countries, because eea is very small number of countries. i’ll look into other card services tho too. anyways, thanks for help me!

You are welcome, Maha! Hope you will enjoy all the features of the Skrill service despite the lack of a card.

I want to use your link to make skrill account, but I have question first – why I must turn off vpn for it to work?

Layla, thank you for your comment! Disabling VPN will protect you from potential blocking problems. The security service strictly monitors the location from where the user logs into his account. If during registration you use the VPN, and then enter the wallet from your real IP, the account can be immediately frozen or even closed for suspicion of hacking.

I’m waiting for verification from Skrill. Can i still pay online during verification with Skrill??

Jasko, thank you for your comment. Before verification, you have the opportunity to make any operations within the total limit of 500 euros. However, we always strongly recommend our clients wait for successful account verification before making any transactions. This is due to the fact that the Skrill security service monitors the actions of unverified accounts very closely, and can freeze the account even after the first 30-50 euros transaction .

skrill is a scam, i tried to sign up for account and they never verified my address!!! Why is that?? i don’t advise using skrill at all

Atsuuu_time_1, we are really sorry for your bad impression of Skrill service. Here are some basic requirements for a address document:

– it must contain your full name and address, specified during registration;

– it must have the signature of the employee or the seal of the organization issuing the document;

– the date of issue of the document must be less than 3 months at the time of uploading the document;

– all edges of the document must be in the frame, the document must not be cut.

Perhaps your problem with the denial of verification is in one of these points.

Please How do i go about the verification of my account.

I do not have my postal code on my Identity care and my address is not well written on my international passport.

Please attend to me at your earliest convenience

Lawrence, thank you for your question, and we are sorry that you had to wait so long for an answer.

Your passport or an international passport will not be suitable for verifying the address. For this step, a bank statement, a housing rental agreement or utility bills will be suitable. You can also see the full list of suitable documents in your account.

The requirements for the address document are common: the full name and address must be specified and match the data in the wallet; the document must be no older than 90 days; there must be a signature or seal of the organization that issued the document.

If you still have any questions, please contact us by email [email protected], and we will respond within a business day

Am in Uganda and I don’t have an account with skrill. There is my money. How can I be registered to withdraw that money

Hi Mumbya! To register a Skrill account, please follow this link and proceed to the identity verification process. Once completed, you will be able to easily make deposits and withdrawals using the available payment methods.

Can you please add rwanda in countries that use skrill please