In the rapidly evolving world of digital currencies, understanding how to securely store and manage your assets is crucial. A crypto wallet is an essential tool for anyone looking to buy, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and others. This comprehensive guide will explain what a crypto wallet is, how it works, and why it’s indispensable for safeguarding your digital assets. We’ll also explore how leading platforms like Binance and services like Baxity Store can enhance your cryptocurrency experience.

Understanding Crypto Wallets

In the world of digital finance, a crypto wallet is your personal tool for accessing cryptocurrencies. It is an application or device that stores special digital codes—your public and private keys, which are necessary for interacting with the blockchain.

What is a crypto wallet and why do you need it?

Despite the name, a crypto wallet doesn’t actually store the coins themselves. Instead, it secures your keys to access digital assets. Without a wallet, you won’t be able to send, receive, or manage your cryptocurrencies.

Using a crypto wallet gives you complete control over your assets, allowing you to make transactions without intermediaries or bank fees. It’s essential for anyone who wants to safely store cryptocurrency, invest in digital assets, or use innovative blockchain-based financial services.

Key Functions of a Crypto Wallet

Crypto wallets perform several key functions that make working with cryptocurrencies convenient and secure. They not only store your access keys but also allow you to interact with different blockchain networks. Thanks to wallets, you can track your balance, view your transaction history, and manage multiple types of cryptocurrencies in one place.

Before using a wallet, it is important to understand its core capabilities:

- Key storage: Secure storage of your private and public keys.

- Transaction handling: Sending and receiving cryptocurrency globally.

- Balance tracking: Instant access to your asset information.

- Multi-currency management: Support for various cryptocurrencies in one app.

The Importance of Public and Private Keys

Understanding the role of public and private keys is the foundation of securely using a crypto wallet. A public key serves as your wallet’s address, which can be freely shared to receive payments. The private key is the secret code that grants you the right to control your funds. Losing it or letting it fall into the wrong hands can result in the loss of all your cryptocurrencies.

The secure storage of your private key is your personal responsibility. Many wallets provide a seed phrase—a series of words to recover access if you lose your key. You should store this information in a secure place inaccessible to others.

How a Crypto Wallet Works

Understanding how a crypto wallet operates will help you use it confidently and keep your funds secure. In this section, we’ll look at how a wallet interacts with the blockchain, how transactions are processed, and the role of cryptography in protecting your digital assets.

Interaction with the Blockchain

The blockchain is a distributed ledger that records all cryptocurrency transactions. It consists of a sequence of blocks, each containing transaction data, and is linked to the previous block using cryptographic methods.

A crypto wallet acts as a bridge between you and the blockchain:

- Transaction initiation: When you initiate a transfer of funds, your wallet creates a transaction and signs it with your private key.

- Receiving information: The wallet queries the blockchain to check your address balance and retrieve your transaction history.

- Data updates: Once the transaction is confirmed by the blockchain network, your wallet updates your balance accordingly.

Example: Think of the blockchain as a global ledger that everyone can access. Your wallet helps you view and make entries in this ledger, which other network participants can verify.

How Cryptocurrency Transactions Work

A transaction in the blockchain is the process of transferring cryptocurrency from one user to another. Here’s how it happens step by step:

- Transaction initiation: You input the recipient’s address and the amount of cryptocurrency to send in your wallet.

- Signing the transaction: The wallet uses your private key to generate a digital signature, confirming that you authorize the transfer.

- Broadcasting to the network: The signed transaction is sent to the blockchain network for processing.

- Transaction validation: The network nodes verify the transaction for accuracy and check for potential fraud.

- Adding to a block: Once validated, the transaction is included in a new block, which is added to the blockchain.

- Transaction confirmation: As more blocks are added, your transaction receives confirmations, making it irreversible.

- Balance update: Your balance decreases by the transfer amount plus the network fee, and the recipient’s balance increases by the same amount.

Important: Blockchain transactions are irreversible. If you make an error in the recipient’s address or the amount, you cannot undo or change the transaction after confirmation.

The Role of Cryptography in Security

Cryptography is the science of securing information through encoding. In the context of crypto wallets and blockchain, it provides:

- Confidentiality: Your private keys are encrypted and stored securely.

- Authentication: Digital signatures confirm that transactions are initiated by you.

- Data integrity: Cryptographic hashes ensure that transaction data remains unchanged.

- Protection against forgery: Asymmetric encryption makes it impossible to forge transactions without knowledge of the private key.

Key cryptographic concepts:

- Asymmetric encryption: The use of a public-private key pair for encryption and decryption.

- Hash functions: Algorithms that convert data into a unique fixed-length string (hash). Any change to the data results in a completely different hash, allowing quick detection of tampering.

- Digital signature: A method for verifying the authenticity and integrity of a message or transaction using a private key.

Example: When you sign a transaction with your private key, it’s like applying an unforgeable electronic signature. The blockchain network can verify this signature using your public key without exposing your private key.

Why This Matters to Users

Understanding how a crypto wallet works and the role of cryptography will help you:

- Enhance security: Knowing how your funds are protected allows you to take extra precautions.

- Conduct transactions confidently: Understanding the process reduces the risk of mistakes and loss of funds.

- Recognize threats: Knowledge of how crypto wallets operate will enable you to spot potential fraud and protect yourself from scams.

Types of Crypto Wallets

There are several types of crypto wallets, each with its own features, advantages, and disadvantages. Understanding the differences will help you choose the best option for your needs and ensure the security of your digital assets.

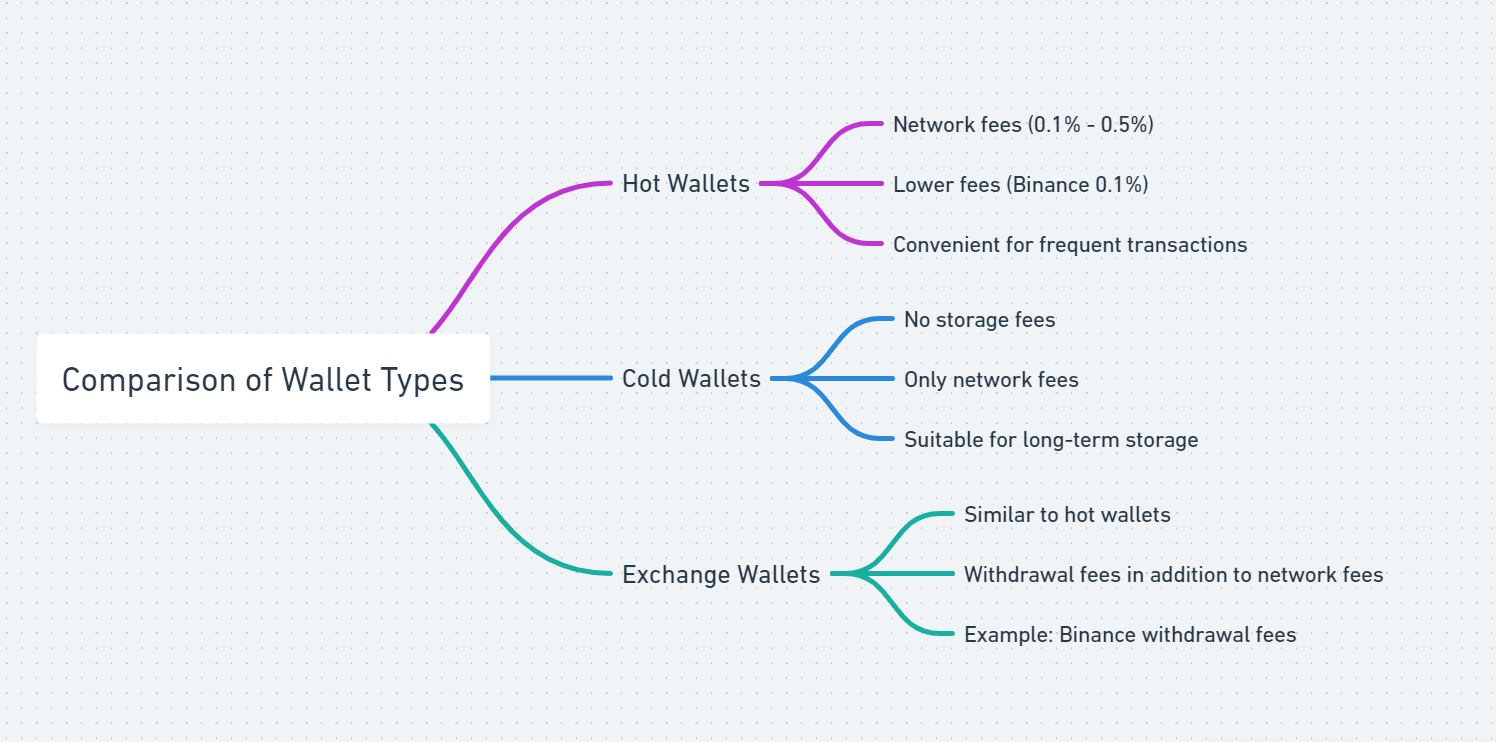

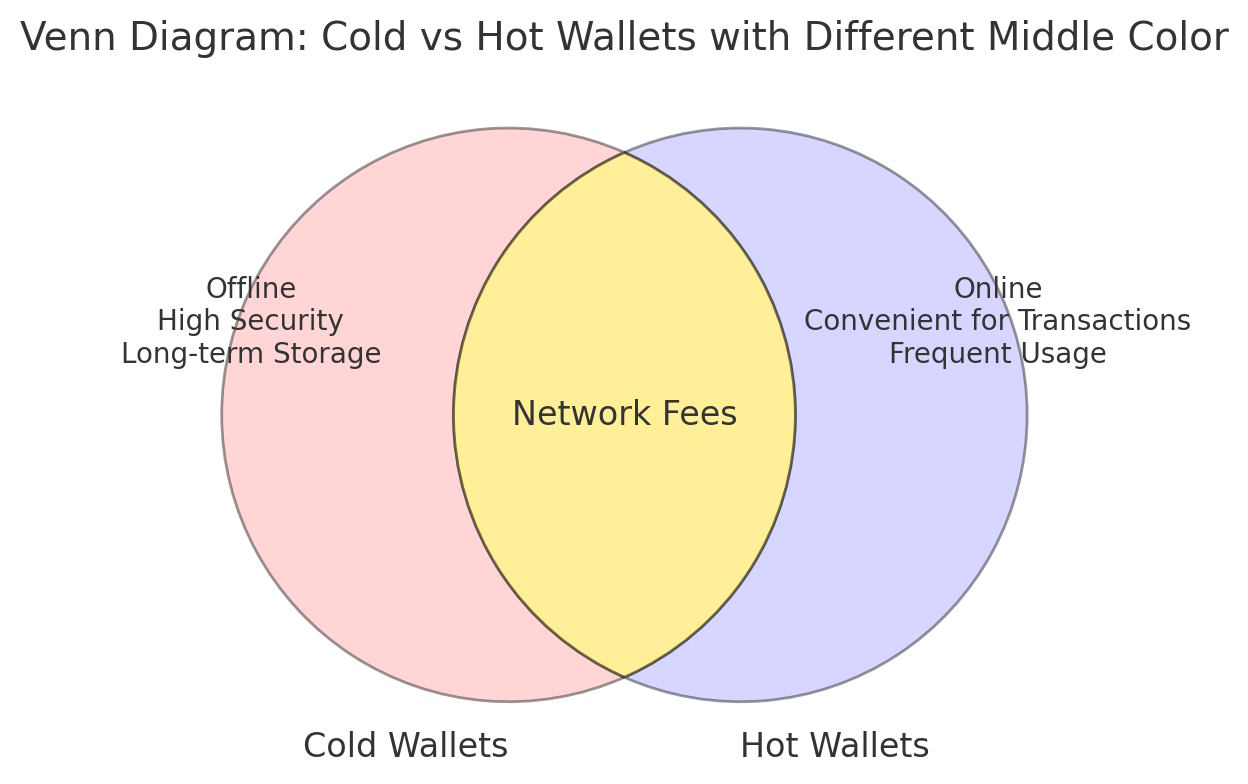

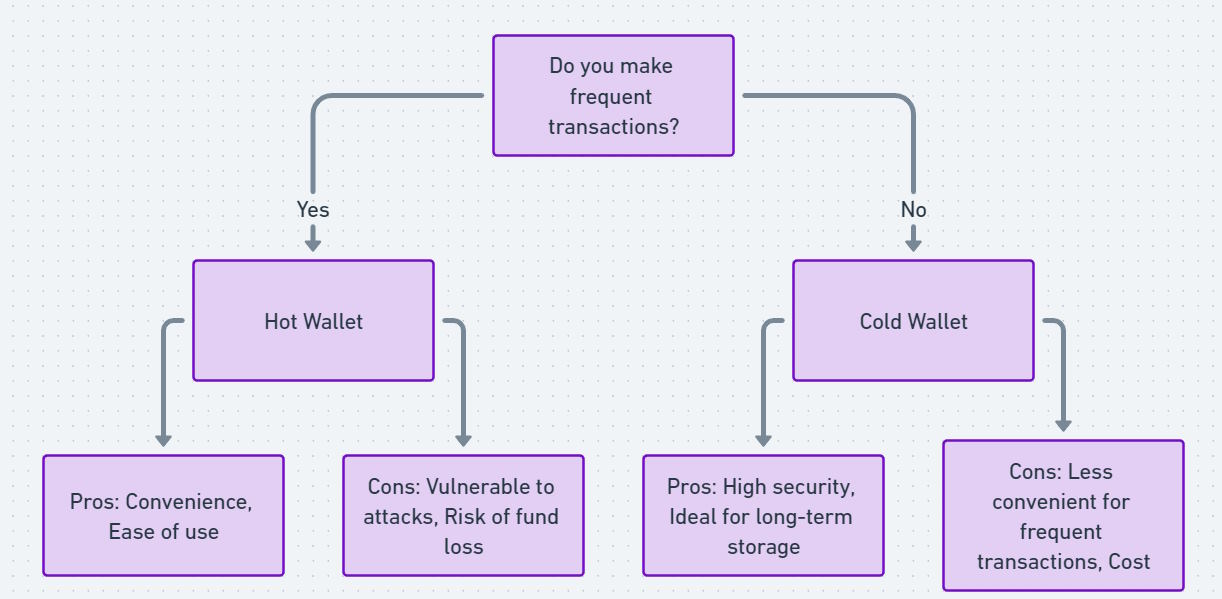

Hot and Cold Wallets

The primary distinction between hot wallets and cold wallets lies in their connection to the internet and level of security.

Hot Wallets: Wallets that are always connected to the internet.

Advantages:

- Convenience: Instant access to your funds, making them ideal for frequent transactions and trading.

- Ease of Use: Simple to set up and manage, suitable for beginners.

Disadvantages:

- Security: More vulnerable to hacking attempts and phishing attacks.

- Risk of fund loss: If your device is compromised, you could lose access to your assets.

Use Case: Online wallets integrated with exchanges, like the built-in wallet on Binance, which allows for easy trading and fund management.

Cold Wallets: Wallets that store your private keys offline.

Advantages:

- Security: Highly resistant to online threats as they are not constantly connected to the internet.

- Ideal for long-term storage: Recommended for holding large amounts of cryptocurrency.

Disadvantages:

- Convenience: Less suitable for day-to-day transactions due to the extra steps needed to access funds.

- Cost: Some cold wallets, especially hardware ones, can be expensive.

Use Case: Cold storage solutions such as hardware wallets like Ledger or Trezor.

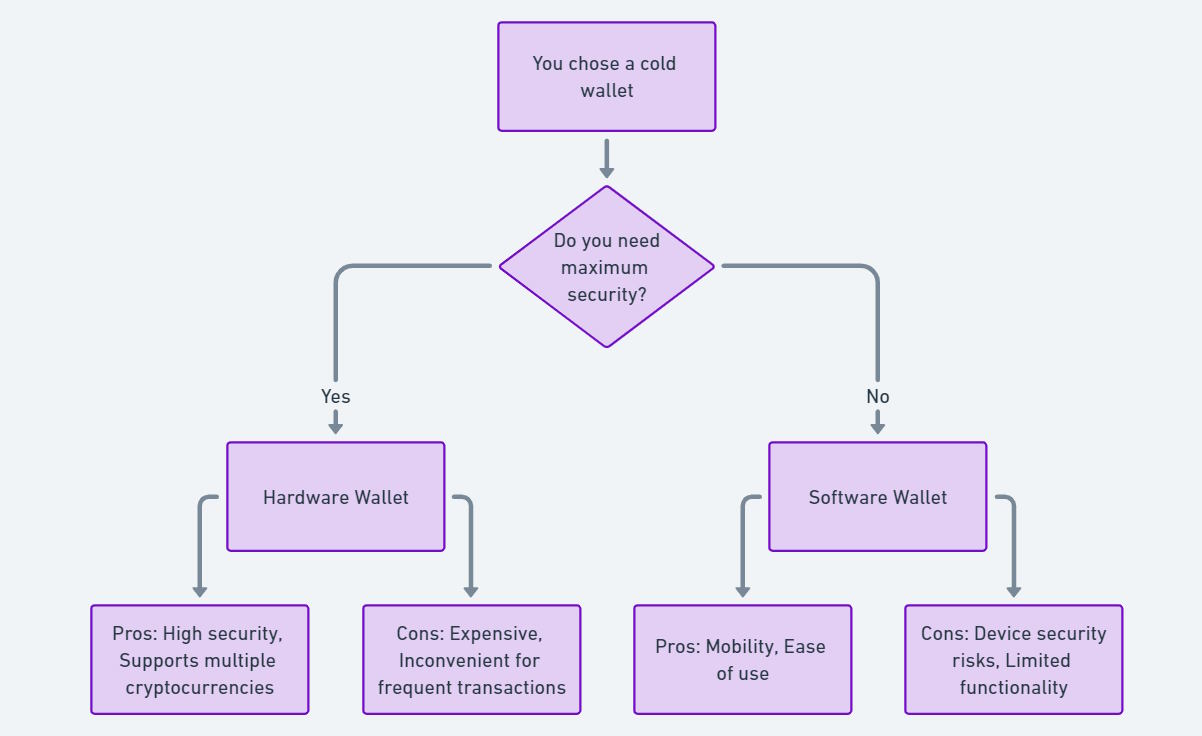

Hardware Wallets

Hardware wallets are physical devices designed specifically for securely storing private keys. Key Features:

- Offline storage: Private keys are stored on the device and never leave it, ensuring maximum security.

- Encryption: Devices are protected by PIN codes and often offer additional security layers.

Advantages:

- High security: Immune to most types of attacks, including viruses and phishing attempts.

- Support for multiple cryptocurrencies: Many hardware wallets allow you to store a wide range of digital assets.

Disadvantages:

- Cost: Hardware wallets can be expensive to purchase.

- Inconvenience for frequent transactions: Not ideal for regular, small transactions due to the need to physically connect the device.

Popular Models: Ledger Nano S/X; Trezor Model T/One

How to Use:

- Purchase the device from an official manufacturer or authorized seller.

- Set up the wallet by following the instructions and securely storing the seed phrase.

- Manage your funds by connecting the device to a computer or smartphone when sending or receiving cryptocurrency.

Software and Mobile Wallets

Software wallets are applications installed on your computer or mobile device.

Desktop Wallets: Installed on your PC or laptop.

Advantages:

- Ease of management: Large screen and full keyboard for easy navigation.

- Functionality: Often include additional features like integration with exchanges.

Disadvantages:

- Security: Vulnerable to malware and viruses if your device is not adequately protected.

Examples: Exodus; Atomic Wallet

Mobile Wallets: Wallet apps designed for smartphones.

Advantages:

- Mobility: Manage your funds anytime and anywhere.

- QR code scanning: Simplifies sending and receiving cryptocurrency.

Disadvantages:

- Risk of device loss: You must ensure your phone is secured with a passcode or biometric lock.

- Limited functionality: Some mobile wallets offer fewer features compared to desktop wallets.

Examples: Trust Wallet (the official Binance wallet); Mycelium

Paper Wallets

Paper wallets involve printing your public and private keys on a physical piece of paper.

How to Create:

- Generate keys: Using a specialized service like BitAddress or WalletGenerator.

- Print the keys: Securely print and, if possible, laminate the paper for protection.

Advantages:

- Offline storage: Completely immune to online threats and hacking.

- Simplicity: Requires no technical knowledge or devices.

Disadvantages:

- Risk of physical damage or loss: Paper can be easily destroyed by fire, water, or simply misplaced.

- Inconvenience: Difficult to use for frequent transactions.

Recommendations:

- Store in a safe place: Consider using a fireproof safe or a bank deposit box.

- Make multiple copies: To prevent losing access in case of an accident.

Online Wallets (Web Wallets)

Online wallets are services that you access through a web browser.

Features:

- Accessibility: Available from any device with an internet connection.

- Ease of Use: No need to download software or apps.

Advantages:

- Convenience: Quick access to your funds, ideal for beginners.

- Integration with exchanges: Often linked to trading platforms like Binance for easy trading and transfers.

Disadvantages:

- Security: Relies on the security measures of the service provider.

- Control over keys: Often, private keys are stored by the service provider, which can pose a risk.

Examples: Binance Wallet; Blockchain.com Wallet

Tips for Choosing a Crypto Wallet

1. Determine Your Needs:

- Frequency of Use: If you plan to make frequent transactions, opt for a hot wallet.

- Amount of Storage: Cold or hardware wallets are preferable for storing large amounts of cryptocurrency.

2. Evaluate Security Levels:

- Two-Factor Authentication (2FA): Look for wallets that offer this feature for added protection.

- Control over Private Keys: Choose wallets where you manage your private keys yourself for maximum security.

3. Check Compatibility:

- Supported Cryptocurrencies: Ensure the wallet supports all the digital assets you want to manage.

- Device Compatibility: Confirm the wallet works on your operating system.

4. Read Reviews and Reputation:

- Developer Reputation: Opt for wallets from established, trusted companies.

- User Reviews: Real-world feedback from users can help you make an informed decision.

How to Choose and Set Up a Crypto Wallet

Choosing and setting up a crypto wallet is an essential step to ensuring the security and ease of managing your digital assets. In this section, we’ll explore the criteria for selecting the right wallet, the setup process, and provide helpful tips for beginners.

Criteria for Choosing a Crypto Wallet

When selecting a crypto wallet, it’s important to consider several key factors to find the one that best suits your needs:

1. Security

- Control over private keys: It’s preferable to use wallets where only you have access to your private keys (non-custodial wallets).

- Additional security features: Look for wallets that offer features like two-factor authentication (2FA), PIN codes, and biometric authentication.

- Reputation: Choose wallets from trusted developers with good reviews and a reliable track record.

2. Cryptocurrency Compatibility

- Supported currencies: Ensure the wallet supports all the cryptocurrencies you plan to manage.

- Multi-currency support: If you plan to manage multiple types of cryptocurrencies, opt for a wallet that can store several digital assets at once.

3. Ease of Use

- User interface: The wallet should be intuitive and easy to navigate, especially for beginners.

- Accessibility: Look for wallets that are available on multiple devices—computer, smartphone, tablet.

- Language support: Having an interface in your native language can make the wallet easier to use.

4. Wallet Type

- Hardware Wallet: High-security solution, recommended for long-term storage of large sums.

- Software Wallet: Convenient for everyday use and trading.

- Online Wallet: Fast access via a browser, but depends on the security of the service provider.

5. Functionality

- Built-in exchange services: Some wallets allow you to swap cryptocurrencies directly within the platform.

- DeFi and dApp support: If you want to interact with decentralized finance applications, make sure the wallet is compatible.

- Backup and recovery options: Look for wallets that allow easy backup and recovery of your private keys.

6. Customer Support

- Technical support: Ensure the wallet offers prompt support in case of technical issues.

- Educational resources: Many wallets offer tutorials, FAQs, and other learning resources for new users.

Steps for Setting Up a Crypto Wallet

Once you’ve chosen the right wallet, it’s essential to set it up correctly. Here’s a step-by-step guide:

1. Download or Purchase the Wallet

- Hardware Wallet: Buy the device from an official manufacturer or authorized reseller.

- Software Wallet: Download the application from the official website or a trusted app store (App Store, Google Play).

2. Install the Wallet

- Hardware Wallet: Follow the instructions to install the device, usually requiring you to connect it to a computer or smartphone.

- Software Wallet: Run the installer and follow the prompts to complete the installation.

3. Create a New Wallet

- Choose the option “Create New Wallet”.

- Set a strong password: Use a combination of letters, numbers, and special characters. Write it down and store it in a secure place.

4. Save the Seed Phrase (Recovery Phrase)

What is a seed phrase: A series of 12–24 randomly generated words that allow you to restore access to your wallet if you lose your device or password.

How to store it:

- Write it down on paper: Manual recording reduces the risk of digital theft.

- Store in a secure place: A safe, a bank deposit box, or another reliable location.

- Avoid digital storage: Don’t photograph or save the seed phrase on your computer or smartphone.

5. Set up Additional Security Features

- Two-factor authentication (2FA): Enable if the wallet supports this feature.

- Set a PIN code or password for access: This prevents unauthorized access to the application.

6. Fund Your Wallet

Get your wallet’s address:

- Locate the «Receive» option.

- Copy the public address or scan the QR code.

Transfer funds:

- From another wallet: Initiate the transfer to your new address.

- Via an exchange: If you are buying cryptocurrency on an exchange, enter your wallet address to withdraw the funds.

7. Check Your Balance

- Refresh the wallet: Ensure the funds have been successfully transferred.

- Track your transactions: Use blockchain explorers (e.g., Etherscan for Ethereum) to verify the status of your transactions.

Tips for Beginners

- Start with small amounts: Use smaller sums for your first transactions to get comfortable with the process.

- Familiarize yourself with the interface: Spend time exploring the wallet’s features and settings.

- Beware of scams: Never share your private keys or seed phrase with anyone.

- Regularly update your software: Updates often include important security patches.

- Create backups: Besides your seed phrase, consider creating additional backup methods if the wallet offers them.

How to Use a Crypto Wallet

After selecting and setting up your crypto wallet, it’s essential to know how to use it correctly and securely. In this section, we’ll cover the main operations, such as sending and receiving cryptocurrency, managing your balance, and connecting to decentralized applications (dApps) and DeFi services.

Sending Cryptocurrency

Sending cryptocurrency to other users or external wallets is one of the primary functions of a crypto wallet. Here’s a step-by-step guide on how to do it:

1. Open the wallet app:

- Web version: Log in to your account on the wallet’s website.

- Mobile app: Open the app on your smartphone.

2. Select the cryptocurrency to send:

- Choose the digital asset (e.g., Bitcoin, Ethereum) from the available list.

3. Click on the “Send” button:

- This is typically labeled as “Send” or represented by an arrow icon.

4. Enter the recipient’s address:

- Copy and paste the address: Double-check the accuracy, as transactions are irreversible.

- Scan a QR code: If available, use your camera to scan the recipient’s QR code.

5. Specify the amount to transfer:

- Enter the amount in cryptocurrency or the equivalent in fiat currency (e.g., euros or dollars).

6. Review the transaction fee:

- Fees can vary depending on network congestion.

- Some wallets allow you to choose the fee size: low (slower confirmation), medium, or high (faster confirmation).

7. Confirm the transaction:

- Review all the information before proceeding.

- Click «Confirm» or «Send».

- Authentication: Enter your password, PIN, or complete 2FA (if required).

8. Track the transaction status:

- In the transaction history section, you can view the status: “pending”, “confirmed”, etc.

- Use blockchain explorers to track the transaction by entering its hash.

Receiving Cryptocurrency

Receiving funds to your crypto wallet is just as simple:

1. Open the wallet app.

2. Select the cryptocurrency to receive.

3. Click on the “Receive” button: This will display your public address and a QR code.

4. Provide the address to the sender:

- Copy the address and send it to the person who wants to transfer cryptocurrency to you.

- Share the QR code: You can send the QR code image or have the sender scan it directly.

5. Wait for the funds to arrive:

- Depending on the network and transaction fee, the transfer may take anywhere from a few minutes to an hour.

- Once the transaction is confirmed, your wallet balance will update.

Managing Balance and Transactions

Efficiently managing your balance and tracking transactions will help you stay in control of your finances:

– Viewing your balance:

- The wallet’s main screen typically displays the current balance of all your cryptocurrencies.

- You can see the balance in cryptocurrency or its fiat equivalent.

– Transaction history:

- View past transaction details such as date, amount, sender and recipient addresses, and status.

- Use filters to find specific transactions.

– Exporting reports:

- Some wallets allow you to export transaction history in CSV or PDF format for accounting or tax purposes.

– Notifications:

- Enable notifications for account logins, sent and received funds, to stay updated in real time.

Connecting to dApps and DeFi Services

Decentralized applications (dApps) and decentralized finance (DeFi) services expand the capabilities of your cryptocurrencies:

1. Install a compatible wallet:

- MetaMask: A popular wallet for interacting with dApps on the Ethereum blockchain.

- Binance Chain Wallet: For accessing applications on the Binance Smart Chain.

2. Connecting to dApps:

- Open the dApp in your browser or app.

- Click «Connect Wallet».

- Select your wallet from the list of supported options.

3. Authorize the connection:

- Your wallet will request permission to interact with the dApp.

- Confirm that you trust the application.

4. Using DeFi services:

- Staking: Lock your tokens to earn rewards.

- Liquidity farming: Provide liquidity to pools and earn income.

- Loans and borrowing: Take or offer loans with cryptocurrency as collateral.

5. Security tips for using dApps:

- Verify URLs and app authenticity: Avoid phishing sites.

- Read terms carefully: Understand the risks involved in DeFi services.

- Limit wallet permissions: Do not grant excessive access rights to dApps.

Tips for Efficiently Using a Crypto Wallet

- Regularly update the wallet: Software updates often include important security patches and new features.

- Create backups: Safely store your seed phrase and private keys in multiple secure locations.

- Use complex passwords: Avoid simple or easily guessable passwords, and change them regularly.

- Be mindful of transaction fees: Fees can fluctuate based on network congestion. Plan your transactions accordingly.

- Stay vigilant against fraud: Never share your private keys or seed phrase with anyone, and be cautious of suspicious messages or offers.

Common Issues and Troubleshooting

1. Transaction not confirming:

- Check the fee: A low fee may cause a delay in confirmation.

- Use transaction accelerators: Some wallets or services offer this feature.

2. Forgot password or PIN:

- Use your seed phrase to recover: Restore the wallet on a new device with your seed phrase.

- Contact support: If you’re using a custodial wallet, reach out to their customer support.

3. Lost or stolen device:

- Immediately restore your wallet on a new device using the seed phrase.

- Transfer funds to a new wallet for added security.

4. Suspicious activity:

- Change passwords and enhance security.

- Scan your device for malware and other threats.

Securing Your Crypto Wallet

Security is one of the most critical aspects of using cryptocurrencies. Unlike traditional banking systems, in the crypto space, you bear full responsibility for protecting your digital assets. This section will cover best practices for securing your crypto wallet, protecting private keys and seed phrases, and avoiding common threats and scams.

Best Practices for Wallet Security

To maximize the security of your cryptocurrencies, follow these proven recommendations:

1. Keep Your Private Keys and Seed Phrases Secret.

- Never share them with anyone: Even if someone claims to be from customer support, they should never ask for your private keys or seed phrase.

- Avoid digital storage: Do not store your keys or seed phrases in digital formats, such as on computers or cloud services, which can be hacked.

- Write them down: The safest method is to manually write them on paper and store them in a secure, offline location.

2. Use Strong and Unique Passwords

- Complexity: Your password should be at least 12 characters long, using a combination of letters, numbers, and special symbols.

- Uniqueness: Avoid using the same password for multiple platforms.

- Regularly update passwords: Changing passwords periodically helps reduce the risk of compromise.

3. Enable Two-Factor Authentication (2FA)

- Use authenticator apps: Prefer apps like Google Authenticator or Authy for added security.

- Avoid SMS-based 2FA: SMS is less secure, as it can be intercepted.

4. Regularly Update Your Software

- Wallet software: Regular updates often contain critical security improvements.

- Operating system and antivirus: Keep your devices secure by installing the latest updates and using trusted antivirus software.

5. Be Cautious of Phishing Attacks

- Verify website URLs: Always double-check the URL before entering any login information, as phishing sites often look very similar to the real ones.

- Avoid clicking suspicious links: Especially in emails or messages that claim to be from crypto services.

- Set up an anti-phishing code: Some services, like Binance, offer this feature to help you identify legitimate emails.

6. Download Apps from Trusted Sources

- Official websites and app stores: Only download wallets from official sites or verified app stores.

- Read reviews and ratings: Ensure that the app you’re using has a solid reputation and positive feedback from users.

Protecting Your Private Keys and Seed Phrases

Your private keys and seed phrases are the gateway to your digital assets. Losing them or having them compromised can result in the irreversible loss of funds. Here’s how to keep them safe:

– Physical Storage

- Write them on paper: Keep your private keys or seed phrases written on paper, stored in a fireproof safe or safety deposit box.

- Use metal plates: Some users prefer engraving their seed phrases on metal plates to protect them from fire or water damage.

– Create Multiple Copies

- Split the phrase into parts: For added security, you can divide the seed phrase into sections and store them in separate locations.

- Avoid keeping all copies in one place: Diversifying storage locations reduces the risk of total loss in the event of a disaster.

– Never Share the Information

- With family and friends: Even people you trust shouldn’t have access to your private keys.

- Customer support: Legitimate crypto platforms will never ask for your private keys or seed phrase.

Common Threats and How to Avoid Them

Being aware of potential threats can help you avoid costly mistakes:

Fake Websites and Apps

- Fake wallets: Always verify the legitimacy of the app or website you are using.

- Fake exchanges: Ensure that you are using trusted platforms for buying, selling, or storing cryptocurrency.

Social Engineering

- Scam offers: Be wary of “get rich quick” schemes or free cryptocurrency giveaways.

- Phishing emails: Never click on links in suspicious emails, and always verify the source before entering personal information.

Malware

- Keyloggers: These programs can track your keystrokes and steal your login information.

- Viruses and trojans: Malicious software can gain access to your wallet or private keys.

Public Wi-Fi Networks

- Avoid making transactions over public Wi-Fi: Hackers can intercept your data on unsecured networks.

- Use a VPN: For added security, use a Virtual Private Network (VPN) when accessing your wallet in public places.

Additional Security Measures

– Whitelist Addresses

- Set up trusted withdrawal addresses: Some wallets allow you to create a whitelist of trusted addresses, ensuring that funds can only be sent to those addresses.

– IP Whitelisting

- Restrict account access: Limit login access to specific IP addresses for added protection.

– Activity Monitoring

- Monitor logins and account activity: Regularly check your account for any unusual activity and take action immediately if something seems wrong.

– Hardware Wallets

- Use for large amounts: Hardware wallets are the safest way to store large sums of cryptocurrency for the long term.

What to Do in Case of Compromise

If you suspect that your wallet security has been compromised, act quickly:

1. Move Funds

- Transfer assets to a new wallet: Create a new wallet and transfer your cryptocurrency to this new, secure address.

2. Contact Support

- Reach out to the exchange or service: Notify the platform (if applicable) of the breach.

3. Scan Your Device for Malware

- Run antivirus software: Thoroughly scan your computer or smartphone for any viruses or malware.

4. Update Passwords and 2FA

- Change all relevant passwords: Don’t reuse old passwords or use weak combinations.

- Re-enable 2FA: If 2FA was compromised, disable and reset it.

5. Inform the Community

- Warn other users: Posting in forums or community groups can alert others to potential risks.

Using Binance as a Crypto Wallet

Binance is not only one of the largest cryptocurrency exchanges globally, but also a powerful tool for storing and managing your digital assets. Using Binance as a crypto wallet offers numerous advantages, combining trading, storage, and interaction with other crypto services all in one platform.

Overview of Binance Features

Binance provides users with an extensive set of features that make managing cryptocurrencies easy and efficient:

- Multi-currency support: Binance supports over 150 cryptocurrencies, including major and emerging tokens.

- Integrated wallet: Store, send, and receive cryptocurrencies directly through your Binance account.

- Mobile app: Manage your wallet and trade on-the-go with the Binance mobile app.

- Additional services: Participate in staking, savings, loans, and other financial services for maximizing your assets’ potential.

Advantages of Using Binance as a Wallet

1. Ease of Use

Binance offers an intuitive interface suitable for both beginners and experienced users:

- All-in-one platform: Access all features from one account without needing to switch between different services.

- Fast transactions: Instant transfers between Binance users with zero fees.

2. High Level of Security

Binance prioritizes security with industry-leading protection features:

- Two-factor authentication (2FA): Add an extra layer of protection to your account.

- Anti-phishing code: Personalize emails from Binance to help distinguish legitimate communications from phishing attempts.

- Whitelist addresses: Restrict withdrawals to only pre-approved addresses.

- SAFU Fund: Binance maintains an emergency insurance fund to protect users in the event of security breaches.

3. Support for Multiple Cryptocurrencies

Binance allows you to manage various digital currencies in one place:

- Diversification of assets: Easily add and store multiple cryptocurrencies in your wallet.

- Internal exchange: Quickly swap one cryptocurrency for another within the platform without using external services.

4. Additional Features

- Staking and Earn: Earn passive income by staking your tokens.

- Loans: Use your cryptocurrencies as collateral to secure a loan.

- Binance Card: Spend your cryptocurrencies in everyday transactions using the Binance debit card.

Security and Convenience

Using Binance as your crypto wallet gives you the best of both worlds—advanced security and ease of use:

- Regular security updates: Binance continually improves its platform to protect users against emerging threats.

- Professional support: 24/7 customer service is available to help with any questions or issues.

- Educational resources: Binance Academy provides comprehensive learning materials to help users understand cryptocurrency security and trading.

How to Start Using Binance as a Wallet

1. Register an Account

- Visit the official Binance website and click on “Register.”

- Fill in your email address or phone number and create a strong password.

- Confirm your registration by entering the code sent to your email or phone.

2. Set Up Security for Your Account

- Go to the Security Settings section.

- Enable Two-Factor Authentication (2FA): For extra security, use Google Authenticator.

- Set up an Anti-Phishing Code: This code helps verify legitimate emails from Binance.

3. Fund Your Binance Wallet

- Using cryptocurrency: Transfer digital assets from an external wallet to your Binance account.

- Using fiat: Deposit funds via credit card or bank transfer.

- Through Baxity Store: Purchase a Binance Gift Card from Baxity Store and redeem it on Binance to top up your wallet instantly.

4. Manage Your Assets

- Check your balance: View all your cryptocurrencies and their values in the “Wallet” section.

- Send and receive funds: Use the Deposit and Withdraw options to manage your assets.

- Trade: Access different trading pairs and markets to exchange or invest in your cryptocurrencies.

Security Tips for Using Binance

- Always verify the website URL: Ensure you are on the official Binance site.

- Do not share personal information: Binance staff will never ask for your password or 2FA code.

- Keep your apps updated: Regularly update the Binance mobile app to access the latest features and security improvements.

- Use strong passwords: Avoid simple combinations and change your password regularly.

Funding Your Binance Wallet with Baxity Store

Topping up your Binance wallet using Baxity Store is a quick, secure, and convenient method. Baxity Store offers cryptocurrency cards that can be easily redeemed on Binance, making the funding process smooth and efficient. Here’s a simple step-by-step guide on how to use Baxity Store to fund your Binance wallet.

How to Top-Up Your Binance Wallet with Baxity Store

- Visit Baxity Store: Go to Baxity Store and register for an account or log in if you are already a user.

- Select a Card: Browse the list of available Binance Gift Cards, and select the desired amount.

- Add to Cart: Choose the voucher denomination and quantity, then click “Add to Cart”.

- Proceed to Checkout: Review your order and proceed to checkout.

- Choose Payment Method: Baxity Store offers several payment methods, including credit/debit cards, bank transfers, cryptocurrency, and digital wallets like PayDo. Select your preferred option.

- Complete the Purchase: Follow the payment instructions to finalize your purchase. Once the transaction is confirmed, you will receive your voucher code via email.

- Redeem Card on Binance: Log in to your Binance account or use this likn binance.com/en/gift-card. Enter the card code, and click “Redeem. Your Binance account will be topped up immediately. You can buy crypto and add it to your Binance Wallet.

Benefits of Using Baxity Store’s Prepaid Cards

- Speed and Simplicity: Purchasing cards through Baxity Store is quick and easy, streamlining the funding process.

- Multiple Payment Options: Choose from a variety of payment methods to suit your needs.

- Security: Baxity Store ensures top-level transaction security, protecting your personal and financial data.

Conclusion

Crypto wallets are essential for securely storing and managing your digital assets. Whether you’re trading, investing, or simply storing cryptocurrencies, understanding how wallets work and choosing the right one is critical to your financial security. Platforms like Binance offer powerful wallet solutions that combine ease of use with advanced security features, while Baxity Store provides a convenient way to top up your wallet quickly and securely.

By following best practices for wallet security and taking advantage of tools like Binance and Baxity Store, you can confidently manage your cryptocurrency portfolio and participate in the rapidly evolving world of digital finance.