What is PaySafeCard?

PaySafeCard is a prepaid payment method offering vouchers that can be used in a huge variety of online stores – including licensed online gambling and video game transactions. There are also other methods you can use to pay besides the e-voucher, such as the PaySafeCard Mastercard. You can even hook up the app to your smartwatch! PaySafeCard makes it easy to safely complete online purchases. In this review, we will look at the fees, limits, security, and registration process of the service, and also give some information about the prepaid MasterCard. We hope that this review will help you make an informed decision about whether the service is right for you.

Benefits of Paysafecard

Secure Transactions

When using PaySafeCard online, your personal and financial information will be completely secure. So, this service is a great choice for people who prioritize their privacy and don’t want other people to review their purchases.

Simplicity

There is no need for you to input and review a ton of details in order to complete a transaction with PaySafeCard. It isn’t even necessary for you to have a credit card or bank membership to get started with your account! Purchasing a PaySafeCard is accessible to anybody with funds, whether it be cash, check, money order, prepaid gift card, or another method of payment. Once you’ve loaded your card with money, all you have to do is enter your PaySafeCard’s 16-digit PIN when checking out in an online transaction.

Easy to Find

You can purchase a cash voucher at over 650,000 stores such as gas stations and supermarkets– or, for the ultimate convenience, you can even purchase one online.

Registration and Verification on PaySafeCard

One major draw of PaySafeCard is how accessible it is to purchase one; as mentioned earlier, it isn’t even necessary for you to access a credit card or have a bank membership. In our review of PaySafeCard’s registration and verification process, we found that you should follow these steps when purchasing it from a physical location:

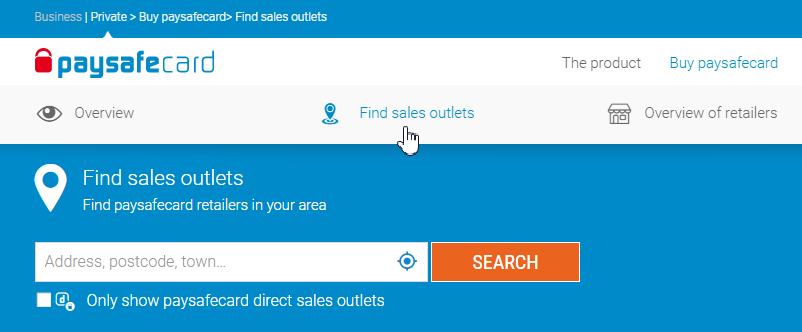

- Firstly, you need to find a physical sales outlet where you can purchase a PaySafeCard. To do so, visit the PaySafeCard website and input your address or zip code into the retailer finder search bar. Doing this will allow you to review every retailer in your area that provides you with the ability to purchase a PaySafeCard. If you find that there are limits to using the website, you can always use the PaySafeCard app to search your location and review your options.

- Go to your local retail outlet and ask to purchase a PaySafeCard. Typically, such retail outlets are grocery stores and gas stations, so perhaps you can review if you need to run any errands beforehand – two birds, one stone.

- Review and choose the total amount that you would like to load onto your PaySafeCard. You can choose the bill denominations between 10 EUR and 100 EUR. Give the cashier any other information that they may require during this part of the registration process. If the process requires proof of identity for verification purposes during registration, PaySafeCard accepts the following documents: a passport, an ID card, proof of residence, or a driver’s license.

- Once you complete the registration and the purchase, you will receive your PaySafeCard cash voucher, which has a 16-digit PIN number on it. The voucher will look like this:

- Now you can use your PaySafeCard cash voucher to make payments at numerous websites!

All right, so let’s say that you are not interested in the purchase and registration of a PaySafeCard cash voucher, but you want an e-voucher instead. No worries! You can simply visit PaySafeCard’s website, click on the PaySafeCard Online PIN Shop link, and follow the checkout and registration procedure. Choose your denomination between 5 EUR and 100 EUR. Fill out and review any personal information that is required during the checkout and registration process. After the registration and checkout, your PaySafeCard PIN will be available in your PIN Shop account. This will happen immediately after your registration and payment go through. You can also review your e-voucher balance through your account dashboard at any time.

Review of Fees and Limits on Paysafecard

Before deciding if PaySafeCard is an ideal option for you and filling out the registration form to get one, be sure to review its structure of fees and any potential limits.

Fees

There are monthly maintenance fees that are charged after your PaySafeCard has been activated for 7 months. The monthly fees will be GBP 3.

There are also foreign currency conversion fees for all transactions that are in a different currency. If you would like to see what the potential fees would be, check out PaySafeCard’s exchange rate via its currency converter tool. It’s quite simple to use – just enter the amount of the transaction and select the two currencies that you are working with. Then, the converter will tell you exactly what your fees would be. Transaction refunds come with fees of GBP 6 ($7,5) per refund, which is deducted from the total refunded amount.

If your PaySafeCard has been inactive for 24 consecutive months, there will be monthly maintenance fees of $2.

There are no fees charged for using the PaySafeCard website to check your balance or your account statements.

Now that we’ve given a review of the fees let’s look at PaySafeCard’s limits.

Limits

When looking at the PaySafeCard website, it says that there are limits of GBP 40 per purchase for the physical cash vouchers and e-vouchers. Now, for payouts, you will have to create a PaySafeCard account in order to receive winnings from gambling sites to your card. There are two kinds of accounts you can create: standard and unlimited. Different limits apply for both types of accounts.

Payout Transaction Limits

With a Standard account, there will be daily limits of 250 EUR. With an Unlimited account, the limits will be 2 500 EUR.

For monthly transaction limits for payouts, Standard account holders have limits of 250 EUR. Unlimited account members will not have monthly payout transaction limits.

Standard members will not have annual payout transaction limits, whereas Unlimited members have annual limits of 15 000 EUR.

| Standard Account | Unlimited Account | |

| Daily Payout Transaction Limits | 250 EUR | 2500 EUR |

| Monthly Payout Transaction Limits | 250 EUR | No Limit |

| Annual Payout Transaction Limits | No Limit | 15,000 EUR |

PaySafeCard also offers a Mastercard. We will go over the Mastercard limits later in this review.

Information about Security

PaySafeCard offers 2-factor verification for app sign-ins. However, in order to make a purchase with a cash voucher or e-voucher, you simply need to input the voucher’s 16-digit PIN. This means that if somebody gets a hold of your voucher, they can make fraudulent purchases.

The Terms & Conditions page states that it is the customer’s duty to secure their PIN and review transactions. If, after reviewing purchases, a customer believes that there have been fraudulent purchases, they must contact PaySafeCard in order to receive a new PIN. All transactions using the vouchers will be treated as being authorized by the customer (no refunds for fraudulent purchases.)

PaySafeCard also states the if a customer’s PaySafeCard is lost or stolen, they will not be able to receive a new PIN or be reimbursed for lost money.

Because PaySafeCard does not take security measures to protect the vouchers, customers must be sure to vigilantly protect the PIN number and review purchases on a regular basis.

Information about Paysafecard Mastercard

PaySafeCard offers a Mastercard option if you are not fond of the idea of purchasing vouchers on a regular basis. After all, their vouchers can only hold up to 100 EUR.

How It Works

According to PaySafeCard’s Mastercard Terms & Conditions page, every customer who has an unlimited account may apply for a Mastercard. They can only have 1 Mastercard per account. The only prerequisites are that the Unlimited account is not suspended and that the customer has sufficient funds to cover the Mastercard’s first annual fee (9,90 EUR). Customers must fill out an application on the PaySafeCard website for the card’s registration; the company is authorized to request proof of identification if necessary to complete the registration process. If an applicant is under 18 years of age, they must provide written proof of permission from a parent or a guardian during the registration.

The MasterCard will be sent out to applicants 14 days after they complete the application and registration for the card. If a customer is under 18 years of age, they will be sent a Mastercard Youth Card, which cannot be used for gambling purposes.

When your Mastercard arrives in the mail, it isn’t going to be activated yet. In order to activate the card, login to your PaySafeCard account and follow the steps listed.

Mastercard Fees

The PaySafeCard Mastercard has annual fees of 8GBP, card replacement fees of 4 GBP, and exchange rate fees of 3% (with a 1% reservation for fluctuations.)

Furthermore, the Mastercard has cash withdrawal fees of 3%, with a minimum of 3 GBP, and card loading fees of 4%.

Mastercard Limits

The limits for the PaySafeCard Mastercard is split up into two categories: Adult and Youth.

| Adult | Youth | |

| Maximum Card Balance Limits | GBP 4,000 | GBP 750 |

| Daily Top-Up Limits | GBP 1,500 | GBP 750 |

| Monthly Top-Up Limits | GBP 4,000 | GBP 1,500 |

| Annual Top-Up Limits | GBP 40,000 | N/A |

| Single Transaction Limits | GBP 750 | GBP 750 |

| Daily Transaction Limits | GBP 1,500 | GBP 750 |

| Single ATM Cash Withdrawal Limits | GBP 400 | GBP 400 |

| Daily ATM Cash Withdrawal Limits | GBP 400 | GBP 400 |

| Monthly ATM Cash Withdrawal Limits | GBP 1,000 | GBP 1,000 |

Summary

PaySafeCard offers a convenient way for people without a bank account, credit card, or debit card to find a way to make online purchases. These vouchers make online shopping accessible for everybody who lives near one of the retail locations that sell PaySafeCards. Furthermore, PaySafeCard Mastercard is a great option for people who want to make secure gambling deposits and withdrawals.

It’s no safe anymore.

I lost my money and they blocked my account.

2weeks I already try to sent my 120€ to my bank account and they just sayed: we have problem, you must wait. Your account is blocked.

I TOLD ALL my verification, but I must wait

Yevheniia, from your message it is not entirely clear which payment system we are talking about. Could you write to our online chat on the site, please? Perhaps we can help you or give you contacts to reach the necessary support.

Also with me try to transfer money to my banks account is not working even trying to order things with it isn’t working so worried i have alost of money inside

PRECIOUS EGUNGIE, you should contact Paysafecard support directly to solve this issue.

Deposited 10 drillar card

Hi, Rod! Can we help you?

What is drillar?

This is a stupid scam people. Dont ever make a paysafecard. You can not use it anywhere, and when you do so, they will block your card.

Thank you for your comment and for sharing your experience with PaySafeCard. We understand your concerns about your card being blocked. While we do not represent PaySafeCard, we would like to offer some helpful advice:

If your PaySafeCard has been blocked for security reasons, you can request its unblocking using a special online form on the PaySafeCard website. You will need to enter the blocked PIN and provide additional information, including photos of your ID and the blocked PaySafeCard. You can use this link for that purpose: https://customer.cc.at.paysafecard.com/cct/

Your request will be processed within a few working days, and you will receive an email confirmation once it has been completed.

We hope this information helps you resolve the problem. Good luck!

If I’m asked for a Paysafe Proof of Ownership, what screenshot or document that I can show?