We all know that money conversion within payment systems is our pain.

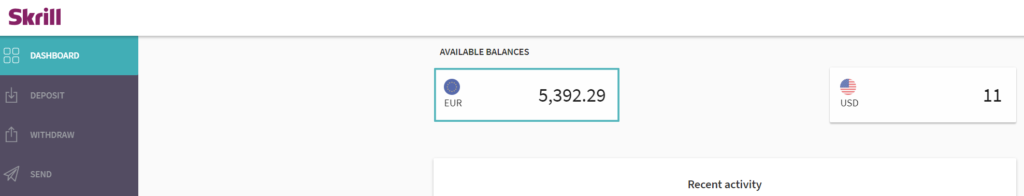

Skrill eats from 1.99% up to 3.99% on that. Earlier, to decrease conversion fee, you had to gain VIP Silver or higher, which means deposits of 15k per calendar quarter. Starting November 14th 2019 all accounts have become multicurrency. So, what you should know about this?

New currency does not appear automatically

To add the new currency, you need to deposit at least $1 (EUR etc.) from a card or a bank account. While depositing, you will be offered to choose a currency even if your card is in another currency. A transaction from another account will not add a new currency but will make a regular conversion to your basic currency.

No cheating

Once you add a new currency, you can accept payments in it. The system itself will see the necessary account and put money on it. The sender will still need your email only. If your account does not have the appropriate currency, the transaction will be converted as per usual 3.99% fee (lower if you are VIP) and credited to your primary account.

Works everywhere

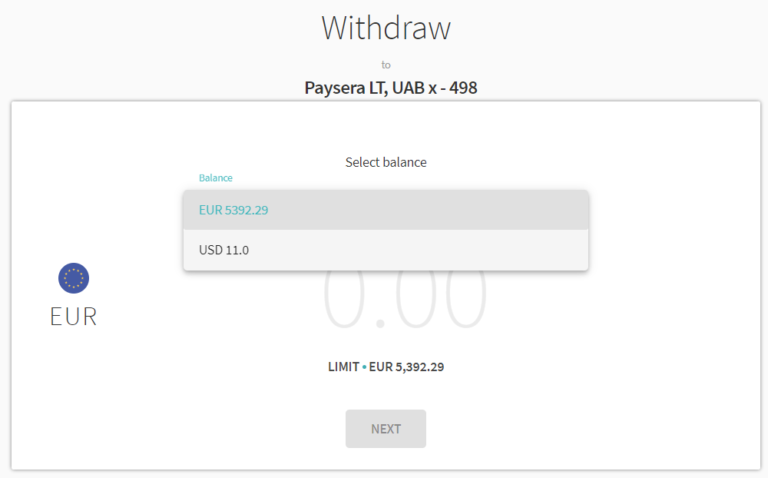

There will be no attempt for conversion. Whatever transaction you make, you will always have a choice in the currency. No matter whether it is a withdrawal, deposit, or internal transfer, you will still have to choose transaction currency

What do I do if I have several accounts in various currencies?

Nothing. Additional accounts for VIPs remain active, but they are useless as long as each of them is now a multicurrency account. Thus, you decide to use them or not.

Let’s compare multi-currencies in popular payment systems.

Skrill vs NETELLER

We have not seen much of useful innovations from Skrill recently. Hence, such decision gives this system a definite advantage over NETELLER where you still have to create a separate account and be VIP Silver or higher.

ecoPayz vs Skrill

ecoPayz has had a multicurrency option with 45 currencies available, so now these two are equal in this regard.

PayPal vs Skrill

PayPal is famous for trying to convert currencies everywhere. It happens even in the most unpredictable moments. Say, you pay in EUR from your EUR card. Paypal will try to process this transaction in GPB and grab 5% as a conversion fee. Skrill has nothing to do with that now. Moreover, the regular conversion is cheaper. Therefore, in terms of currency conversions, Skrill if ahead of Paypal, especially if you have VIP status.