Whether you are a player, bettor or trader, nothing gets done without a secure and efficient way to deposit money to a number of online merchants. Be they poker rooms, casinos, bookmakers or broker officers, the quicker your funds get to them, the more convenient it is for both parties involved.

With the exponential growth of online platforms like Amazon, eBay, AliExpress and even Skype, the same very much applies to cash withdrawals, bank transfers, online purchases, transactions between accounts and even cryptocurrency trading. What is more convenient than to be able to access these actions on one and only platform? Two leading payment systems offer just that: Skrill and NETELLER which are the best and favorable way to buy gaming credits, vouchers, gift and prepaid cards on Baxity Store.

History of NETELLER/Skrill:

At the cusp of the last century, in 1999, Optimal Payments PLC launched NETELLER as a payment system destined to work hand in hand with the online entertainment industry. And indeed, it only took a year for the company to realise its ambitions by serving as much as 85% of entertainment platforms.

A year after NETELLER’s success, in 2001, Skrill was founded under its original name ‘Moneybookers’ which it would hold onto until the next decade in 2011.

A few years later, NETELLER went onto launching an IPO on the London stock exchange market in 2004 and succeeding in raising $70M as a result.

The two companies continued to grow over the years, both seeking new ways to diversify their trade to include businesses and individuals as clients, starting with Skrill in 2009 and closely followed by NETELLER a year later.

Despite its measures to expand its market base and reduce its risk exposure, NETELLER struggled to develop under stricter US regulations put in place in 2007. Restrictions on NETELLER accounts in the US saw its revenue drop to a quarter of its value to $61M, eventually compelling it to leave the US market completely as of 2019.

Having been fierce competitors for more than a decade, NETELLER, represented by Optimal Payments PLC, acquired Skrill in 2015 in a deal valued at €1.1 billion. Skrill’s takeover not only promoted the parent company, now known as Paysafe Group, to the largest electronic payment system in the world, but it also made transfers between the two platforms possible.

Since the acquisition, Skrill has kept growing on its own path by introducing cryptocurrency trading directly from within user accounts. Its efforts were rewarded at the Future Digital Awards in 2019 where it was hailed as the “Best Digital Wallet” of 2019.

It is clear that despite Skrill’s takeover, both payment systems have remained distinctive of each other. We will have a closer look at what these differences are, what exactly they entail and how to identify which payment system is better fitted to you.

Below is a table for general comparison between Skrill and NETELLER:

| Skrill | NETELLER | |

| Number of accounts worldwide | 36 million | 23 million |

| Rating on https://www.trustpilot.com/, max rating 5.0 | 4.5 stars, 71% of reviews rate the service as “excellent”. | 1.4 stars, 83% of reviews rate the service as “bad”. |

| Number of supported currencies | 48 | 42 |

| Registration | ||

| Via the site directly | via skrill.com | via neteller.com |

| Via baxity | follow our link → get benefits | follow our link → get benefits |

| Verification | ||

| Directly | 2-5 business days, $5 deposit required from card or bank account | 2-5 business days, $5 deposit required from card or bank account |

| Via baxity | up to 24 hours, no deposit required | up to 24 hours, no deposit required |

| Rates | ||

| Adding funds to your account | with Bank account or VISA / Mastercard: 0-2.5% depending on the country | with Bank account or VISA / Mastercard: 2.5% |

| Money withdrawal | a) to Bank account or SWIFT: 5.5 EUR (free-from VIP Silver) | a) to Bank account or SWIFT: $ 10 (free from VIP Gold) |

| b) to VISA: 7,5 % (free from VIP Silver) | b) to VISA: N/A | |

| c) to Mastercard: N/A | c) to Mastercard: N/A | |

| p2p transfer | from 4.49% to 1.45% * (free from VIP Silver) | from 4.49% to 1.45% * (free from VIP Silver) |

| Currency conversion | from 3.99% to 1.99% ** | from 3.99% to 1.29% ** |

|

Prepaid Mastercard limits (EEA only) |

||

| Daily ATM withdrawal limits | €900 non-VIP; €1200-5000** | $1000-3300** |

| Daily POS limits | €2700 non-VIP; €3000-10000** | $3000-7000** |

|

VIP program |

||

| DEPOSITS TO MERCHANTS PER QUARTER: | DEPOSITS TO MERCHANTS FOR THE YEAR: | |

|

Transaction amounts to merchants to achieve the status during registration: Directly / via Baxity |

||

| Silver €15 000/ €5 000*** | Silver $15 000 / $ 7 500*** | |

| Gold €45 000 | Gold $45,000 | |

| Diamond €90 000 | Diamond $150,000 | |

| Exclusive $600,000 | ||

| The duration of the status | Calendar quarter | Calendar quarter |

|

Prepaid Mastercard + Virtual card |

||

| Countries | For residents of the European Economic Area (EEA) | For residents of the European Economic Area (EEA) |

| Currencies |

ЕUR

|

EUR |

| Cash withdrawal fee | 1.75% ( free for VIP Silver and higher) |

1.75% ( free for VIP Silver and higher)

|

| Issuing a virtual card | first – free, second and subsequent: €2.5 | first – for free, second and subsequent: $3 |

|

Mobile application |

||

| Yes, + cryptocurrency trading (for EEA residents) | Yes + cryptocurrency trading (for EEA residents) | |

|

Loyalty program |

||

|

KNECT 0.1 % of transactions are converted to Knect points. Limits: One transaction up to 1000 points = 1 EUR 500,000 points per month = 500 EUR |

Missing since 30.04.2020 (There is, however, a bonus program offered by Baxity. Simply send a request letter with the subject line: “All Neteller bonuses” and we will send you all the conditions for the Neteller bonus program.) |

|

|

There are no increasing coefficients for VIP status No annual bonus |

||

| Points are awarded for cryptocurrency trading | ||

|

Cryptocurrency trading |

||

| Charges | 1.5%, amount more than €100 if the currency is EUR | 1.5% if the currency is USD or EUR. |

| 3.0% any other currency | 3.0% any other currency | |

| p2p-Cryptocurrency transfer | Available for 0.5% of the transfer amount | Not available |

|

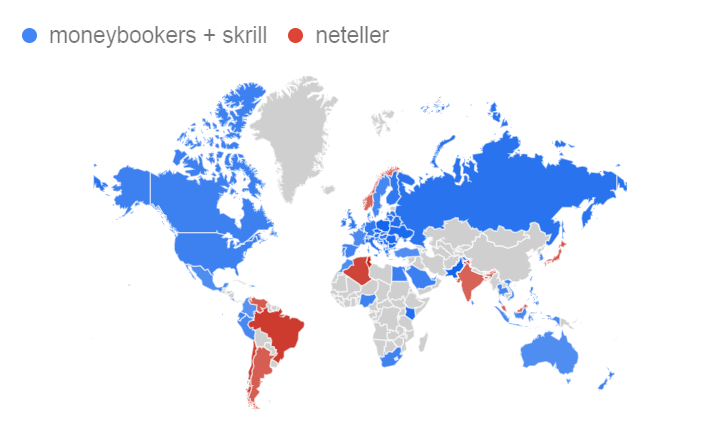

Availability by country: Countries served that a competitor payment system does not have |

||

|

|

|

|

Benefits of connecting via Baxity: |

||

| Verification within 24 hours and with no prior deposit (instead of 2-5 working days and $5 Deposit) | Verification within 24 hours and with no prior deposit (instead of 2-5 working days and $5 Deposit) | |

| The volume of transactions to merchants for VIP status has been reduced by 2-3 times |

VIP statuses: – getting VIP Bronze Pro for free and immediately after verification – VIP Silver for $7,500 (instead of $15,000) |

|

* * with restrictions, see the Comparison of Skill and NETELLER fees section for details

** depends on the VIP status and country of the user

*** the amount must be collected within 30 days after connecting via Baxity

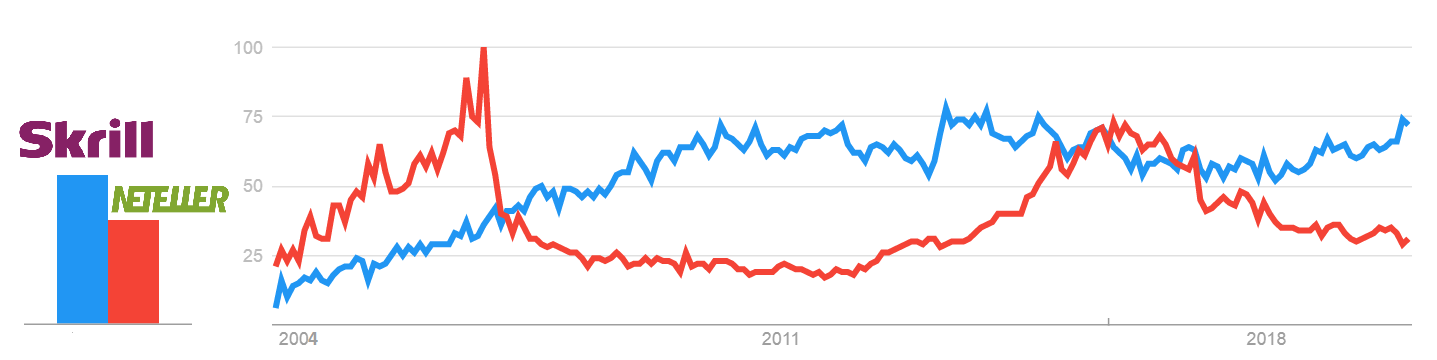

Dynamics of the popularity of Skrill (+Moneybookers) vs Neteller on the Internet for 16 years

For the period from January 2004 up until May 2020.

Popularity dynamics refers to the level of interest in a topic on the Internet relative to the highest indicator for a specific time period and region.

Comparison of Skrill and NETELLER VIP programs

VIP programs are designed as reward schemes for user’s loyalty, helping them reduce their commissions, increase their limits, open additional multi-currency accounts, obtain more efficient service and benefit from an array of profitable offers.

Payment systems feature such programs to incite their users to deposit money to merchants or trade in cryptocurrencies both in greater amounts and on a more frequent basis. It is precisely on such actions that they themselves earn their income and VIP reward schemes become profitable to offer on their platform.

VIP programs operate on simple terms. The more merchant deposits or cryptocurrency transactions a user carries out, the higher VIP level they are able to reach. With each status upgrade comes additional benefits including lower commissions, more generous transaction limits and overall improved terms of condition.

VIP status level upgrades account for transactions made over fixed periods of time, usually over the quarters of a calendar year. For status levels achieved on Skrill, those acquired within the first two months of a calendar’s quarter are valid right up until the end of the current quarter. If it was only obtained in the last two months, the VIP status level may be retained all through the current and next quarter.

Neteller has the same time frame for status action as Skrill. When a VIP status does expire, it may just a simply be reinstated by fulfilling the required deposit amounts over the specified time period.

Skrill’s VIP program differs from NETELLER’s in the following ways:

- Neteller has higher transaction volume requirements over a period of one calendar year. That is for the VIP Diamond status, which is worth of $150,000.

- NETELLER has an additional VIP status: Exclusive.

The table below shows a clear comparison of the requirements for each status level for both Skrill and NETELLER’s VIP programs:

| VIP | Skrill | NETELLER | ||

| Regular terms | via Baxity | Regular terms | via Baxity | |

| The duration of the status | Calendar quarter | Calendar quarter | ||

| Bronze | N/A | N/A | N/A | free (Bronze Pro) |

| Silver | €15,000 per quarter | €5,000 for 30 days* | $15 000 for a quarter | $7 500* |

| Gold | €45,000 per quarter | N/A | $45,000 per quarter | N/A |

| Diamond | €90,000 per quarter | N/A | $150,000 per quarter | N/A |

| Exclusive | N/A | N/A | $600,000 per quarter | N/A |

* the amount must be collected within 30 days after registration onto the payment system using our link

** To get one of these statuses on preferential terms, you must make deposits within 6 months from the date of registration via our link. Send a request letter with the subject line: “All NETELLER bonuses” and we will send you all the conditions for the NETELLER bonus program from us.

For more information about the VIP program of each payment system, read the articles Skrill VIP and NETELLER VIP.

Comparison of Skrill and NETELLER fees

Whether you are using Skrill, NETELLER or any payment system for that matter, you are likely to come across a number of commissions depending on the action you wish to carry out. The most obvious charges are set on money withdrawals and deposits, as well as on transfers within and out of the payment system. Additional fees apply for currency conversions and the selling or buying of cryptocurrencies through the site. Less evident charges can be encountered for the issue and delivery of a Mastercard plastic card, along with general administrative commissions.

Although fees vary depending on the operation at hand, they are also greatly reliant on your country of residence and the status of your account. The former is noted down during registration, whilst the latter varies from regular accounts right after verification all the way to the highest VIP status.

No fee is charged whenever you wish to make a deposit to merchants since these pay the platform’s commission themselves. This holds as long as the currency of your Skrill or NETELLER account matches that of your desired transaction, a currency conversion fee otherwise applies depending on the status level. On the other hand, cryptocurrency trades are always subject to a fee.

No matter the operation, rates are significantly dependent on one’s status level. It is therefore important to keep an eye out on your account’s primary currency as well as your VIP status level to avoid having to pay for unnecessary charges.

| Regular account | Bronze | Silver | Gold | Diamond | Exclusive | |

|

Skrill // NETELLER |

Skrill // NETELLER |

Skrill // NETELLER |

Skrill // NETELLER |

Skrill // NETELLER |

Skrill // NETELLER |

|

| For regular registration | — | N/A | €15,000 per quarter | €45,000 per quarter | €90,000 per quarter | N/A |

| — |

N/A

|

€15,000 per quarter

|

€45,000 per quarter

|

€150,000 per quarter | €600,000 per quarter | |

| via Baxity | — | N/A | €5 000 for 30 days1 | N/A | N/A | N/A |

| — | Bronze Pro (free) |

$7,5001

|

N/A | N/A | N/A | |

| Additional account in a different currency | multicurrency | multicurrency | multicurrency | multicurrency | multicurrency | multicurrency |

| multicurrency | multicurrency | multicurrency | multicurrency | multicurrency | multicurrency | |

| Adding funds to your account (bank transfer, VISA, MasterCard, local and global methods) | 0 – 2,5% (vary by country) | |||||

| 2,5% | ||||||

| Withdraw money to a bank account | €5,5 | €5,5 | free | free | N/A | free |

| $12,75 (for SEPA – $10) | $12,75 (for SEPA – $10) | $12,75 (for SEPA – $10) | free | free | free | |

| Withdraw money to VISA or MasterCard |

VISA -7,5%, Mastercard – 4,99% 3 |

VISA -7,5%, Mastercard – 4,99% 3 |

VISA – free, Mastercard – 4,99% 3 |

VISA – free, Mastercard – 4,99% 3 |

N/A |

VISA – free, Mastercard – 4,99% 3 |

| N/A | N/A | N/A | N/A | N/A | N/A | |

| Transfer account to another account within the payment system (p2p transfer) 4 | 1,45%, min 0,50€ | 1,45%, min 0,50€ | free | free | N/A | free |

| 1,45%, min 0,50$ | 1,45%, min 0,50$ | free | free | free | free | |

| Currency conversion | 3,99% | 3,79% | 2,89% | 2,59% | N/A | 1,99% |

| 3,99% | 3,79% | 3,19% | 2,79% | 2,39% | 1,29% | |

1 – the amount must be collected within 30 days after registration in the payment system via Baxity

2 – to get one of these statuses on preferential terms, you must make your deposits within the first 6 months from the date of registration via our link. Send a request letter with the subject line: “All Neteller bonuses” and we will send you all the conditions for the Neteller bonus program from us.

3 – withdrawal to the Mastercard card is only available to residents of Russia and Ukraine

4 – when adding funds to your account via P2P transfer, the transfer fee will depend on the date of account registration:

- until 17.03.2020: 20% (but not less than $30) – first transfer;

- from 18.03.2020 to 07.04.2020: 10% (but not less than $100); 2.99% — all subsequent transfers;

- with 08.04.2020: of 4.49% (the first and all subsequent transfers).

In order to reduce the commission on P2P transfers to 1.45%, you need to first top up your account by Bank transfer or VISA/MasterCard.

Below are listed the associated fees for the buying and selling of cryptocurrencies directly from within the payment system:

| Skrill | NETELLER | Skrill and NETELLER | |||

| Transactions up to € 19.99 | Transactions in the amount of € 20.00 – € 99.99 | Transactions over € 100 | Transactions for any amount | Transactions in other currencies (other than euros) | |

| Buying cryptocurrency | € 0.99 per transaction | € 1.99 per transaction | 1.50 % per transaction | 1.50 % per transaction | 3.00 % per transaction |

| Cryptocurrency sales | € 0.99 per transaction | € 1.99 per transaction | 1.50 % per transaction | 1.50 % per transaction | 3.00 % per transaction |

| Transfers to another account (p2p) | 0.50 % per transaction | N/A | N/A | ||

Users should keep in mind that as of now, cryptocurrency trading is reserved to member residents of any one of the 31 countries part of the EEA.

The administrative fees associated with accounts registered under Skrill and NETELLER’s platforms are comparable overall. The only notable difference comes into play when one wishes to request a refund. In such an instance, NETELLER charges $30 and Skrill €25, which amounts to an approximate 10% more expensive rate for Skrill when one considers the relevant exchange rate.

We can, therefore, summarise the main differences between Skrill and NETELLER’s fees:

- Skrill boasts cheaper money withdrawals to a Bank account (especially on VIP Silver status)

- Skrill has slightly lower currency conversion charges

- Skrill’s commissions are higher for the buying or selling of cryptocurrencies for transaction amounts below €100

For further information on each payment system’s pricing, you may consult the articles Skrill Fees and NETELLER Fees respectively.

Comparison of Skrill and NETELLER Mastercard

Skrill and NETELLER both feature their very own Mastercard plastic prepaid cards. The Skrill Prepaid Mastercard and the Net+ Prepaid Mastercard respectively, may be ordered and mailed to all residents of the 31 member countries of the EEA. Once delivered to your front door, these plastic cards provide direct access to your online account for an instantaneous way to pay in stores or withdraw cash at nearby ATMs across the world wherever Mastercard payment are accepted.

| Skrill | NETELLER | |

| Currencies to choose from when ordering a card | EUR | EUR |

| The validity of the card | 3 years | 3 years |

| Regular account | Bronze | Bronze PRO* | Silver | Gold | Diamond | Exclusive | |

|

Skrill // NETELLER |

Skrill // NETELLER |

Skrill // NETELLER |

Skrill // NETELLER |

Skrill // NETELLER |

Skrill // NETELLER |

Skrill // NETELLER |

|

| Issue and annual maintenance of the card | €10 | N/A | N/A | free | free | free | N/A |

| $13 | N/A | $13 | free | free | free | free | |

|

Limit on cash withdrawals from ATMs Per day |

€900 | N/A | N/A | €1 500 | €3 000 | €5 000 | N/A |

| $1 000 | N/A | $3 300 | $3 300 | $3 300 | $3 300 | $3 300 | |

| Fee for cash withdrawals at ATMs | 1,75% | N/A | N/A | free | free | free | N/A |

| 1,75% | N/A | 1,75% | 1,75% | 6$ (4€) | 6$ (4€) | 6$ (4€) | |

| Currency conversion | 3,99% | N/A | N/A | 2,89% | 2,59% | 1,99% | N/A |

| 3,99% | N/A | 3,79% | 3,19% | 2,79% | 2,39% | 1,29% | |

| The limit on the payment card in shops (terminal) per day | €2 700 | N/A | N/A | €3 000 | €5 000 | €10 000 | N/A |

| $3 000 | N/A | $3 000 | $3 000 | $7 000 | $7 000 | $7 000 |

* – status is assigned free of charge when registering onto NETELLER via Baxity

One can compare the Skrill Mastercard and the Net+ Mastercard as follows:

- Skrill offers a more profitable offer in terms of the fees associated with ATM cash withdrawals; currency exchanged and its annual service charge.

- NETELLER applies a greater number of limits on both ATM withdrawals and card payments, a drawback if you are used to trading large sums at one given time.

If you are still unsure of how to order or use each of these Mastercards, more information is available in the articles Skrill Mastercard and NETELLER Mastercard.

Comparison of Skrill Virtual Prepaid Mastercard ® and Net+ Virtual Prepaid Mastercard ®

Whilst plastic cards are ideal for convenient in-store purchases and nearby cash withdrawals, when it comes to making secure payments online, virtual cards are the way to go. As the name suggests, these virtual cards may only be used for online purchases on any verified site accepting Mastercard payments. Their immediate cancellation upon meeting their set transaction limit makes them one of the most secure payment methods online, although they remain exclusively available to residents of the EEA with fully verified accounts.

These virtual cards may be created right from within your personal account and in a matter of a few clicks. Simply go to the “Cards” section, select “Virtual card” and specify your choice of currency and its limit for it to be issued. Special care should be taken when setting the transaction limit as this will determine exactly when the virtual card will be cancelled. You may also manually block or delete your card from your profile whenever you so wish, even though there is no service charge associated with them.

Still, a virtual card differs from a verified card and the following actions are not permitted:

- withdrawing money from ATMs or paying directly in-store

- booking a hotel, buying a ticket or even renting a car

Differences between Skrill Virtual Prepaid Mastercard ® and Net+ Virtual Prepaid Mastercard ®:

| Skrill Virtual Prepaid MasterCard® | NET+ Virtual Prepaid MasterCard® | |

| Creating the first card for a single account | free | free |

| Registration of the second and further card | € 2,5 | € 2.5 |

| The conversion fee |

1.99% – 3.99% (depending on VIP status) |

1,29% — 3,99% (depending on VIP status) |

| Available currency for the card | EUR | EUR |

| The daily limit for payment | EUR: €6 300 | EUR: €6 300 |

Net+ Virtual Prepaid Mastercard ® is more profitable when it comes to avoiding currency conversion fees (depending on the VIP status) and flexibility in terms of a larger selection of card currencies.

Cashback comparison of Skill and NETELLER

The opportunity for cashback is offered by both Skrill and NETELLER in the form of loyalty programs encouraging users to transact, deposit, withdraw and transfer money via their platform.

NETELLER users may automatically be eligible for an exclusive bonus program if they have registered onto the site using our link.

Skrill’s Knect loyalty program is still very much active, whilst NETELLER’s Reward Points initiative was shut down only months ago on the 30th of April 2020. Nevertheless, NETELLER users could redeem their Reward Points up until the 30th of June 2020 and may also expect a reviewed loyalty program to be released shortly.

Meanwhile, Baxity has never ceased to offer additional bonuses to NETELLER users registered via our link. You may contact us for more details about the specific opportunities available to you.

| Skrill | NETELLER |

| KNECT |

Reward points (cancelled program from 30.04.2020) |

| 0.1 % of transactions are converted to Knect points. | N/A |

|

Limits |

|

|

One transaction up to 1000 points = 1 EUR 500,000 points per month = 500 EUR |

There are no limits

|

| There are no increasing coefficients for VIP status | There are increasing coefficients for VIP status 1.25-1.50 |

|

No annual bonus

|

Annual bonus of 1000-50000 points depending on VIP status |

| Points are awarded for cryptocurrency trading | No points are awarded for cryptocurrency trading |

All the how to’s and where’s of Skrill’s loyalty program are detailed in the Skrill Knect article.

Security comparison of Skrill and NETELLER

It is obvious that neither Skrill nor NETELLER has reached their respective levels of success without stellar security to back up their payment systems over their two decades of operation. Indeed, both platforms feature the same highly reliable security system through which have already passed billions of dollars’ worth of transactions from as many as 59 million accounts.

The security of the payment system is determined by two primary factors:

- The safety of the money stored within one’s account and the assurance that the holding company will not simply vanish alongside its users’ funds.

- The account security and its protection against various forms of fraudulent activity.

Over their years of service, both Skrill and NETELLER have continued to adhere to a number of requirements:

- The safety of users’ money is approved and monitored by the Financial Conduct Authority (FCA) based in the UK. Their requirements state that a payment system must keep 100% of users’ money in their accounts to be available for return at all times.

- Account security is ensured by a number of standard, tested tools:

- a site protected by an SSL certificate (https)

- a complex password requirement with a unique SMS code for every log in

- complex password + permanent PIN code + one-time email PIN code that is valid for 15 minutes

- compliance with password security rules: a complex password that you change every 3-6 months, an updated and protected computer with antivirus, logging out of your personal account via “log out”, regularly checking the transaction history for potential signs of fraudulent activity.

If you do happen to notice any type of suspicious activity in your account, you should immediately change your password and notify the payment system support service.

Benefits of Skrill and NETELLER

If you have come this far in our comparison of Skrill and NETELLER, it will seem obvious that each platform offers its own advantages on various fronts. Whilst this may make one’s decision on how to choose their next payment system more difficult, we have rated their main features on a 5-point scale for easy comparison with one’s needs and preferences.

| Skrill | NETELLER | |

| Prevalence among merchants (entertainment merchants, bookmakers, forex brokers and poker rooms) | 5 | 4 |

| High transaction speed, instant transfers to merchants without commission | 5 | 4 |

| VIP program that allows you to reduce commissions on withdrawals, increase limits and increase the number of additional accounts | 5 | 5 |

| Loyalty program | 5 | 2 |

| Skrill Knect | Since 30.04.2020 there is no loyalty program, but there is a loyalty program from Baxity | |

| MasterCard + Virtual card | 5 | 5 |

| A convenient mobile application that allows you to use the system in any place where there is internet | 5 | 5 |

| Quick support service for users with VIP status | 4 | 1 |

|

Advantages of registering with Baxity |

||

|

Fast verification in 24 hours

|

5 | 5 |

|

Getting VIP statuses

|

4 | 5 |

| N/A | VIP Bronze Pro (lower conversion fee and higher ATM withdrawal limits) immediately after verification | |

| VIP Silver for 5,000€ deposits (for 30 days) instead of 15,000€ deposits per quarter | VIP Silver for $7,500 instead of $15,000 (gives free transfers inside Neteller, reduced by 0.6% commission on currency conversion) | |

| Support in Russian, English, Bulgarian 365 days a year 24/7 | 5 | 5 |

| Total points: | 48 | 41 |

Like the table nicely summarises, Skrill and NETELLER are worth each other on the most important aspects. Differences only become notable if one considers the more complex components of each payment system.

What should I choose Skrill or NETELLER?

In the realm of payment systems, it is clear that Skrill and NETELLER reign near the top and indeed, both are equally comparable over a range of most important factors. Ultimately, it all seems to boil down to the user themselves. Are you more of a player who is looking for efficient deposits and quick withdrawals? Or are you more serious about reliable and beneficial trading? It is primordial to consider exactly what kind of transactions you will be mostly focusing on when using such a payment system and hence decide accordingly.

Skrill is accessibility at its finest, with a straightforward and fast platform featuring a good help service and rewarding loyalty program. We recommend it to any amateur player or trader who is looking for a simple but reliable tool to work with – without the intention of moving large sums left, right and over long periods of time.

On the other hand, NETELLER features a slightly more complex user interface and slower customer support, although this may easily be sped up with Baxity. Such preferable conditions are ideal for any avid player with a frequent and regular playing routine as the site rewards its loyal customers with reduced commissions for VIP status holders and exclusive bonuses with Baxity.

If you are still undecided, you can always register onto both systems via our link and carry out your own comparison on such things as Skrill and NETELLER’s commissions, transactions or merchant deposits.

I was wondering if transactions i make with skrill are private. Сan anybody see my name or info when i buy something?

Dear Kaia, thank you for your question! When you make a deposit to merchant it won’t see your details. Skrill does not disclose your card details or personal information to merchants, thus protecting you from scammy practices.

Wow! this comparison was so helpful! I decided to sign up with neteller bc you guys could get me into the bronze pro VIP program. I didn’t want to spend lots of money to get perks. the verification was really fast, it didn’t even take 24 hours. I am interested in baxity neteller loyalty program, please look for my email because I want to learn more info. Thank you very much

Dear Vivaan, thank you very much for your feedback! We are happy you enjoy our service. As you have already passed verification in Neteller, you can get VIP Bronze PRO status for free and VIP Silver – on our special terms. To get VIP Bronze PRO status, contact our support in a live-chat or via e-mail, enter you Neteller ID and e-mail and after that, we will send a request for your VIP Bronze PRO. Then you will be able to get VIP Silver on favourable terms.

both sound good so I made accout for skrill ANd neteller! skrill verification was faster but only by small amount.

Dear Johanna, thank you for your feedback!I am sure that you will quickly determine the most suitable payment option for you. Also, I remind you that if you have signed up with us in Neteller, you can get a free VIP Bronze Pro status, just contact us and specify your ID.

After reading hole review a few tiems and very careful, i decide to go with skrill. Even tho both are very similar in the advantages, i really like skrill knect program. U mentioned a skrill knect article, but i don’t see link, can you send me link please?

Dear Numanator, thank you for your feedback! Here is the link to Skrill Knect loyalty program review: https://baxity.com/skrill-knect-review

Thanks for giving me the link!! i read the hole thing a couple time but I now have a new question for you.. okay, so you say that transactions between friends add points to ur kinect points. now, does the sender get the points or does the receiver get it? or both? Also does the points expire? and can your point rates increase if you increase your vip level up to silver?

Only sender gets knect points in the case you mentioned. All loyalty points earned in any calendar year must be redeemed by the end of the next calendar year, and all points earned within the current year will expire at the end of the following calendar year. The points expire on Jan 1st at 00:00. Your VIP status doesn’t influence the amount of Knect points you can get.

Gotcha!! i like that the knect points don’t expire for a hole year, so i got lots of time to save them up. I signed up for skrill, cant wait to start geting points!

We are very glad that you are delighted with the service! Contact us if you have any more questions.

You gave both skrill and neteller a rating of 46 points, but don’t you like 1 more than other? Pls be honest and tell me which 1 you preffer.

Morwo, thank you for interesting question! Earlier, I would have answered that Skrill is better. In total, it was more convenient for me to use it, although I have both eWallets. At least thanks to the ability to withdraw money from the system to my bank card.

But now, after a lot of changes in both design and commissions / VIP program, wallets have become almost identical, so the choice is up to your personal preferences now 🙂

How can I register using your link I want to register both if possible more ewallet using your link

Dear Kelechi,

Please, use these links for registration:

1) Skrill – http://wlskrill.adsrv.eacdn.com/C.ashx?btag=a_79336b_3279c_&affid=71646&siteid=79336&adid=3279&c=

2) Neteller – http://wlneteller.adsrv.eacdn.com/C.ashx?btag=a_79337b_332c_&affid=71647&siteid=79337&adid=332&c=

3) Astropay – https://affiliates.astropay.com/visit/?bta=35061&brand=astropay

4) ecoPayz – https://secure.ecopayz.com/Registration.aspx?_atc=e2k9nvxlbq59av9zmtxq52mlr