Bitcoin is not just a digital currency; it is a revolution that is changing the world of finance, technology, and society as a whole. Since its inception in 2009, it has transformed from an experimental project into a global phenomenon, attracting the attention of investors, tech enthusiasts, gamers, and even governments. In this article, we’ve gathered 70 amazing facts about Bitcoin, divided into thematic categories. Each fact is described in detail and accompanied by interesting specifics, figures, and data. At the end of the article, you’ll find a guide on how to quickly and securely buy crypto gift cards on Baxity Store and join the world of cryptocurrencies.

Facts 1-10: History and Origins

1. Mysterious Creator under the Pseudonym Satoshi Nakamoto

Bitcoin was created by an individual or group under the pseudonym Satoshi Nakamoto. In 2008, Nakamoto published the technical paper “Bitcoin: A Peer-to-Peer Electronic Cash System,” where the principles of this new digital currency were described. To this day, Satoshi’s identity remains unknown, despite numerous attempts to uncover it. As of 2024, Satoshi’s wallet, containing approximately 1 million bitcoins, remains untouched.

2. The First Block in the Blockchain (Genesis Block and Hidden Message)

On January 3, 2009, the first Bitcoin block, known as the Genesis Block, was created. Satoshi Nakamoto left a message in it: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This was a headline from a British newspaper referencing the financial crisis and the need for an alternative to traditional banking systems.

3. First Bitcoin Transaction

On January 9, 2009, the first Bitcoin transaction occurred between Satoshi Nakamoto and cryptographer Hal Finney. Finney was one of Bitcoin’s first enthusiasts and actively participated in its development. He received 10 bitcoins from Nakamoto, marking the beginning of real cryptocurrency use.

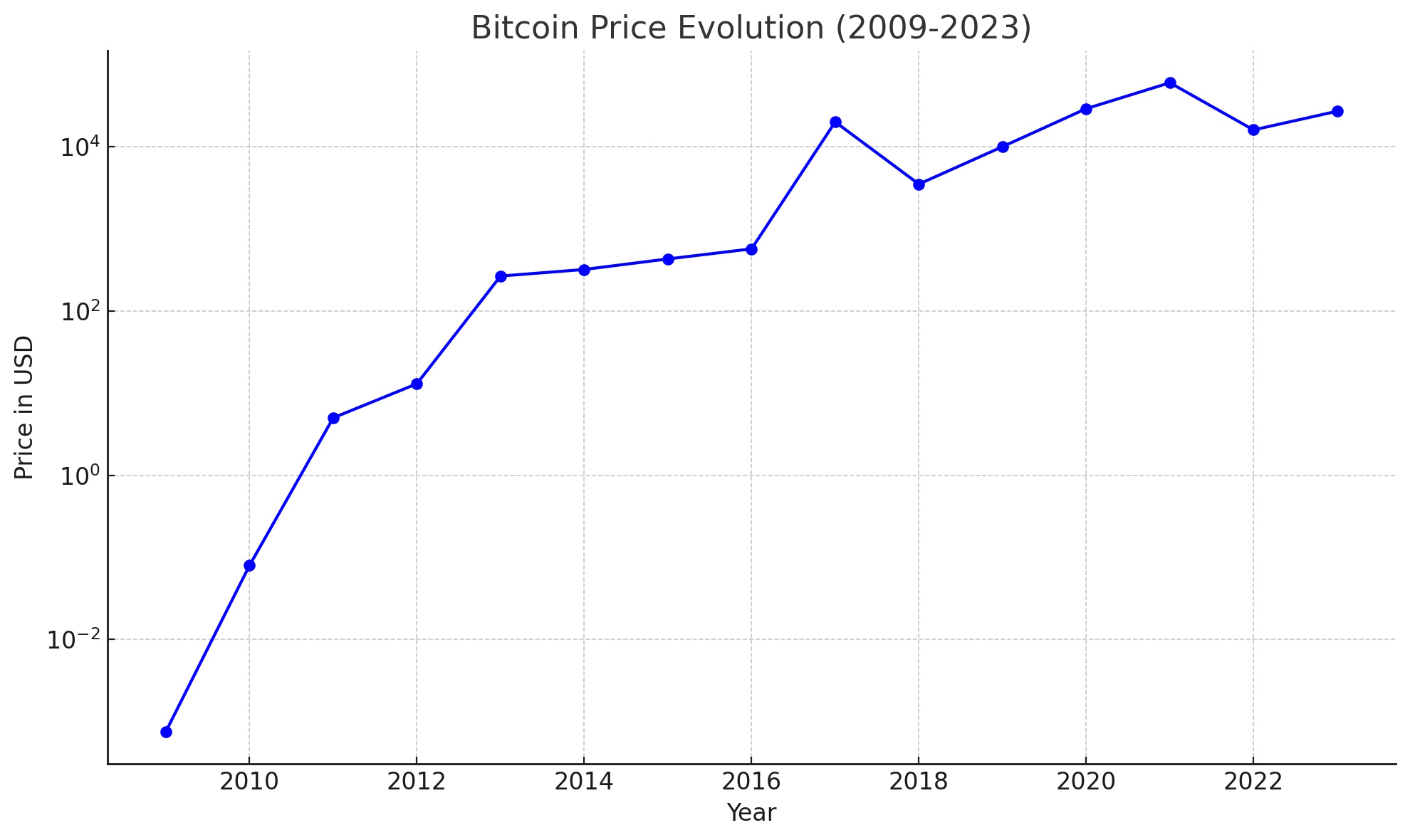

4. First Exchange Rate: $0.00076 per 1 BTC

In October 2009, the first exchange rate of Bitcoin to the US dollar was established at $0.00076 per 1 BTC. This rate was calculated based on the electricity cost required to mine one Bitcoin. Since then, Bitcoin’s price has increased by millions of percent.

5. The First Commercial Bitcoin Transaction (Bitcoin Pizza Day)

On May 22, 2010, programmer Laszlo Hanyecz made the first commercial transaction using Bitcoin, buying two pizzas for 10,000 BTC. At the time, this sum was worth about $41. As of 2023, those bitcoins are worth more than $300 million. This date is celebrated as “Bitcoin Pizza Day,” symbolizing the growth in cryptocurrency value.

6. The First Bitcoin Exchange

In March 2010, the first cryptocurrency exchange, BitcoinMarket.com, was launched, allowing users to buy and sell bitcoins for US dollars. This event marked the beginning of the infrastructure for cryptocurrency trading. As of 2024, over 400 crypto exchanges exist, and Bitcoin remains the most traded cryptocurrency, with daily volumes exceeding $30 billion.

7. Limited Supply of 21 Million Coins

Bitcoin’s protocol provides that only 21 million bitcoins will ever be created. This limited supply makes Bitcoin a scarce resource, akin to gold. As of 2024, approximately 19 million bitcoins have been mined, and the last Bitcoin is expected to be mined in 2140.

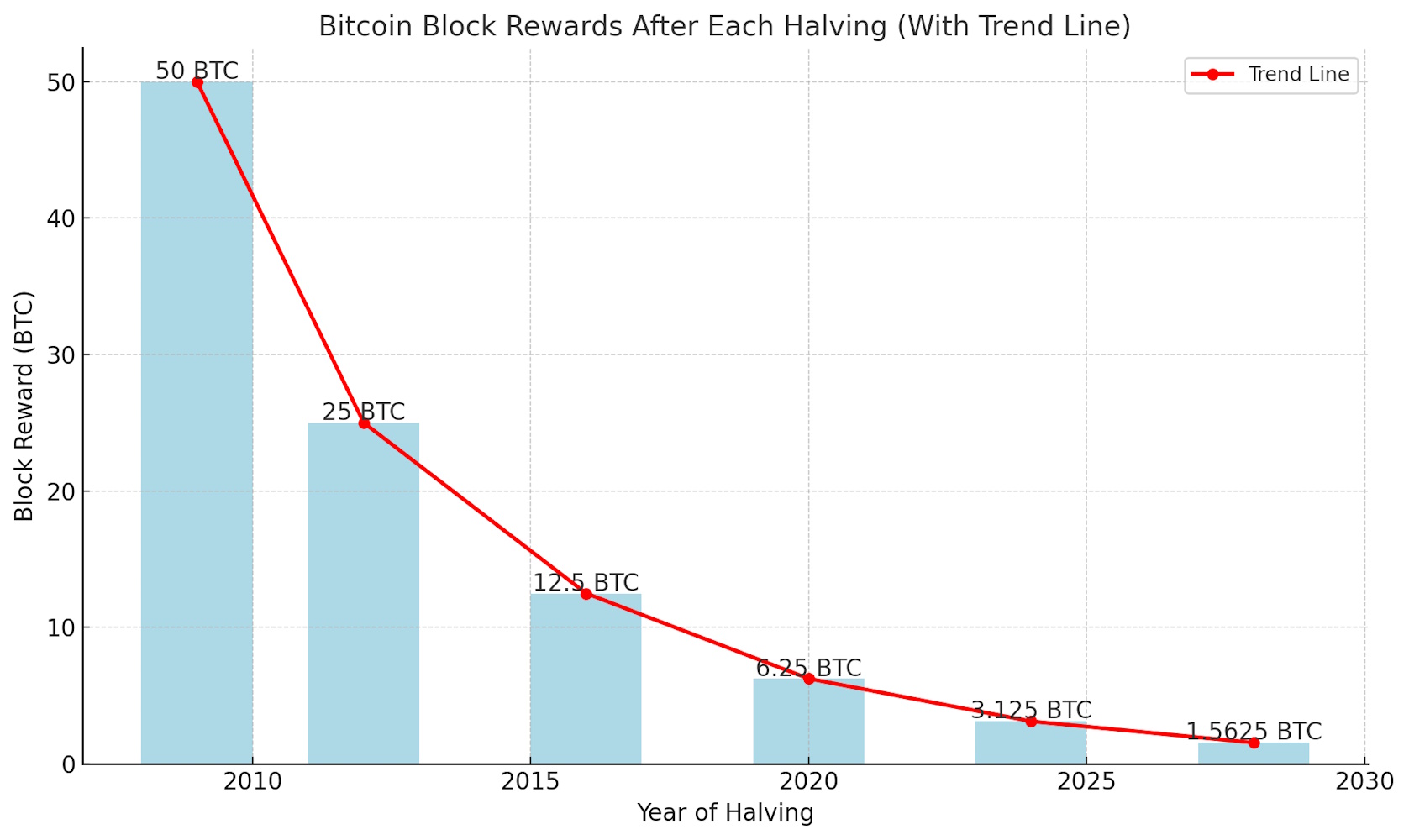

8. Halving

The first Bitcoin halving occurred on November 28, 2012, when the block reward for miners was reduced from 50 to 25 bitcoins. Subsequent halvings occurred in 2016 and 2020. The most recent halving took place in April 2024, reducing the reward from 6.25 to 3.125 BTC per block as expected. This event, as always, attracted significant attention, but unlike previous halvings, there was no immediate sharp price increase. At the time of the halving, Bitcoin’s price was around $63,000, which was already below its previous peak.

9. Bitcoin Is Not Controlled by Any Government or Organization

One of Bitcoin’s key features is its decentralization. It is not controlled by governments, central banks, or corporations. Transactions are verified by a global network of users, ensuring resistance to censorship and manipulation. The Bitcoin network consists of thousands of independent nodes (computers) distributed worldwide. As of 2024, the network has more than 15,000 nodes, ensuring transaction confirmation and resilience to centralized control.

10. The Disappearance of Satoshi Nakamoto

In April 2011, Satoshi Nakamoto sent his last known email to developer Mike Hearn, stating that he had “moved on to other things.” Since then, Satoshi has not appeared publicly, leaving Bitcoin’s further development in the hands of the community.

Facts 11-20: Technology and Security

11. Blockchain – The Foundation of Bitcoin

Bitcoin operates on blockchain technology, a decentralized ledger where all transactions are recorded in blocks. Each block is linked to the previous one using a cryptographic hash, making the system resistant to tampering. This technology was introduced in Satoshi Nakamoto’s technical paper in 2008.

12. Mining and Transaction Confirmation

Miners use computational power to solve complex mathematical problems that confirm transactions and add new blocks to the blockchain. For their work, miners are rewarded with new bitcoins and transaction fees. At the beginning of 2024, the reward per block was 6.25 BTC, but after the halving in April 2024, it was reduced to 3.125 BTC.

13. Mining Difficulty and Automatic Adjustment

Every 2,016 blocks (approximately every two weeks), the mining difficulty is automatically adjusted to maintain an average block creation time of around 10 minutes. This is one of the mechanisms that ensures the stability of the Bitcoin network despite changes in the number of miners.

14. Public Key Cryptography

Bitcoin uses public key cryptography to secure transactions. Each user has a private key (secret) and a public key (address). The private key is used to sign transactions, while the public key is used to receive funds.

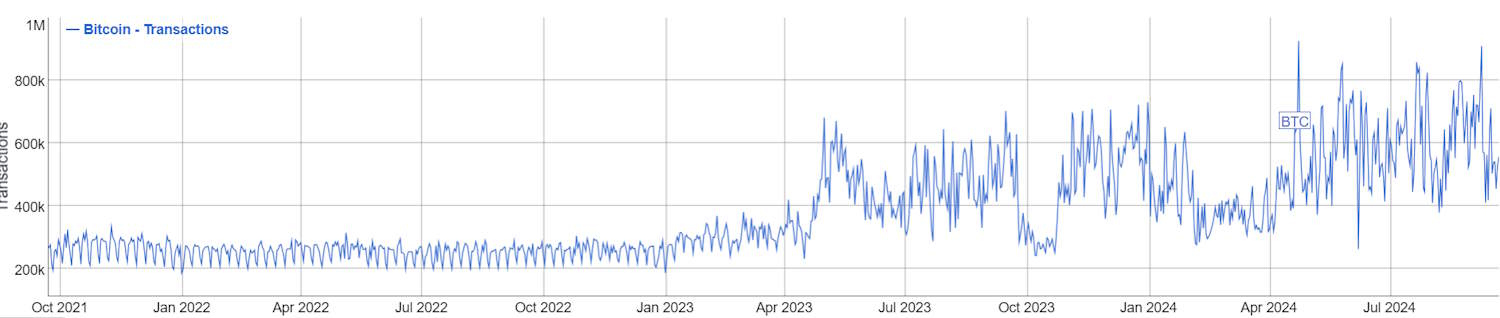

15. Irreversibility of Transactions

Transactions on the Bitcoin network are irreversible. Once confirmed and added to the blockchain, they cannot be canceled or altered. As of 2024, the Bitcoin network has processed over 800 million irreversible transactions. This ensures that each block contains final data that cannot be modified or deleted.

16. Satoshi – The Smallest Unit of Bitcoin

The smallest indivisible unit of Bitcoin is called a satoshi and is equal to 0.00000001 BTC. This allows for microtransactions, especially within solutions like the Lightning Network, which has become popular in 2024 for fast and low-cost transfers.

17. Lightning Network for Fast and Cheap Transactions

The Lightning Network is a second-layer solution built on top of the Bitcoin blockchain, allowing for instant and almost fee-free transactions. It uses payment channels between users, reducing the load on the main network and increasing scalability. This technology has been actively developing since 2018, and as of 2024, it significantly enhances Bitcoin’s scalability.

18. Multi-Signature for Enhanced Security

Multi-signature technology requires several private keys to confirm a transaction. For example, a wallet can be set up so that three out of five trusted parties must sign off on a transaction. This greatly enhances the security of storing large amounts of Bitcoin.

19. The 51% Attack and Network Resilience

A 51% attack occurs when a miner or group controls more than 50% of the network’s computing power. This would allow them to double-spend funds or change the order of transactions. However, the scale and decentralization of the Bitcoin network make such an attack extremely costly and unlikely.

20. Cold and Hot Wallets

Bitcoin can be stored in hot (online) and cold (offline) wallets. Hot wallets are convenient for frequent use but are more vulnerable to attacks. Cold wallets, such as hardware devices or paper wallets, store private keys offline, ensuring maximum security. As of 2024, over 60% of all bitcoins are held in cold wallets, such as hardware devices (e.g., Ledger or Trezor). Cold wallets provide maximum security for large Bitcoin holders by storing assets offline, reducing the risk of hacking.

Facts 21-30: Economy and Market

21. Price Volatility and Record Highs

Bitcoin is known for its high price volatility. Throughout its history, it has experienced several significant price surges and drops. In December 2017, Bitcoin’s price reached a record high of $19,783, only to drop to $3,200 by December 2018.

In March 2024, Bitcoin reached a new all-time high, exceeding $73,750 on March 14. As of now, Bitcoin’s price stands around $59,489, making it one of the most prominent digital currencies globally.

22. Bitcoin’s Market Capitalization

At its peak in 2021, Bitcoin’s market capitalization exceeded $1 trillion. As of 2024, Bitcoin’s market capitalization is around $600-700 billion, confirming its significance in the global financial market.

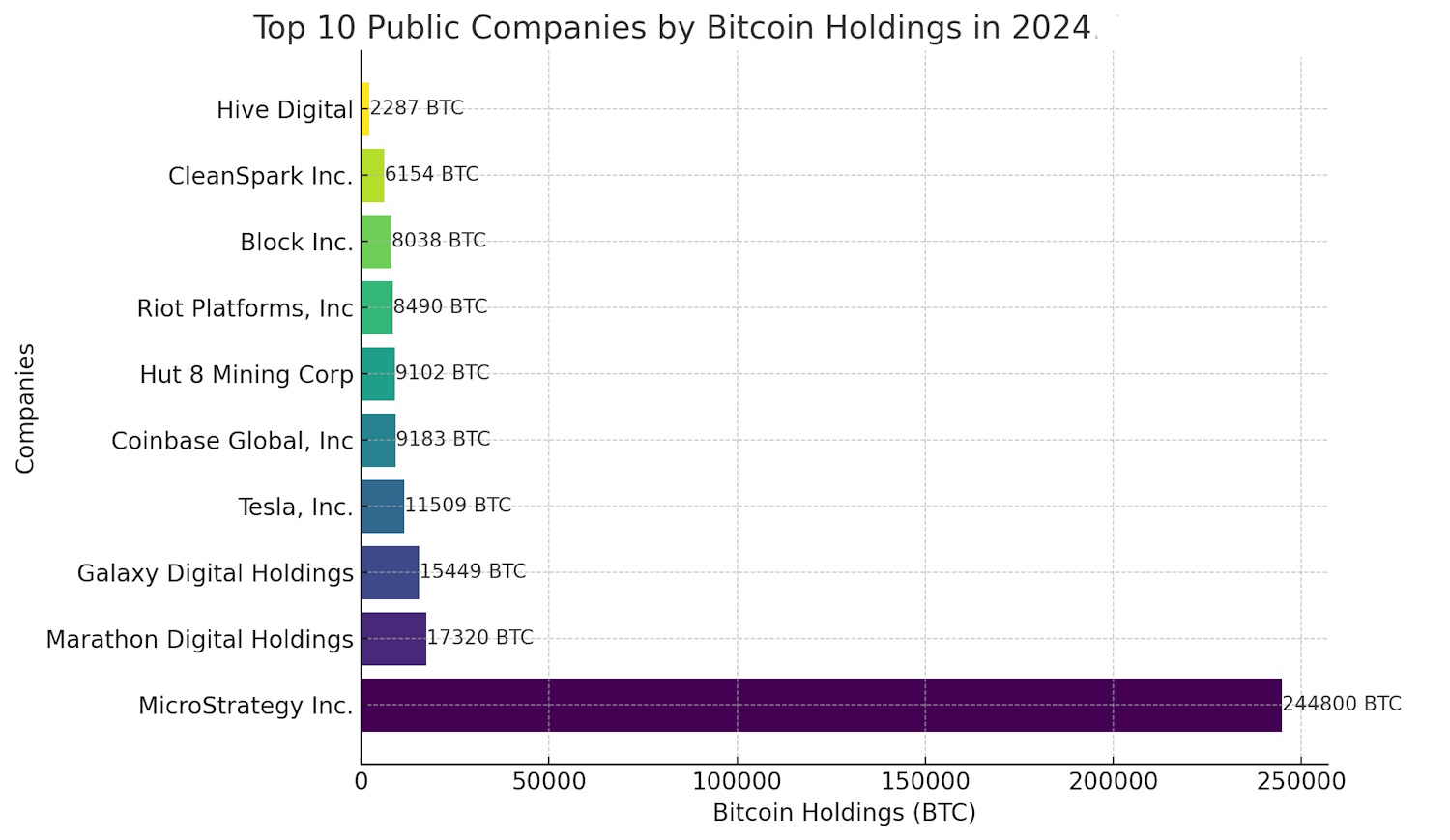

23. Institutional Investment in Bitcoin

Large companies like Fidelity Digital Assets and Coinbase Custody offer custodial services for storing cryptocurrencies. This allows institutional investors like MicroStrategy and Tesla to securely hold large amounts of Bitcoin. According to Fidelity, over 90% of institutional investors were interested in digital assets by 2021. As of 2024, MicroStrategy holds over 150,000 BTC (approximately $89 billion at the current rate), making it one of the largest Bitcoin-investing companies.

24. Global Share of Bitcoin Transactions

In 2024, more than $10 billion worth of transactions were conducted using Bitcoin globally, representing a significant portion of all cryptocurrency transactions. This confirms Bitcoin’s status as the leading digital currency for international payments.

25. Bitcoin ATMs Worldwide

As of 2024, there are over 40,000 Bitcoin ATMs installed worldwide, allowing users to buy and sell bitcoins for fiat currency. Most of these ATMs are located in the US, Canada, and Europe, but their number is rapidly increasing in Latin America and Asia.

26. Bitcoin Futures and Options

Since 2017, financial exchanges like CME Group and Bakkt have been offering Bitcoin futures and options. This allows investors to hedge risks and speculate on Bitcoin’s price, contributing to the cryptocurrency’s integration into traditional financial markets. The volume of Bitcoin futures trading in 2024 continues to grow, attracting institutional investors.

27. Transaction Fees and Their Dynamics

Bitcoin network fees depend on its load. During high activity periods, fees can reach tens of dollars, while during quieter periods, they drop to just a few cents. For example, in 2024, the average fee is about $2-5, depending on transaction volume and network load.

28. Lost Bitcoins

According to various estimates, around 20% of all bitcoins (approximately 3.7 million BTC) are considered lost due to forgotten private keys, lost hard drives, and other reasons. This further reduces the available supply of Bitcoin, which could affect its value.

29. Environmental Debates Around Mining

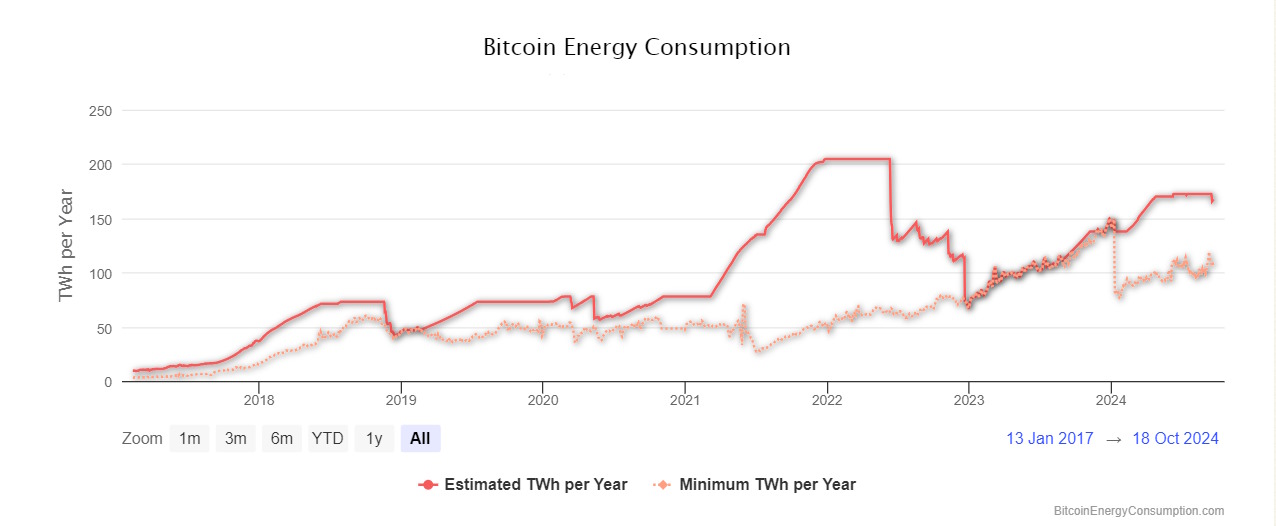

Bitcoin mining requires a significant amount of electricity, sparking debates about its environmental sustainability. Some estimates suggest that the Bitcoin network’s energy consumption in 2024 is comparable to that of countries like Norway or Sweden. This has led to active research into energy-efficient mining methods and the use of renewable energy sources.

The red line shows the estimated annual energy consumption of the Bitcoin network, highlighting a steady increase with noticeable spikes, particularly peaking above 200 TWh in 2022.

The dotted orange line represents the minimum energy consumption, indicating the lower bound of the estimate.

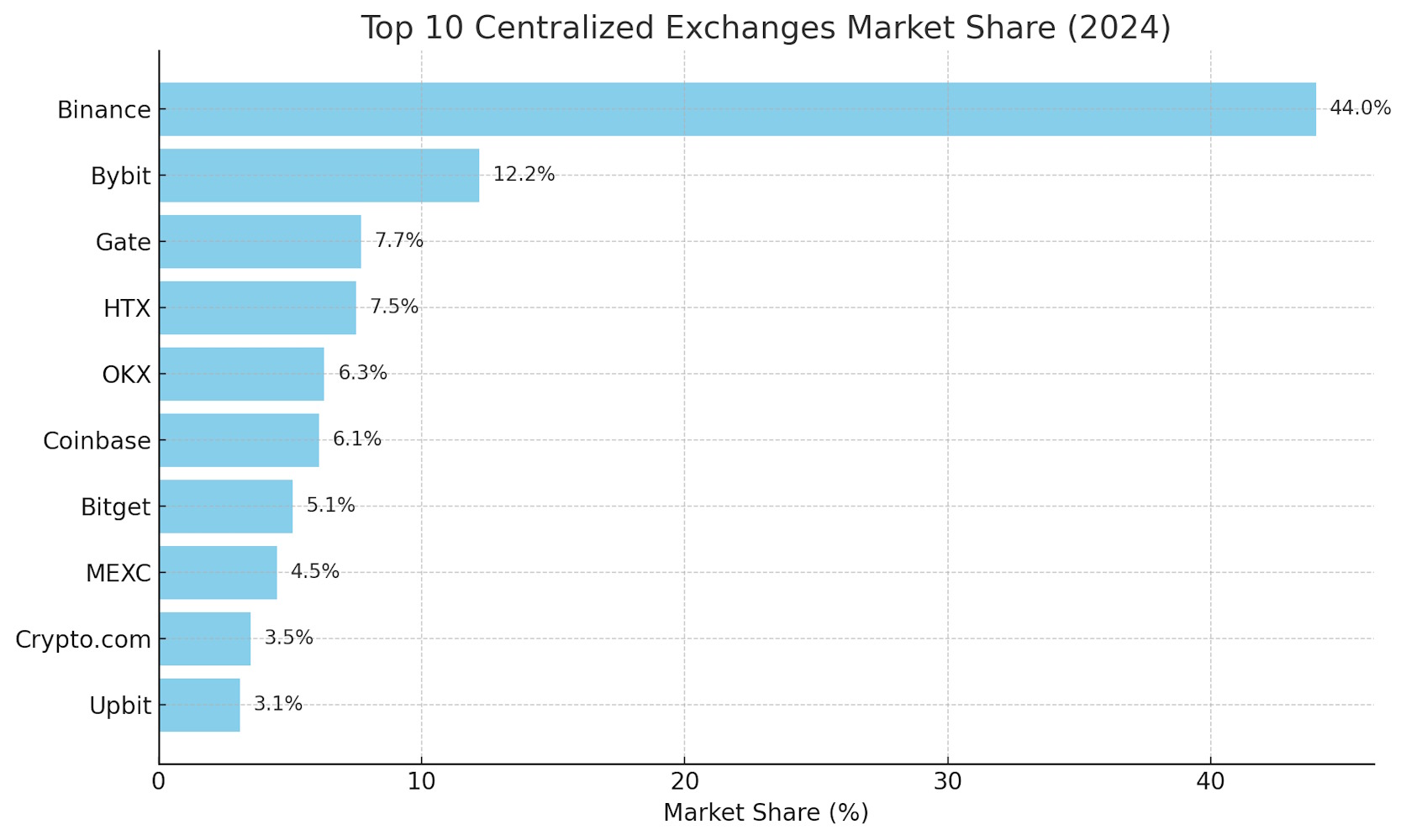

30. Largest Exchanges by Bitcoin Trading Volume

In 2024, exchanges such as Binance, Coinbase, and Kraken remain the leading platforms for Bitcoin trading, with daily volumes reaching billions of dollars. These exchanges continue to lead due to their liquidity and user-friendliness.

Facts 31-40: Culture and Society

31. Bitcoin in Pop Culture

Bitcoin has permeated mainstream culture, appearing in movies, TV series, and music. It has been mentioned in shows such as Mr. Robot and Black Mirror, the film In Time, and even in songs by well-known artists. This reflects the growing influence of cryptocurrency on society.

32. Bitcoin and Charity

In 2024, charitable organizations such as UNICEF, Save the Children, and Greenpeace accept Bitcoin donations, allowing international transfers to be faster and more secure. The total volume of cryptocurrency donations in recent years has exceeded $100 million.

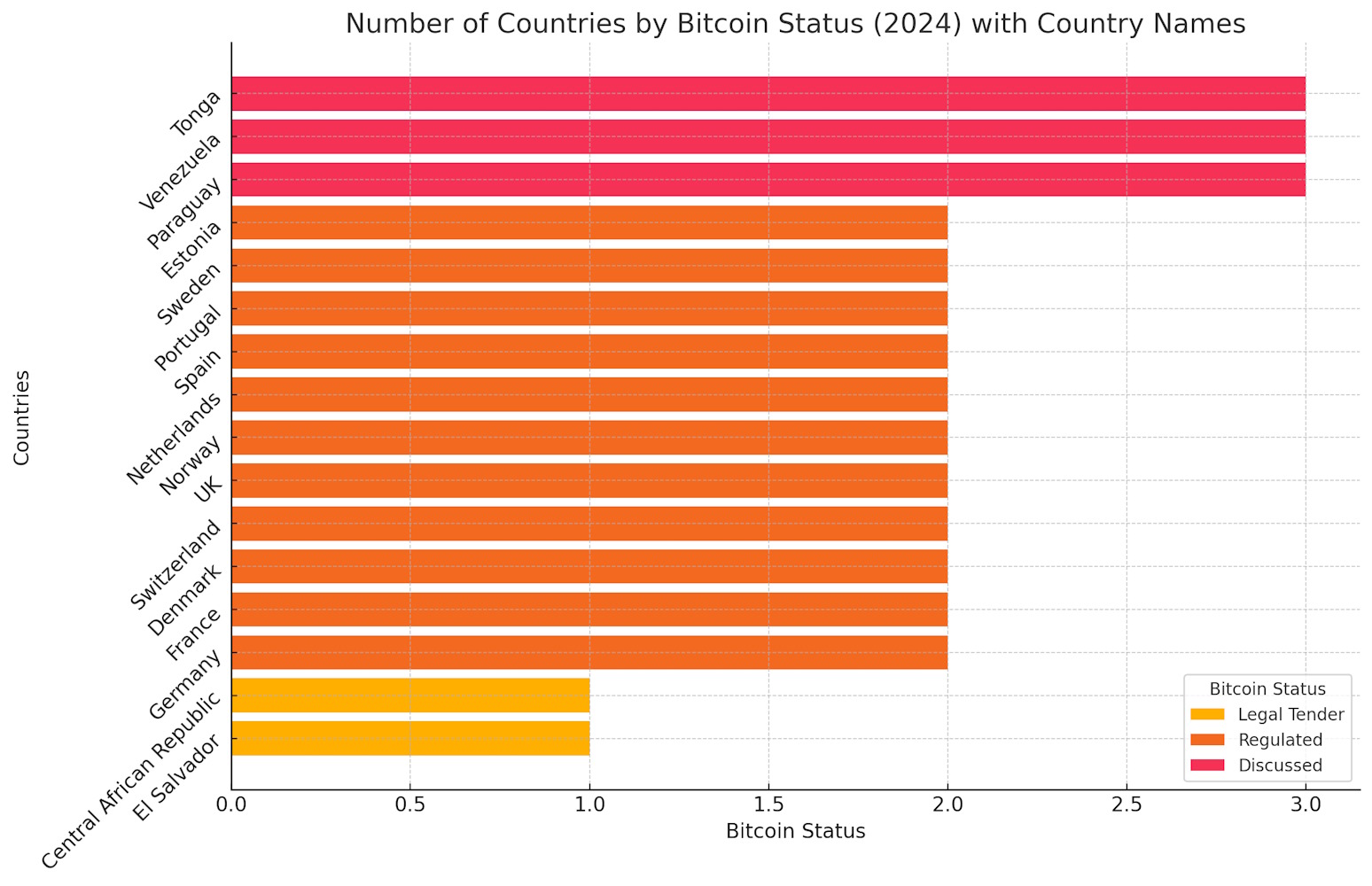

33. Legislative Recognition of Bitcoin

On September 7, 2021, El Salvador became the first country to adopt Bitcoin as legal tender, alongside the US dollar. In 2024, the government of El Salvador continues to actively support cryptocurrency, building its economy around Bitcoin with initiatives to attract investors and create Bitcoin City.

In addition to El Salvador, the Central African Republic recognized Bitcoin as legal tender in 2022. As of 2024, other governments are considering adopting Bitcoin at the legislative level, potentially reshaping the global financial system.

34. Bitcoin as a Tool for Financial Freedom in Countries with Economic Problems

In countries with high inflation and restrictions on traditional financial instruments, such as Venezuela, Turkey, and Lebanon, Bitcoin has become a popular means of protecting assets from currency devaluation and banking controls. As of 2024, millions of people in these countries actively use Bitcoin to store wealth and make international transfers.

35. Educational Programs and University Courses on Bitcoin

Leading universities such as MIT, Oxford, and Stanford offer courses on cryptocurrencies and blockchain. Each year, the number of such programs grows, reflecting the recognition of cryptocurrency as an important economic and technological phenomenon. This contributes to the preparation of new specialists and the development of the industry.

36. Bitcoin Conferences and Events

Every year, international conferences dedicated to Bitcoin and blockchain are held, such as Consensus, Bitcoin Conference, and Blockchain Expo. These events attract thousands of participants, including developers, investors, and enthusiasts, promoting the exchange of knowledge and ideas.

37. Cybercrime and Security

Although blockchain technology is one of the most secure, cryptocurrency exchanges and users are still vulnerable to hacking. The most infamous attack occurred in 2014 on the Mt. Gox exchange, where 850,000 BTC was stolen, valued at around $450 million at the time. In 2024, hacking attacks on crypto exchanges and wallets remain a serious threat. Over the past 10 years, hackers have stolen more than $4 billion worth of cryptocurrency.

38. Legal Aspects and Regulation

In 2024, the legal status of cryptocurrencies varies greatly depending on the country. In countries like Japan and Switzerland, progressive laws have been developed to promote the growth of the crypto industry. Japan recognized Bitcoin as legal tender back in 2017, and by 2024, crypto-assets are regulated with a focus on investor protection. Meanwhile, other countries, like China, continue to impose strict restrictions on the use of cryptocurrencies.

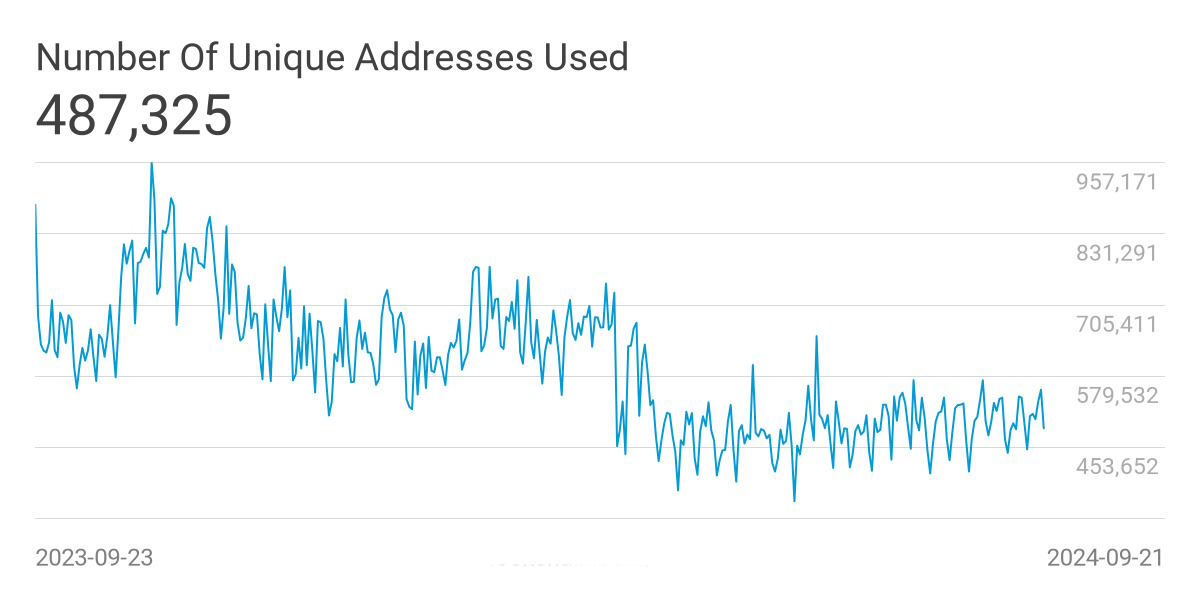

39. Number of Bitcoin Addresses

As of 2024, the number of Bitcoin addresses holding assets exceeds 48 million. Of these, about 900,000 addresses hold more than 1 BTC. These figures show the steady growth of interest in Bitcoin as a store of value and demonstrate that more and more users are choosing long-term investment in cryptocurrency.

40. Ecosystem of Products and Services Around Bitcoin

Since 2009, a vast ecosystem has grown around Bitcoin, including cryptocurrency exchanges, wallets, micropayment platforms, and educational resources. As of 2024, there are over 500 exchanges and 1 million cryptocurrency wallets worldwide, providing users with access to Bitcoin. Companies like Baxity offer a wide range of crypto products, such as crypto vouchers, making it easier for new users to enter the world of cryptocurrencies.

Facts 41-50: Trading and Arbitrage

41. Price Differences on Exchanges Create Arbitrage Opportunities

The price of Bitcoin can vary significantly across different cryptocurrency exchanges and platforms. For example, in 2017, the so-called “kimchi premium” appeared in South Korea when Bitcoin prices on local exchanges were 20% higher than on international platforms. This was due to high demand and regulatory restrictions on cross-border money flows. Arbitrage traders could buy Bitcoin on foreign exchanges and sell it in South Korea, profiting significantly from the price difference.

In 2024, arbitrage remains a popular strategy among traders, especially in regions with restrictions on cross-border transfers.

42. 24/7 Trading Without Weekends

The cryptocurrency market operates 24 hours a day, 7 days a week, without weekends or holidays. This is unique compared to traditional financial markets, which close on weekends and holidays. Traders can respond to news and events in real time, increasing the market’s dynamism and volatility.

43. High Liquidity on Major Exchanges

Cryptocurrency exchanges such as Binance, Coinbase, and Kraken offer high liquidity, with daily trading volumes reaching tens of billions of dollars. For example, in 2024, the average daily trading volume on Binance is around $30 billion, making it one of the most liquid platforms.

44. Margin Trading Opportunities

Many exchanges offer margin trading, allowing traders to use borrowed funds to increase their positions. For instance, on the BitMEX platform, traders can use leverage up to 100x. This means that with a $1,000 deposit, one can control a position of $100,000. However, high leverage increases both potential profits and the risk of losses.

45. Algorithmic and High-Frequency Trading

Modern traders actively use trading bots and algorithms to automate trades. As of 2024, around 80% of all trading volumes on major crypto exchanges are generated by algorithmic systems and trading bots. Algorithmic trading allows for executing trades within milliseconds, using strategies like arbitrage and market-making.

46. P2P Platforms Facilitate Direct Trades

Peer-to-peer (P2P) trading platforms like Paxful and LocalBitcoins allow users to trade directly with each other. In 2024, the volume of trades on Paxful continues to grow, amounting to more than $2 billion annually. P2P platforms are particularly popular in countries with limited access to traditional financial services.

47. Stablecoins Help Hedge Risks

Stablecoins like Tether (USDT) and USD Coin (USDC) are actively used to hedge against volatility in the cryptocurrency market. In 2024, Tether’s market capitalization exceeded $80 billion, underscoring its importance as a tool for quickly transferring funds between exchanges.

48. Cryptocurrency Arbitrage Funds

In 2024, many arbitrage funds actively use Bitcoin to profit from price discrepancies across different cryptocurrency exchanges. These funds employ complex arbitrage strategies and manage capital worth billions of dollars. For example, funds like Three Arrows Capital use algorithms to detect price anomalies across multiple markets.

49. Using Derivatives for Speculation

Derivatives such as Bitcoin futures and options allow traders to speculate on price movements without owning the asset itself. In 2024, the trading volume of derivatives on CME Group and other exchanges continues to grow, reaching record levels.

50. Baxity Store Crypto Gift Cards Speed Up Operations

Baxity Store offers crypto cards that enable instant account top-ups on various exchanges and platforms. This is particularly useful for traders and arbitrageurs who need fast fund transfers for timely trades. Baxity Store cards support various denominations and payment methods, simplifying the trading process.

Facts 51-60: Investment and Usage of Bitcoin

51. Bitcoin as a Store of Value

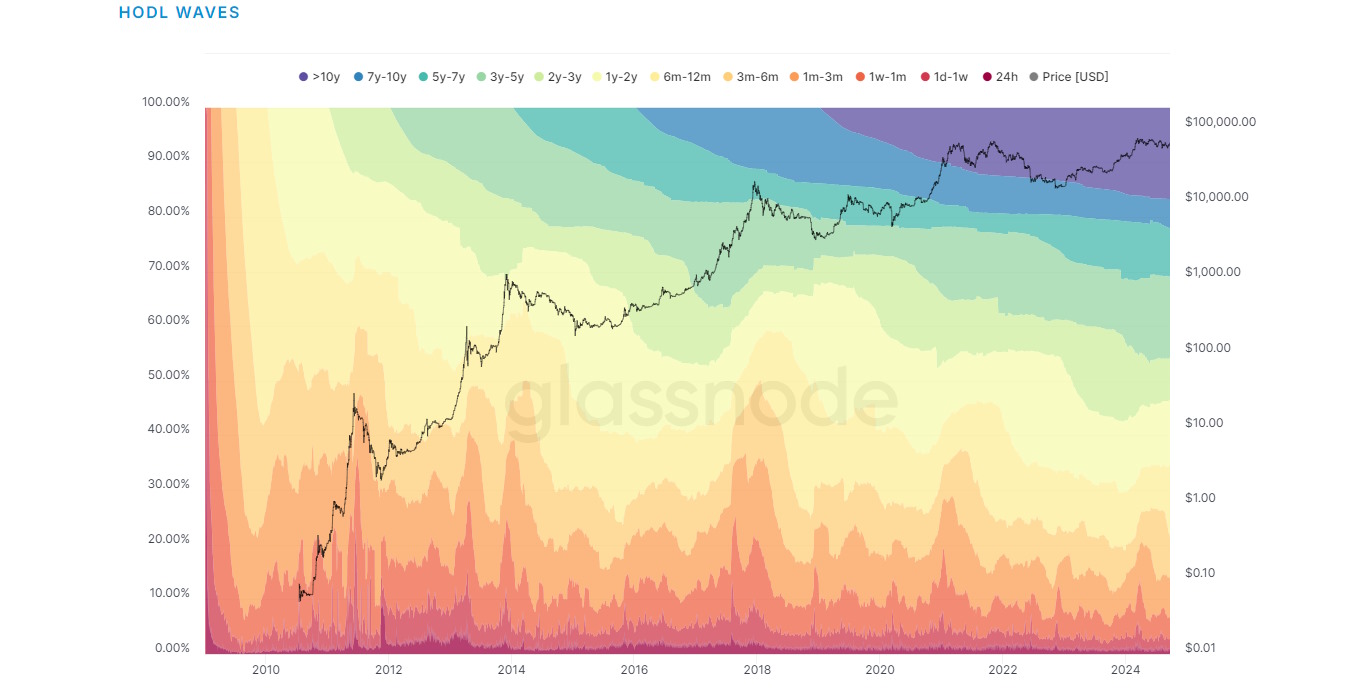

Bitcoin is often referred to as “digital gold” due to its limited supply and resistance to inflation. In times when central banks print money to stimulate the economy, investors seek assets that can preserve value. In 2020, Bitcoin outperformed gold in terms of returns, increasing by more than 300%.

As of 2024, over 65% of all bitcoins have not moved in the past 12 months, indicating that many investors are using it as a long-term store of value and a hedge against inflation.

52. Pension Fund Investments in Bitcoin

In 2024, pension funds such as the California Public Employees’ Retirement System (CalPERS) and the New York State Common Retirement Fund began adding Bitcoin to their investment portfolios. This marks a significant step toward recognizing Bitcoin as a long-term asset among the largest institutional investors.

53. Bitcoin Investment Through Exchange-Traded Funds (ETFs)

In 2021, Canada approved the first Bitcoin ETFs, such as the Purpose Bitcoin ETF, which attracted over $1 billion in assets under management within the first few months. By 2024, the assets under management of Bitcoin ETFs have grown to more than $30 billion, making them a popular tool for investors.

54. Mining as a Profitable Business

Bitcoin mining remains a profitable business in countries with cheap electricity, such as Kazakhstan, Iceland, and Texas (USA). At the beginning of 2024, miners’ revenue from block rewards and transaction fees amounts to about $20 million per day, despite the constant increase in mining difficulty.

55. Earning Passive Income Through Staking

While Bitcoin does not support staking directly, platforms such as BlockFi and Celsius Network offer interest accounts that allow users to earn up to 6% annually on Bitcoin deposits. This attracts investors looking for passive income from their assets.

56. Risks of Holding Bitcoin

Holding Bitcoin comes with certain risks, particularly the risk of losing private keys and its high volatility. As of 2024, around 20% of all bitcoins (approximately 3.7 million BTC) are considered lost due to user negligence or lost private keys, further reducing the available supply of Bitcoin.

57. Cold Wallets for Secure Bitcoin Storage

Investors who want to store their Bitcoin securely use cold wallets, such as Ledger and Trezor, which isolate private keys from the internet. These devices are becoming increasingly popular among crypto investors due to the rising number of hacking attacks on exchanges. In 2024, more than 15% of all Bitcoin holders use cold wallets.

58. Bitcoin in Investor Portfolios

Adding Bitcoin to an investment portfolio reduces risk due to its low correlation with traditional assets like stocks and bonds. In 2024, many financial advisors recommend that investors allocate 1-5% of their portfolios to cryptocurrencies, particularly Bitcoin, for diversification and risk hedging.

59. Increase in the Number of Bitcoin Whales

As of 2024, the number of Bitcoin addresses holding more than 1,000 BTC continues to grow. Around 2,500 large addresses exert significant influence on the Bitcoin market, leading to fluctuations in its price.

60. Decentralized Finance (DeFi) and Bitcoin

Decentralized finance (DeFi) protocols allow users to borrow, earn interest, and trade without intermediaries. Bitcoin is one of the assets that can be used as collateral on DeFi platforms like Aave and Compound. As of 2024, more than $10 billion in cryptocurrency assets, including Bitcoin, are involved in the DeFi ecosystem.

Facts 61-70: Bitcoin in the Gaming Industry

61. Paying for Games and Services with Bitcoin

Companies like Microsoft, Xbox, Big Fish Games, and some sellers on Steam accept Bitcoin for game purchases and in-game items. As of 2024, more than 5,000 companies worldwide accept Bitcoin for various digital transactions, including purchasing games and add-ons.

62. Blockchain-Based Games and NFTs

Games like Axie Infinity and The Sandbox use blockchain to create unique digital assets in the form of NFTs (non-fungible tokens). In its peak of popularity in 2021, Axie Infinity players earned a combined $30 million in a single week. As of 2024, NFT games continue to thrive, with a combined market turnover of over $35 billion.

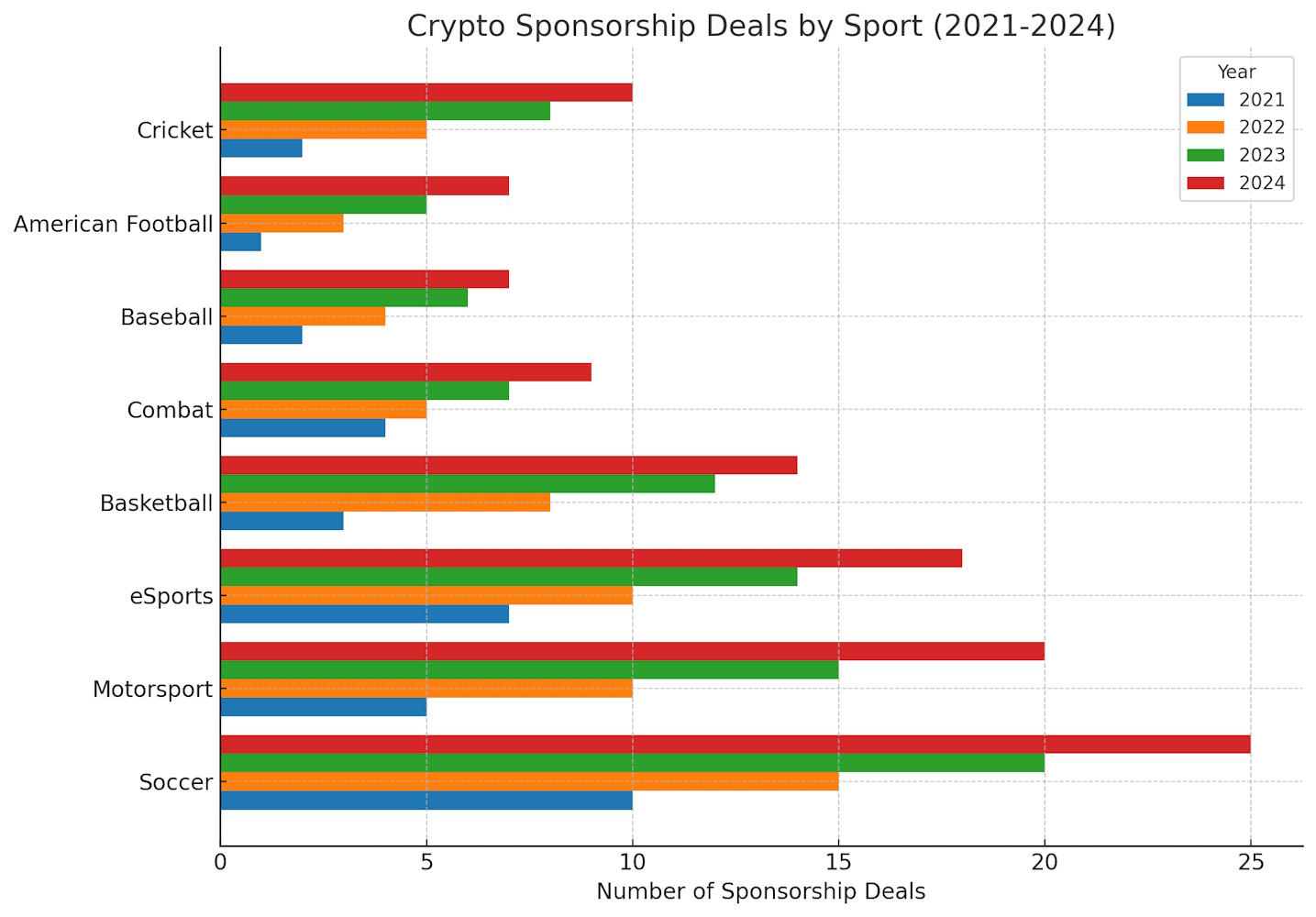

63. Esports and Cryptocurrency Sponsorships

Cryptocurrency companies actively sponsor esports teams and tournaments. For example, in 2021, the cryptocurrency exchange FTX signed a $210 million sponsorship deal with the esports organization Team SoloMid (TSM). Despite FTX’s bankruptcy in 2022, other crypto exchanges continue to support esports actively, with the total volume of crypto sponsorships in the industry exceeding $500 million by 2024.

64. Play-to-Earn Model

The play-to-earn model allows players to earn cryptocurrency by participating in gameplay. In countries like the Philippines, where crypto games have gained mass popularity, players can earn between $200 and $600 per month by playing games like Axie Infinity. In 2024, this model is evolving across dozens of blockchain-based games, attracting millions of new users.

65. Supporting Independent Developers Through Bitcoin

Independent developers increasingly accept Bitcoin for payments, bypassing large commissions on platforms like Steam and Google Play. By 2024, more than 10% of independent game developers use cryptocurrencies for direct sales of their projects, allowing them to retain up to 95% of their revenues without intermediaries.

66. NFTs as In-Game Assets

NFTs are increasingly being used in games to create in-game items and characters that can be freely traded. In 2024, platforms like The Sandbox and Decentraland generate an annual trading volume of over $1 billion from NFT-based transactions.

67. Buying In-Game Items with Bitcoin

In 2024, gamers can use Bitcoin to buy in-game items in popular games such as Roblox, PUBG Mobile, and Minecraft. In some countries, more than 15% of gamers use cryptocurrencies for such purchases, increasing transaction speed and reducing fees.

68. Games with Cryptocurrency Prize Pools

Cryptocurrency prize pools are becoming increasingly popular in gaming tournaments. In 2024, around 20% of all esports prize pools are paid out in cryptocurrencies, including Bitcoin. This attracts new sponsors and simplifies international payments to winners.

69. Blockchain Games with Million-Dollar Prize Pools

In 2024, the prize pools for blockchain-based games such as Axie Infinity and Gods Unchained exceed $500 million. This incentivizes new players and attracts professional gamers who make a living from crypto games.

70. Baxity – Your Gateway to the World of Crypto Games

The Baxity platform provides gamers with an easy way to purchase game vouchers and credits using Bitcoin. As of 2024, Baxity supports a wide range of products for gaming platforms like Steam, PlayStation Store, and Xbox Live, offering convenient and secure payment methods for gamers worldwide.

How to Quickly and Securely Buy Crypto Gift Cards on Baxity Store

At Baxity Store, we aim to make your shopping experience as convenient as possible. Here is a step-by-step guide to purchasing crypto gift cards, along with information on available payment methods.

Step-by-Step Purchase Process:

1. Go to the Official Baxity Store Website. Visit the Baxity Store website.

2. Register or Log into Your Account

- New Users: Click “Register” and fill out the form, entering your email and password.

- Existing Users: Click “Login” and enter your account credentials.

3. Select a Crypto Card. Go to the section with cards and choose the desired voucher, for example, Binance Gift Card.

4. Add the Item to the Cart. Select the voucher denomination and quantity, then click “Add to Cart.”

5. Proceed to Checkout. After adding the item to the cart, proceed with the checkout process.

6. Choose a Payment Method. Before completing the purchase, review the available payment methods. If your preferred payment method is not listed or if you have any questions, contact Baxity Store customer support.

Available Payment Methods:

- Credit and Debit Cards. Baxity Store accepts payments from major credit and debit cards such as Visa, MasterCard, American Express, and Discover.

- Bank Transfers. You can make a direct bank transfer. Banking details will be provided during the checkout process. Please use the reference number to ensure smooth payment processing.

- Cryptocurrency. Baxity Store supports cryptocurrency payments. The available cryptocurrencies will be displayed during the checkout process.

- Digital Wallets. Some digital wallets are also supported, such as PayDo, PayOp, ZEN, and Binance Pay.

- Other Payment Methods. Baxity Store accepts various other payment methods, which may vary depending on your location. These include: Neosurf, Paysafecard, Cryptomus, CashToCode, Pago Facil, Rapipago, Interac®, Webpay, PIX via QR-code, Oxxo, Revolut, Mobile Money (Kenya, Ghana, Cameroon), and more.View the full list of available options on the website during checkout.

Completing the Purchase:

- Confirmation and Payment. After selecting the payment method, complete the transaction by following the on-screen instructions.

- Receive Your Card. Once the payment is successful, the card code will be sent to your email. You can also find it in your account on Baxity Store.

- Use Your Card. Follow the instructions to activate the voucher on the relevant platform. For Binance Gift Card:

- Log into your account on Binance.

- Go to “Wallet” > “Gift Cards.”

- Click “Redeem Card” and enter the voucher code.

Conclusion

Bitcoin continues to transform various aspects of our lives, from finance and investment to gaming and international transactions. Its decentralized nature and innovative technology open up new possibilities for people around the world. Whether you are an arbitrage trader, investor, gamer, or simply interested in cryptocurrencies, Bitcoin offers tools to help you achieve your goals.

Baxity Store is ready to assist you on this journey by providing convenient and secure services for purchasing crypto vouchers and digital products. With an easy-to-use interface and excellent customer support, you can easily become part of the cryptocurrency revolution. Don’t miss out! Purchase your crypto voucher today on Baxity Store and discover a world of new opportunities!