What is Revolut: A Comprehensive Review of This Digital Bank App

Revolut is one of the world’s most prevalent digital bank solutions. You can access the bank services via the Revolut app. Such services on the app include sending cash through a money transfer to another person’s account, in addition to exchanging cryptocurrency.

The Revolut bank app was released in 2015 and has since drummed up over 8 million customers, 350 million account transactions, and tens of billions of dollars of cash through money transfer services.

Another draw to the app is that, when you create an account, you could be eligible to receive a prepaid Mastercard that you can load cash on. This allows you to make easy POS purchases with a card, so you don’t have to carry cash around with you.

When you review Revolut as a company, you can see that its goal is to allow its customers to manage every money transfer, as well as other financial services, via a single app. The app is quite popular among people who travel often and need a bank app that allows cash transactions with limited fees.

The Revolut bank app also has a host of other features available from your account, such as ways to budget your cash, insurance, and more.

In this review, we will look at the pros and cons of Revolut, its fees and limitations, and other information. We hope that this review of the Revolut bank app and its money transfer service (among other services) will help you decide whether creating an account is right for you.

Revolut’s Pros and Cons

Pros

One of Revolut’s pros is that you can hold cash in your account in a large number of currencies. In fact, the Revolute bank app supports over 150 currencies and allows you to hold up to 29 of them in your account. This means that when you make an international money transfer, you don’t have to worry about your account being hit with a huge cash fee.

Another benefit of the app is that the account registration process is quite simple. To create a Revolut bank account, you just need to fill out and review some basic personal information and upload an identification document for verification review purposes.

You won’t have to have a credit review done, pay cash, or verify your address to create a Revolut bank account. You can start spending cash and make a money transfer very quickly.

The Revolut bank app is quite user friendly; you won’t have to struggle to figure out how to make a money transfer or spend some cash. Just a quick review of the app’s functions is all you’ll need to get started.

Revolut is loaded with all kinds of account features besides just making a money transfer or using your prepaid MasterCard to spend cash. We’ll go into these in more detail later in this review.

One final pro of the bank app is that customer service is reachable 24/7. Anytime you have a problem with your account, such as not being able to complete a money transfer or send cash, they can review the issue and help you.

Cons

Because the currency markets are closed on the weekends, the Revolut bank app will charge you a 0.5% fee for its main currencies and 2% for the other available currencies.

Another con is that only the first £200 of your monthly cash withdrawals are free.

Lastly, Revolut is only available online, as are its customer service representatives. If you prefer going to a physical bank and doing account services there, you might not like Revolut.

Revolut’s Features

There are many things that you can do with a Revolut bank account, and all features are conveniently located within the app. Such features include:

- Sending cash internationally: except on the weekend, you can send a money transfer to an account in another country with no fees. You get it at the interbank rate of exchange. This also applies to spending cash worldwide.

- Paying friends with cash: As you already know, the Revolut bank app makes it quite easy to make a money transfer to another customer’s account. However, the app also has a feature that lets a group of people split a bill. No more squabbling over physical cash in a restaurant!

- Review cash spending: You can use the Revolut bank app’s analytics to review how you spend your cash. This can really help you budget your cash better!

- Set a monthly spending limit: If, after you review your account, you find that you are spending too much cash, you can set a limit on your account. You can only spend a certain amount of cash from your Revolut bank account each month.

- Vaults: Use the Revolut bank app’s Vaults to save cash! You can make a personal vault or a group vault for cash-saving purposes. You can set up a single money-transfer to the Vault, have the money transfer occur on a regular basis, or choose to have every cash purchase round up to the next dollar and put the change in the account. You will have cash saved up in your Revolut bank account before you know it!

- Insurance: The Revolut bank app offers travel, device, and medical insurance that you can pay for directly from your account. The rates are relatively affordable, so you won’t have to drop too much cash.

- Cryptocurrency: This review will have a whole section about the Revolut bank app’s cryptocurrency capabilities. For now, though, just know that you can use your account to exchange crypto easily.

Revolut Accounts

If you want to sign up for a person’s Revolut bank account, there are three options: Standard, Premium, and Metal. Revolut also offers a Business account and a Junior account. Let’s go through what each type of account can provide.

Standard Bank Account

It won’t cost you any cash to set up a Revolut Standard bank account. This free account still delivers many perks, such as interbank rates for international money transfers, bank money transfers that are free, free ATM cash withdrawals (up to €200/£200 cash per month) and 1 free cross border transfer per month, (£0.50 thereafter).

Premium Bank Account

Signing up for a Revolut premium bank account will cost a bit of cash each month – £6.99/month, to be exact. The perks of the premium account include the same as the standard account, but the ATM cash withdrawal total is increased to €400/£400 cash per month. Premium also introduces many new amenities, such as:

- Access to three complimentary Premium prepaid Mastercards

- Free Access to prepaid disposable virtual cards

- Free exchange between currencies

- The option to get travel insurance for overseas purposes

- Prioritized customer service for account issues

- Access to purchasing airport lounge passes for cash

- You (and 1 associate) can receive complimentary lounge passes if your airline flight has a delay greater than 1 hour.

- You can create 2 Junior accounts for your children or a minor ward.

Metal Bank Account

When you sign up for a Revolut Metal bank account, there is a £12.99 monthly cash fee. This type of account includes all of the Premium perks, and it increases the ATM cash withdrawal total to €800/£800 cash per month.

Exclusive Metal account perks include:

- Access to a contactless prepaid Revolut MasterCard made of stainless steel

- Exclusive concierge access (they can help you set up restaurant reservations, book trips, and more.)

- Cashback perks to your account for card cash payments made in supported currencies

- You (and 3 associates) can receive complimentary lounge passes if your airline flight has a delay greater than 1 hour.

- The ability to create 5 Junior accounts for your children or minors you have guardianship over.

Business Account

The Revolut Business account is meant to allow companies to manage finances easily from one app. Here are the main draws of the Revolut business account:

- Ordering a card for employees, as well as creating a virtual card (or multiples) easily

- Adding a card (or multiple cards) to one multi-currency Revolut account

- Eliminating worries related to managing expenses: Company cardholders can use the Revolut Bank app to send in receipts.

- Receiving expense reports in real-time and having the option to accept or reject the purchases.

- Exporting cash expenses as a .csv file

- Creating monthly spending limitations

- Tracking money transfers

- Turning on/off ATM cash withdrawals

The Revolut business account has a free subscription, but you will have to pay for services depending on the needs of your company. Make sure to review your options.

Junior Bank Account

If you have a Revolut personal account, you can create a Revolut Junior bank account for your child or another minor that you have legal responsibility over. They must be between the ages of 7-17 in order to have an account, make money transfers, and spend cash. If you have a Premium Revolut bank account, you can create 2 Junior accounts. With a Metal Revolut bank account, you can instead have 5 Junior accounts.

Juniors can use the Revolut Junior app in order to view their transactions and track their pocket money. You will also receive instant alerts to your own device when they spend money. Juniors can also have one Revolut Junior card each, which can only be used by them. Juniors can use the Revolut Junior card in the same manner as a regular card. For instance, they can make internet purchases, physical purchases, and ATM withdrawals. However, you can turn these permissions on and off from within your app.

Keep in mind, Revolut blocks any inappropriate purchases that are attempted from a Junior card. For instance, gambling merchants and alcohol merchants are restricted.

Revolut Account Fees & Limits

Fees

Revolut fees are split up based on which account subscription you have. Please see the table below for a thorough review of the different fees.

| Review of Mastercard Order + Delivery Fees | |||

| Service | Standard Account | Premium Account | Metal Account |

| Account Subscription | N/A | Monthly: £6.99 Yearly: £72 |

Monthly: £12.99 Yearly: £120 |

| First Revolut Prepaid MasterCard | Free + delivery fee (Standard card) | Free (Standard or Premium) | Free (Standard, Premium or Metal) |

| Second Revolut Prepaid MasterCard | N/A | Free (Standard or Premium) | Free (Standard, Premium or Metal) |

| Subsequent Replacement Revolut Prepaid Mastercards | £5 (+ delivery fee) | £10 | £40 for replacement Metal cards/£10 for non-metal cards |

| Additional Virtual Revolut Prepaid Card Charge |

£4.99 | Free | Free |

| Physical Revolut Prepaid Mastercard Delivery Charge |

£4.99+ (Global Express Delivery is an extra cash charge) | Free | Free |

| Review of Transaction Charges | |||

| Service | Standard Account | Premium Account | Metal Account |

| Instant Money Transfer | Free | Free | Free |

| Turbo Transfers | £5 or currency equivalent | Free | Free |

| Revolut Bank Money Transfers | Varies | Varies | Varies |

| ATM Cash Withdrawal Fee | ATM Cash Withdrawals after £200 (or currency equivalent per month) are subject to a 2% cash fee. | ATM Cash Withdrawals after £400 (or currency equivalent per month) are subject to a 2% cash fee. | ATM Cash Withdrawals after £800 (or currency equivalent per month) are subject to a 2% cash fee. |

| SEPA Cross-border Payments | Free | Free | Free |

| Non-SEPA Cross-border Payments | First payment is free. Subsequent payments are £0.5 apiece. | Free | Free |

| SWIFT Payments |

For USD payments: £3 For other currencies: £5 |

First payment is free. Afterwards: For USD payments: £3 For other currencies: £5 |

First payment is free. Afterwards: For USD payments: £3 For other currencies: £5 |

Limits

The Revolut bank app offers some pretty generous account limits. For instance, you can make up to £3,000 in an ATM cash withdrawal every 24 hours. You can also spend £100,000 (or its currency equivalent) every month with each of your Revolut cards.

If you have a new Revolut prepaid Mastercard, there will be a temporary limitation on daily cash expenditure. This will change over time and gradually increase. This limit can’t be changed manually by a customer service representative.

Once your account is in good standing, there are generally no specific deposit limits. If you think you will receive a huge cash money transfer, just be sure to give Revolut a heads up. This way, you can avoid having your account frozen while they review the cash money transfer.

For crypto exchange, you can use your account to make 30 daily exchanges. Each transaction, buying or selling, can be up to €15,000.

If you are making a direct debit cash transaction, there is no limit for GBP. For EUR, the limit is €5,000.

And what about transfer limits? Well, if you’re sending GBP to a recipient who resides in the UK, there will be a single-transfer cap, in addition to weekly and daily limits. The single-transfer cap is £250,000, while the daily limit is £500,000. As for the weekly limit, you can send a total of £1,000,000.

Finally, you can set your own limit for monthly spending. This is ideal for households who are trying to take control of their finances by budgeting their spending.

Revolut Prepaid MasterCard

The Revolut Prepaid MasterCard comes with its own set of fees, which you can see below:

| Prepaid Mastercard Fee Type | Standard Account | Premium Account | Metal Account |

| Account Plan Fee (paying monthly) | $0.00 | $9.99 | $14.99 |

| Account Plan Fee (paying annually) | $0.00 | $94.99 | $149.99 |

| Per Mastercard Purchase Fee | $0.00 | $0.00 | $0.00 |

| ATM cash withdrawal via Mastercard (in-network) | up to 2% | up to 2% | up to 2% |

| ATM cash withdrawal via Mastercard (out-network) | up to 2% | up to 2% | up to 2% |

| Loading cash to prepaid Mastercard | up to 3% | up to 3% | up to 3% |

| Account Customer Service for Mastercard (in-app) | N/A | N/A | N/A |

| Account Customer Service for Mastercard (live call) | $0.00 | $0.00 | $0.00 |

| Mastercard Account Inactivity (after 12 months with no transactions) | $0.00 | $0.00 | $0.00 |

One huge benefit to owning a Revolut prepaid Mastercard is that you won’t be charged an overdraft cash fee. You are insured by the FDIC for up to $250,000.

If you want to order a physical Revolut prepaid Mastercard, you can do so directly through the app. Follow these steps: Open the app. Find the card tab within the app and then tap “Physical.” Review your delivery address and any applicable shipping cost. Confirm the transaction. Your Revolut prepaid Mastercard will arrive at your home in several business days. You can use it in any store that accepts Mastercard.

Another option is to order a Revolut prepaid virtual card. This is similar to the physical prepaid Mastercard, except that it is solely digital. You can use the app to generate a prepaid virtual card; once more, open the app. Navigate to the card tab in the app. This time, you will choose a virtual card instead of tapping on physical. Because this prepaid card is virtual, you won’t be charged a shipping fee. You may have up to 5 virtual prepaid cards at once.

There is one more option regarding Revolut’s cards. You can sign up to receive a virtual card that is disposable, meaning that it is discarded after one use.

After you make a payment, the card’s details are permanently blocked, meaning that nobody could ever use that card in a fraudulent manner to spend your hard-earned cash. It’s very easy to create a Revolut prepaid virtual Mastercard. You will choose “Disposable Virtual” from the card menu, and it will be ready within seconds. Each time you complete a transaction, the card’s details will change afterward.

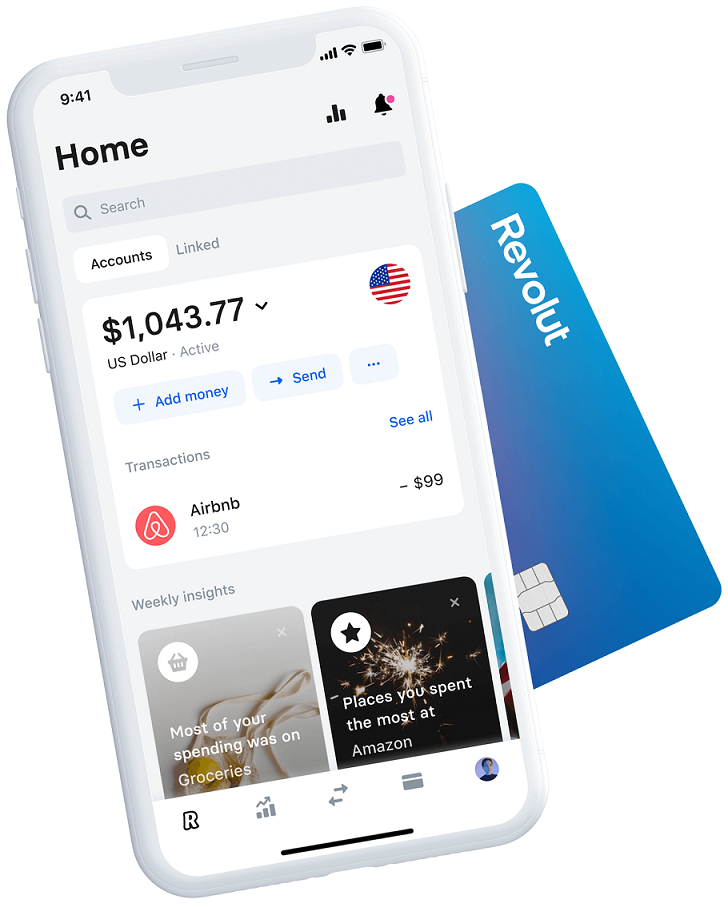

Revolut App

All Revolut dealings can be done directly through the app. The app can be downloaded through the App Store or from the Google Play store. Furthermore, you can access the Revolut app on Apple Watches and other devices that are iOS 11+. Android phones are supported if their system is 5.0 Lollipop (or a more recent version). Currently, the Revolut App is not supported on Android tablets.

So, what makes the Revolut App so appealing? The app is intuitive, sleek, and chock full of features. You can see any money transfer and cash payment in real-time, plus you can manage transactions, freeze spending, split bills, and more.

Revolut’s Perks Program

Another amazing thing about Revolut is that it rewards customers for loyalty, even ones that have a free account. You’ll receive access to excellent deals for all sorts of brands. If you have a Premium or Metal account, you will be upgraded to the Perks Plus program, which offers even more cashback offers and discounts. What’s more, you don’t have to worry about applying to receive rewards.

When you use your Revolut card to pay cash for an eligible transaction, you will automatically receive the reward in your account. Online discounts are also automatically applied when you are using the Revolut bank card or its other payment options.

So, how can you get started? First, make sure that your Revolut bank app is fully updated. Next, tap on your profile and press the Widgets link. On the next screen, navigate to the Rewards section. From this part of the app, you will be able to see all current cashback promotions and discounts that you are eligible to receive at your current account level. Now, simply shop and enjoy the cash rewards and discounts!

Revolut’s Cryptocurrency Exchange

You can use the Revolut bank app to buy and sell cryptocurrency, in addition to sending it and receiving it to/from other Revolut account holders. Revolut offers these types of crypto:

| Available Cryptocurrencies |

| Bitcoin |

| Ethereum |

| Litecoin |

| Ripple |

| Bitcoin Cash |

Revolut was the first app-based bank that allowed customers to exchange cryptocurrency, so it has the most experience out of other apps on the market.

Revolut account holders who are Premium or Metal can automatically participate in cryptocurrency exchange. On the other hand, if you are a Standard member, you must refer 3 people to the Revolut app before you will be eligible to use the cryptocurrency services.

Some features of Revolut Bank’s Cryptocurrency program include:

- Being able to make a money transfer of cryptocurrency to other account holders free of charge.

- Seeing the cryptocurrency exchange rate fluctuate in real-time so that you can make the most advantageous exchange.

- Exchanging one of Revolut’s 25 standard currencies for one of the 5 available cryptocurrencies

- Using the Revolut card to spend currency (the card will automatically convert the payment into local currency without you having to do anything)

When you buy or sell cryptocurrency via Revolut, keep in mind that there is a markup of 1.5%.

Revolut’s Security

Revolut’s bank account security measures differ depending on which entity’s jurisdiction you are under. To see which you are registered under, open up the app, navigate to your settings page, and scroll all the way down. If you see “Revolut LTD”, this means that Revolut safeguards the money you send and receive. Revolut safeguards the money by holding the money into an actual bank account – this way, if Revolut ever went out of business, you would be paid out before members who are under different entities.

Revolut also takes steps to ensure the safety or your account details. Revolut uses 2048-bit SSL encryption to protect all of the app’s data. In addition to this, Revolut implements firewalls and stores info on third-party secure servers.

As far as your personal device security, you can set up 2-factor authentication so that way nobody can log into your account even if they guess your password.

Summary

The Revolut bank app comes with a whole host of features, each of which is well implemented and intuitive to use. It’s impressive that the standard account can access so many of these features. Some of the stand-outs of Revolut is its Perks Program, its easy-to-use crypto exchange platform, and the fact that you can do pretty much everything you want financially from its app.

Thx for sharing!!! I got Revolut account with no credit check and can send money-quick now. Standard account is very good but I think premium account will be better. I will try it next month I think. I guess premium is worth the money, gonna write how it goes later.

Dear Omar, thank you for your feedback! We are happy you enjoy Revolut service!