Payz is an online financial service that enables its users to send and receive money in many kinds of currency. Individuals and businesses alike can use Payz as an e-payment solution. In this guide, we’ll focus on the use of Payz within Canada — for instance, how to sign up for an account, the pros and cons for Canadian users, and frequently asked questions.

Is Payz Available in Canada?

Yes, Canadian residents are able to use Payz. In fact, Payz can be used by customers in over 200 countries. However, only members of the EEA are able to use the Payz physical and virtual MasterCards. That being said, there are still plenty of financial services available to Canadian users — for instance, making online transactions, sending and receiving funds, and withdrawing money to your bank account.

How to Sign Up for an Payz Account in Canada

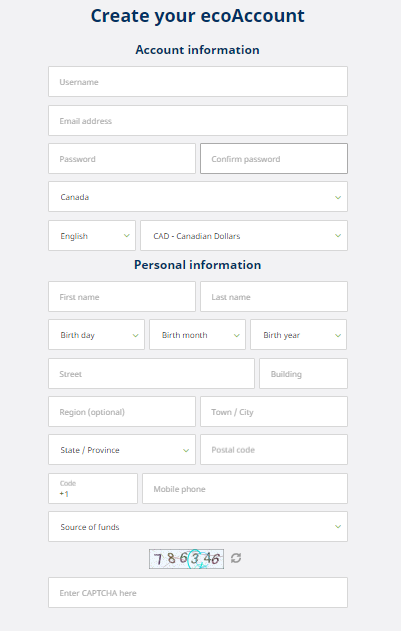

To create an account on the Payz site, you must provide a verifiable email address and create a unique username and password.

Some other information you’ll need to provide during the account registration process includes:

- Country of residence

- Contact language

- Main currency

- Full billing address

- Full legal name

- Birthdate

- Phone number (this includes the country code)

- Source of funds

- CAPTCHA

Upon doing so, you’ll receive an activation link at the email address you inputted. As soon as you access the email and follow the link it contains, you’ll be able to get into your Payz account.

Is There an Payz Canada Contact Number?

No matter which county an Payz user resides in, they may contact an Payz customer service associate via email or live chat. Currently, there is no Payz Canadian phone number located on the website. If you are having an issue with your account or experiencing some confusion during registration, there is no need to seek an Payz Canada phone number — we recommend using live chat instead. You can speak to a representative, almost instantaneously during business hours.

Pros and Cons of Using Payz for Canadians

After taking a close look at Payz, we were able to identify the main advantages of its services:

![]()

Excellent customer service: The representatives are well qualified, polite, and quick to provide Payz help.

![]() Well-designed mobile app: The Payz app enables its users to view and manage all of their account information easily and from one area. Users may also transfer funds between accounts and deposit and send money.

Well-designed mobile app: The Payz app enables its users to view and manage all of their account information easily and from one area. Users may also transfer funds between accounts and deposit and send money.

![]() Availability: With over 54 supported currencies, you will likely find the one you need when choosing your primary account currency. If you are Canadian, but you travel to Europe often, you can set your account to EUR, if you prefer.

Availability: With over 54 supported currencies, you will likely find the one you need when choosing your primary account currency. If you are Canadian, but you travel to Europe often, you can set your account to EUR, if you prefer.

However, there are still a couple of cons associated with Payz, namely:

![]() Card availability: Canadian users are not able to receive an Payz physical prepaid card or virtual card.

Card availability: Canadian users are not able to receive an Payz physical prepaid card or virtual card.

![]() Complicated fee structure: Residents of different countries have different fee schemes — it is easy to become confused when trying to figure out which fees are applicable to you.

Complicated fee structure: Residents of different countries have different fee schemes — it is easy to become confused when trying to figure out which fees are applicable to you.

Payz Sign-Up Bonus

When you use our link to register in Payz, you receive the most competitive account terms:

- an immediate upgrade to Gold status for free

- a multicurrency account

- speedy priority verification (this will take less than two hours on business days)

- lowered VIP thresholds — join this exclusive group when making only 10,000 EUR (15,600 CAD).

High rollers who use Payz to make lots of purchases may receive the chance to earn cashback.

FAQ

Before wrapping up our review of Payz in Canada, we wanted to address some questions that we frequently receive from our readers.

How Can I Top Up My Payz Account?

You can top up your Payz account in many ways:

| VISA |

Interac online | ecoVoucher | BTC | codePayz | Paysafecard | Instadebit |

| 2.90% | 0,50 EUR + 5,00% (2,90% from Silver level) |

Free | Free | Free | 8,50% | 0,50 EUR + 5,00% |

Can I Reduce Payz Fees?

Yes, it is possible to reduce your Payz fees by moving to a higher level account. When you use Baxity to sign up for Payz, you automatically begin with a Gold level account, which features lower currency conversion fees when compared to a classic account (1.49% vs. 2.99%). As you move to Platinum and then VIP, fees will drop even lower.

Can I Get an Payz MasterCard?

As mentioned above, only members of the EEA are currently able to receive an Payz MasterCard. If you are a Canadian resident, you won’t be able to receive one.

As mentioned above, only members of the EEA are currently able to receive an Payz MasterCard. If you are a Canadian resident, you won’t be able to receive one.

However, the process for EEA residents looks like this:

- Access your Payz account.

- From the main menu, click on the ‘Payz cards’ option.

- Select the tab that is labeled ‘Payz Mastercard.’

- Click on the icon that says ‘Get your card.’

- Check your shipping details.

- Read the terms and agree to them, and then submit the application.

Payz will process your MasterCard application for two business days. You can go back to this section of the site to look at your application’s status. Once your request has been approved, you will get a confirmation email from Payz. Then, the MasterCard will be shipped out; you will receive it within three weeks.

If you have any questions that our Payz Canada review didn’t cover, simply leave a comment below — we’ll do our best to address it ASAP.

I am pretty happy to find this review, I am going to Canada on a working visa and I wanted a way to pay for things without having to make an account at a real bank there. For clarification though, is it possible to pay for in-person services without a ecopazy card since I am not eea resident? or will I just be able to make online tranasactions using the account balance?

Iggie, thank you for your question. Yes, you can make online purchases using your account. But there are not so many shops that accept ecoPayz as a payment method, if you do not take into account gambling merchants. In this case, the ecoPayz card is much more universal, because it can be used to pay wherever a Mastercard is accepted. But it does have geographic shipping restrictions, it is true.

Thanks for the honest reply, I appreciate it. good thing I do some gambling online so I can get some use from the ecopayz

Iggie, you are welcome. I hope my consultation was helpful. Have a nice day!

If covid dies down, I am planning on travelling through Europe next summer. I know that I can’t get an ecopayz card in Canada, but if I get it delivered to family that lives in Europe, can I use it during my travels?

Mollie, thank you for your question! Of course, you can use your card in every country you go. However, it is better to notify the support service about your trips in advance, so your card could not be accidentally blocked for suspicion of theft. I also need to remind you that the card is delivered only to the verified address in account. Therefore, you will either have to ask your relative to create an account and issue a card in his/her name and address, or change and verify the address in your account to a European one.

Do you know if ecopayz can be used to buy alcohol and tobacco products online?

Piedpiper, thank you for your question! It depends on the store where you plan to buy it, whether it has ecoPayz among the payment methods.

Basically, all online and offline purchases are made using a plastic or virtual ecoPayz card, but alas, they are not issued for users outside Europe, and therefore are not available for Canada.

So, the answer to your question is more likely no than yes.

Def going to sign up for this when I turn 18 next month! Haha I have been too nervous to make an account at a real bank but this seems easy. Are there any problems in verification?

theofficefan, there is absolutely nothing to worry about when registering or verifying an ecoPayz account. Verification is quite simple and straightforward: you will need to take a photo of your passport or driver’s license, take a statement with the address in your bank, and take a selfie. No more pitfalls.

But if, nevertheless, it will be scary to do something wrong, write to us in the online chat or email, and we will give you all the information step by step.