Choosing a viable and trustworthy online brokerage to trade with can be overwhelming. And it’s hard to make such an important decision when there are so many possible options. In addition, the market is saturated with online platforms offering these services.

The problem is that some of these brokers cannot be trusted and may be fraudulent. We want to make your decisions easier by shining light on the popular online trading brokerage known as AMarkets. This broker has gained a massive following and interest over the years and accepts traders worldwide. Let’s delve into this in-depth review as we uncover the facts and aspects of this lucrative online trading brokerage.

About AMarkets Forex Broker

“AMarkets” is a reliable Forex company already trusted internationally by a vast number of traders. Moreover, the broker offers its customers good cooperation conditions: a wide range of trading instruments, popular platforms, instant order execution, dedicated customer support, etc.

Regulation and Licensing

One of the best means of determining the safety of a broker like AMarkets is to establish which regulating authorities are watchdogs over its actions.

AMarkets is a member of the Financial Commission, an independent external dispute resolution organization that ensures that traders and brokers resolve their disputes quickly, efficiently, and unbiasedly. The Financial Commission provides insurance for up to €20,000 per claim from its Compensation Fund. In addition, the quality of order execution at AMarkets is audited and assessed monthly by an independent service, Verify My Trade (VMT).

Apart from being a Hong Kong Financial Commission member, AMarkets is also a professional member of the Russian Centre for Regulation in OTC Financial Instruments and Technologies (CRFIN). Regulated brokers will not manipulate market prices, and withdrawal requests will be honored. If AMarkets violates any regulatory rules, their regulated status could be stripped.

Serviced Countries

AMarkets provides brokerage services in Europe, Asia, Middle East, Africa, and CIS countries in more than 16 languages. AMarkets offers high-quality services and comprehensive support to its clients and partners. Our professional team is committed to finding innovative solutions and introducing new technologies so that AMarkets clients worldwide can get the best trading conditions.

Markets Offered

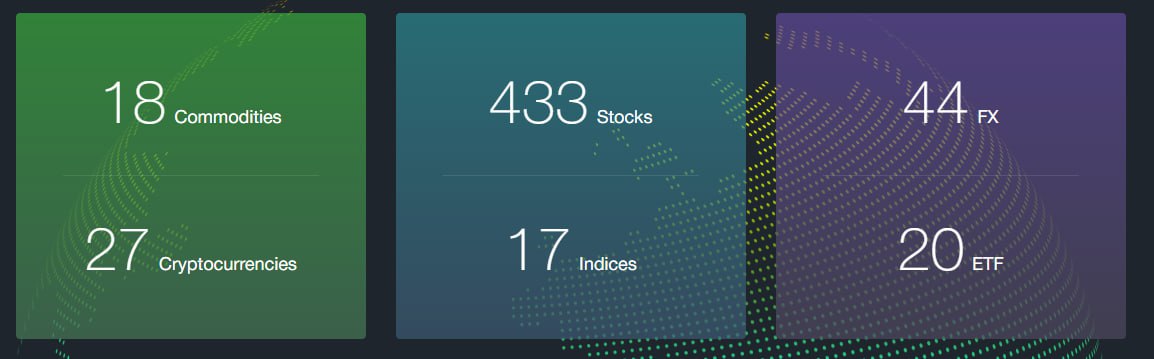

AMarkets offers its traders a wide array of financial instruments to trade across numerous lucrative global markets. For instance, traders can find opportunities trading forex, precious metals, commodities, stocks, indices, and cryptocurrencies. The number of financial assets offered in each market is presented in the screenshot below.

How to Register at AMarkets Broker Website

It’s simple to create an account on AMarkets. Opening an account with AMarkets includes the following steps:

Go to the Official Website

Step 1. Be sure that you are on the correct AMarkets official website.

Fill out the registration form

Step 2. Fill out the registration form. If you’re registering a forex trading account with AMarkets for the first time, you will be required to go through a basic “Know Your Customer” process.

Provide the necessary information

Step 3. You will need to provide basic documentation to prove your identity as part of AMarkets onboarding and normal KYC identity checks. It will allow AMarkets to make sure that your submitted personal details are correct and that your funds’ safety and account details are ensured.

Confirmation Email

Step 4. After the initial registration, you will receive a confirmation email with your login details: username and password to access your trading platform. You will be directed to your new AMarkets account.

AMarkets Account Types

Often, the number and type of accounts that a trader can open with a broker differ depending on the country in which it operates and the regulatory authorities under whose jurisdiction it falls. You have three AMarkets forex accounts to choose from and a possibility to create an Islamic account (swap-free), depending on the type of trade you want to execute.

Available payment options

Depositing and withdrawing funds with AMarkets is simple and easy, and like anything else with this online trading brokerage, there are plenty of options. See the supported deposit and withdrawal methods below and their associated fees and processing times.

How to make a Deposit

The following payment options are available to clients of AMarkets:

Deposits can be funded in USD, EUR, or RUB currencies. While deposits are free, there are withdrawal fees as well as minimum amounts applicable. You may find additional information in the “Deposit Funds” section on the AMarkets website.

Funds withdrawal

There are also multiple ways to withdraw funds from AMarkets through bank wire transfer, credit cards, Neteller, WebMoney, etc. Each method has different fees and commissions, entry minimum, and processing times.

Fees, Spreads, and Commissions

Making AMarkets review, we made fees, spreads, and commissions clear:

- To be able to fund your trading account, you have to complete the identity verification;

- The minimum initial deposit is $100/€100;

- AMarkets’ withdrawal fees vary on the payment method;

- AMarkets does not charge a fee for inactive accounts;

- AMarkets does not charge deposit fees.

With AMarkets, spreads start from 0.0 pips on EUR/USA. Spread types and commission fee charges with AMarkets depend on the type of live account, the financial instrument, and the market conditions. Spreads and commissions that traders can expect from AMarkets are from 1.3 pips on the Standard Account, from 3 pips on the Fixed Account, and 0.0 pips on the ECN Account. On the ECN Account, commissions of $2.5/€2.5 are charged per lot.

Thus, the AMarkets review shows that commission fees can differ depending on the trading type, financial asset type, and your trading account level.

Why choose Skrill, Neteller and Trastra Visa for AMarkets Payments

In order to select a payment system, you need to understand why you need it and what its advantages and disadvantages are. Based on the feedback from players and traders, we want to recommend three payment systems with special bonuses for AMarkets users.

NETELLER is an electronic payment service operating across the world, equally prized by legal entities and individuals for the ease and rapidity it allows them to send money to other users online.

NETELLER has seized the opportunity to differentiate itself from other payment services in various ways:

- NETELLER operates in more than 200 countries, available for the majority of merchants, bookmakers, Forex brokers, and poker rooms;

- It has an extensive VIP program offering significant benefits, particularly for users used to carrying out comprehensive and frequent deposits to merchants and transacting with other users;

- A mobile application that lets you transact whenever you have a working internet connection;

- VIP statuses are based on a calendar year, not a quarter, as with Skrill. In other words, VIP statuses are only reset at the beginning of the new calendar year. If you obtained a particular VIP status in the fourth quarter of the year, the same status would also be valid for the following year;

- Net+ MasterCard@ (EEA 31 country residents only);

- Virtual Net+ cards for secure payments.

Skrill is one of the leading payment services worldwide. Several payment services may roam the web, but Skrill certainly establishes itself at the top of internet searches with its most notable benefits which you can get by opening a Skrill account via Baxity link:

- All transactions to merchants are high-speed and instantaneous without additional fees;

- A VIP program that reduces commissions for money withdrawals, increases limits and the number of additional accounts to open in any one of the 39 currencies on offer;

- A practical mobile app lets you take your Skrill wallet anywhere you go with an internet connection;

- Fast customer support for VIP status users;

- Skrill MasterCard (for countries part of the European Economic Area only);

- Virtual Skrill cards for secure payments.

TRASTRA is an ideal solution for converting сryptocurrencies to euros and cashing out without using a bank account.

Here’s what we’re offering:

- BTC, ETH, LTC, BCH, XRP, USDC, and USDT wallets;

- Absolutely confidential;

- Withdraw money in ATMs worldwide;

- Quick exchange inside the App;

- Just €2.25 fee from up to €300 withdrawal;

- No one bank account is needed;

- Card issuing + delivery: FREE for Baxity clients.

To sum up, we can underline key reasons for using these payment systems with AMarkets:

- Deposit funds without questions from banks;

- Cashback for big volume traders;

- Withdrawals from Skrill to the crypto wallet;

- Transfers of crypto between accounts within Neteller/Skrill;

- FREE Trastra crypto card for deposits and cashouts in BTC;

- Deposits and withdrawals to/from AMarkets;

- Verification within 24 hours without adding funds to Skrill and NETELLER.

You may get special AMarkets bonuses and prepaid cards by registering via Baxity links, our special payment system partner. You don’t need any e-wallet within it – join the Baxity loyalty program.

How does the Trading Bonus from AMarkets work?

Trading Bonus increases the clients’s balance and is used in trading the same way as the trader’s real funds. It doesn’t require any trading turnover for activation and is ready to be used at any time.

It allows to:

- Trade in higher volumes;

- Withstand higher drawdowns;

- Withdraw your profits at any moment without losing the bonus;

- You can withdraw your own funds, but you can not withdraw the Trading Bonus;

- If you withdraw your deposit, the bonus will be written off.

How new users can the Trading Bonus?

1. The user make deposit to the trading account in the first 48 hours after registration at the platform. The user receives the bonus of 15% +3 cashback level after registering with the company and opening a real trading account.

2. 20% deposit bonus for transferring positions to AMarkets from another brokerage company. The user needs to confirm that he previously traded on a real account with another broker by providing a statement.

3. 15% bonus – with promo code “SDELKA”. To credit the bonus, after making a deposit, contact the AMarkets customer support service and provide this promo code .

Available Trading Platforms

In essence, the forex trading platform is the software provided by AMarkets to its clients to carry out their trades. A multi-asset trading platform allows clients to trade forex and other asset classes, including CFDs on stocks, stock indices, precious metals, and cryptocurrencies. The decision about which platform to choose will always depend on what a client would like to trade. AMarkets have three types of convenient trading platforms to choose from, MetaTrader 4, MetaTrader 5 and xStation.

Margin and Leverage

Leverage is a facility that enables you to get a much larger exposure to the market you are trading than the amount you deposited to open the trade. Leverage is expressed as a ratio of 50:1, 100:1, or 500:1.

Assuming you have $1,000 in your trading account and you trade ticket sizes of 500,000 USD/JPY, your leverage will equate to 500:1. Margin is the amount of collateral to cover any credit risks that may arise during your trading operations.

It is expressed as the percentage of position size (e.g., 5% or 1%), and you have to have funds in your trading account to ensure sufficient margin. AMarkets provides high leverage of up to 1:1000, while most brokers give maximum leverage between 1:200 and 1:400. Leveraged products, such as forex trading, magnify your potential profit and increase your possible loss.

Is AMarkets a Scam?

Forex scam brokers are not always represented by brokers, and they are most likely to be individual players without companies, but who position themselves as broker companies.

AMarkets is regulated, governed, and supervised by reputable financial regulatory bodies. Regulatory bodies monitor the brokers’ behavior, and if things go wrong, they will take necessary action. Regulatory authorities protect the traders with reimbursement schemes that regain the client’s investment if the broker becomes insolvent.

AMarkets are considered safe as they are regulated and checked for conduct by the International Finance Corporation (IFC). Any payments funded to AMarkets accounts by traders are held in a segregated bank account. For added security, AMarkets use tier-1 banks for this. Tier 1 is the official measure of a bank’s financial health and strength.

AMarkets Bonuses

The AMarkets review analyzed what types of bonuses it can offer. Compared to other brokerages, AMarkets regularly runs various promotions and discount vouchers that allow clients to increase their trading profitability. There is a list of AMarkets promotions:

- AMarkets returns part of the spread to clients. The cashback amount depends on the trading volume within getting cashback from AMarkets. The program has 5 levels. To advance to the next level, you need to reach a monthly trading volume whithin 30 days. This is the required trading turnover and it remains unchanged for each level. Clients perform trades and get cashback for their trading activity depending on their level in the program.

- Switch your broker to AMarkets and get an exclusive 20% bonus on your deposit and the best trading conditions;

- If you have open positions with another broker, transfer them to AMarkets and get the most attractive trading terms for maximum profit by transferring your trading account to AMarkets promotion;

- Make a deposit, and AMarkets will double it with double your trading deposit program;

- When trading on a demo account with AMarkets, you can transfer your profit to a live account;

- You can receive 20% as a trading bonus when transferring your affiliate reward to your trading account;

- Do not miss the opportunity to withdraw funds from your AMarkets account without any commission – get 100% of your income;

- AMarkets pays an additional bonus for the withdrawal of your affiliate rewards;

- Get 10$ for every friend you refer to AMarkets company;

- AMarkets reimburses all deposit fees and commissions charged by payment systems without restrictions.

Keep in touch with AMarkets bonuses and promotions that you may find here.

AMarkets App and Mobile Trading

AMarkets app allows its clients to access their trading accounts and make money in the financial markets straight from their smartphones. In the App, clients can place orders, deposit and withdraw funds, and stay up-to-date with the latest market events, company news, promotions, and offers.

AMarkets account is protected by two-factor authentication to ensure maximum security. In addition, you can use a 4-digit PIN, protected against brute-force attacks or your fingerprint. Thus, you can always be sure that your account data is safe and protected from outside intruders.

Customer Reviews

As the AMarkets review reveals, many brokers and traders from around the world share positive feedback about their experience. The company has earned strong customer satisfaction, reflecting the confidence users place in its services.

There are the latest AMarkets broker reviews:

Steven: “I want to give 5 points to the company’s analysts. They write only in essence, without unnecessary water, do not miss all important events and news. I don’t have time to read longreads like others do. And here only the specifics, facts and forecasts. Some may not like it, but for me this company is the best!”

Brandon: “I trust the broker, I have been trading for about a year and a half, it works like clockwork, the most important thing is to learn to understand market trends. There were no requotes or slippages in real time, I also like that the analytics are very meticulous.”

Pros and Cons of AMarkets Broker

| Pros | Cons |

|

+ Min deposit from $1 + Used by over 10,000 traders + High leverage levels offered + A wide selection of bonuses available |

– Restricted in some countries – Not FCA regulated |

Conclusion

AMarkets can be summarily described as a worthwhile company for potential traders and investors. It is a reliable, award-winning FX broker with many years of experience in the industry, which offers a good variety of trading instruments, platforms, account types, and solutions. Online broker AMarkets is a leading forex company that provides direct access to global markets and executes nearly 10,000 trades per day, with comfortable trading conditions that include no commission and tight spreads. AMarkets’ account types come with unique features and benefits for beginner and advanced traders and users to trade on globally recognized trading platforms.

Frequently Asked Questions

What is AMarkets?

“AMarkets” is a reliable Forex company already trusted by a vast number of traders. Moreover, the broker offers profitable customer cooperation conditions: a wide range of trading instruments, popular platforms, immediate orders execution, professional support in various issues, etc.

How to register at AMarkets Broker Website?

Go to the official AMarkets website. Next, click the “Open account” window in the top right corner and provide essential documentation to prove your identity. Then, you will be directed to your new account. After the initial registration, you will be emailed with login details corresponding to a login on a trading platform matching your type of account.

What Account Types Does AMarkets Offer?

There are three account types, and a possibility to create a Forex Islamic account is also known as a swap-free account as it implies no swap or rollover interest on overnight positions, which is against the Islamic faith.

For trading, the Amarkets company is super, especially cryptocurrency trading 24/. For analytics, we should separately thank the company’s management, there is a lot of cool and useful information.

At first I started trading with a standard account, but not long ago I decided to switch to ECN and it became more profitable for me to trade in terms of profit and conditions. Although the platform as a whole works fine.

Dear Beethov,

Thanks for the feedback! We appreciate it!

A good broker who deserves to be trusted. There are no questions about payments, I traded, earned, requested money – I received it. So I can advise Amarkets.

Hi Cr4Zed,

Thank you for sharing your experience.

Not a bad broker, they have been working for a long time. Regulated, profit withdrawn. You can trade without worrying about your money. Variety of trading instruments, relatively low spreads.

A large number of trading instruments are offered. The withdrawal of funds does not take much time, which confirms the good impression of the platform. Security is at a very high level, so do not be afraid for the safety of your funds.

No wonder the broker has so many awards and clients. It’s good that I switched from another broker where there were problems with the withdrawal. But here with the withdrawal of funds for the year of work, there have never been problems