In 2025 – 2026, the question of how to grow crypto assets effectively and securely becomes especially relevant for the entire market. The trend for passive income is driving more crypto holders to look for tools that allow them to earn without constant trading or deep financial expertise. Binance Earn provides these opportunities — offering flexible ways to get interest on your coins and make the most of a growing crypto market.

Getting started takes just minutes: you can top up your Binance wallet using a Binance Gift Card, which is easy and secure to buy online at Baxity Store — an official Binance partner. This is the optimal way to quickly get access to all earning products and grow crypto with Binance right away. At the end of the article, you’ll find a step-by-step guide on how to purchase a Binance Gift Card, use it to fund your Binance account, and start earning.

In this overview, we’ll explain simply and clearly how to reliably increase your crypto with minimal risk — even if you have no previous experience with Binance Earn.

What Is Binance Earn?

In 2025–2026, simply “hodling” crypto is becoming outdated. If your coins just sit idle, you’re missing out on real earning opportunities — even in a sideways market. According to Glassnode, more than 60% of Bitcoin and leading stablecoins worldwide remain inactive, which adds up to billions of dollars in lost passive income each year. The new trend: more users are looking for simple, transparent ways to earn on Binance and similar platforms, without getting into complex trading or DeFi.

📚 Related Articles

Binance Earn Explained: The Platform for Passive Crypto Income

Binance Earn explained in simple terms: it’s a complete suite of passive income products, built right into the world’s number one crypto exchange by trading volume and active users (CoinMarketCap, 2024). This is much more than just “interest on your balance” — it’s a toolbox for every experience level and every strategy.

- Beginners can start with as little as $10 – $100 in Flexible Savings and see daily yield, while keeping full liquidity.

- Experienced investors can build custom portfolios, mixing Locked Savings, earn Binance strategies like Dual Investment, and automated investing with Auto-Invest.

Main Binance Earn Crypto Products: Simple Earn & Advanced Earn

There are now over 120 Binance Earn crypto products — the broadest offering among any centralized platform (CoinMarketCap, 2024). The selection falls into two main categories:

- Simple Earn: Flexible deposits allow you to withdraw at any time and earn daily interest. Fixed-term products offer higher rates if you’re willing to lock your assets for a set period.

- Advanced Earn: For those seeking maximum yield and more control: Dual Investment (profit from volatility, settle in your chosen asset), staking (earn rewards from blockchain networks), Launchpool (farm new tokens before listing), and Auto-Invest (automated recurring investment).

Real-Life Example: What You Can Earn on Binance

For a typical user, putting $500 in Flexible Savings at a 3% annual rate earns around $15 a year — effortlessly and with zero loss of liquidity. Advanced investors can combine dozens of products, balancing yield and risk within a single unified ecosystem.

Full Functionality of Binance Earn in 2025 – 2026

Binance Earn brings together every major passive income model on the market, letting users:

- Allocate funds into flexible or fixed deposits (Simple Earn) and earn daily or fixed interest.

- Use Dual Investment for higher returns, combining spot and options exposure without needing to actively trade.

- Stake leading coins (including liquid staking) to receive network rewards.

- Participate in Launchpool to farm new tokens and get in early on projects.

- Automate long-term portfolio growth with Auto-Invest, using a DCA (dollar cost averaging) strategy.

- Set up a Binance Earn subscription for automatic renewal and reinvestment of earnings.

- Instantly move funds between Earn, spot, P2P, or a Binance Card, all from a single wallet.

- Track all earnings, interest rates, lockup terms, and early exit options in a transparent dashboard.

- Minimize risk by diversifying between flexible and high-yield products, without ever leaving Binance’s ecosystem.

In short, Binance Earn explained: you’re not just earning interest — you’re getting full control over your crypto’s earning power, whether you’re a beginner or building complex investment strategies. In the next sections, we’ll break down every product and approach, so you can find the best way to grow your crypto with Binance in 2025 – 2026.

How to Start Earning with Binance Earn

Earning money on Binance isn’t just for traders anymore. Passive income with Binance Earn has become a must-have strategy for both beginners and experienced investors. You can start with just a smartphone, a valid document, and the desire to make your crypto work for you.

Step 1. Registration, Verification, and Account Funding

The first thing you need to do is register a Binance account. A key advantage of Binance is that one account gives you access to the entire ecosystem — trading, Earn, NFT, P2P, Launchpool, and more. You don’t need a separate account for Binance Earn or other features: everything is managed through a single login, with all services seamlessly integrated.

After registration, complete the standard KYC verification:

- Upload a photo of your identity document (passport, ID card, or driver’s license).

- Take a selfie for facial recognition.

- In some cases, confirm your residential address (utility bill, bank statement, or another official proof).

Most users complete verification in 5 – 60 minutes, sometimes a bit longer. Once you’re verified, you can fund your Binance Earn Wallet using a bank card, crypto deposit, or a Binance Gift Card voucher from Baxity Store — an especially convenient option for fast and flexible top-ups.

Step 2. Fund Your Binance Earn Wallet — Including via Baxity Store Voucher

You can top up your wallet via:

- Bank card or wire transfer,

- Direct crypto deposit,

- Or with a Binance Gift Card bought from Baxity Store. With a voucher, you instantly get a code. Just redeem it on Binance, and funds are credited to your funding wallet, ready to use for earning products.

Step 3. Select Your Product and Start a Subscription

Binance Earn offers several products for different earning styles and risk profiles. Let’s break down the main options, so you can choose the best way to grow crypto with Binance and build real crypto passive income.

Flexible Savings / Binance Savings

Binance Earn Savings is the entry point for most users exploring ways to earn on Binance. Simply allocate your idle assets — such as USDT, BNB, or ETH — and receive daily interest payments directly to your Binance Earn wallet. Your funds remain accessible at all times, giving you the flexibility to withdraw instantly if the market moves or your plans change.

- Average rates: 1 – 5% APY (varies by asset and demand)

- Minimum deposit: Typically as low as $1

- Payouts: Daily, automatically

Best for: Beginners, users wanting liquidity, or anyone looking to try out Binance Earn for beginners without risk.

Pros:

- Withdraw anytime

- Daily earnings

- Simple, no lockup

Cons:

- Lower rates than locked or advanced products

- APY may change

Example: If you put $500 into Flexible Savings at 3% APY, you’ll earn around $15 per year with no loss of access.

Locked Savings

Locked Savings offers higher, fixed interest rates if you’re willing to commit your assets for a set period — usually 30, 60, or 90 days. You can earn interest on crypto at better rates, but your funds are locked until maturity. This product is perfect for users with a medium-term outlook who want to maximize yield on stablecoins or major assets.

- Rates: Often double or more compared to Flexible Savings

- Lock periods: 30, 60, 90 days (sometimes custom options)

- Minimum deposit: Varies by asset

Best for: Users willing to trade liquidity for higher guaranteed earnings.

Pros:

- Higher, fixed APY

- Transparent terms

- Wide asset selection

Cons:

- Funds inaccessible during lock period

- Early withdrawal forfeits interest

Example: Locking $1,000 USDT for 60 days at 6% APY earns about $10 over the term.

Dual Investment

Dual Investment is one of the most advanced ways to earn money on Binance. It lets you potentially earn high yields by depositing assets and selecting a target price and settlement date. Depending on market performance, you either get paid in your chosen asset or another currency (usually between your deposit and a paired asset like USDT or BTC). It’s a tool for those seeking higher Binance Earn returns and are comfortable with some market risk.

- Potential APY: Often much higher than savings products, but not fixed

- Customizable: Choose your asset, strike price, and term

- Settlement: On the set date, you receive funds in the settlement asset (may differ from your original)

Best for: Experienced users wanting higher returns, those who follow market trends and are open to dynamic outcomes.

Pros:

- Potential for much higher yield

- Opportunity to buy or sell assets at better prices

- Suits advanced strategies

Cons:

- Market risk — settlement may not match your initial asset

- More complex than simple savings

- Not for risk-averse users

Example: Deposit 1 BTC in Dual Investment, set a settlement price above the current market. If BTC rises past your strike, you receive higher yield in USDT; if not, you keep BTC plus interest.

Key features for all products:

- All activity and interest are managed within your Binance Earn wallet.

- You can automate participation with recurring subscriptions and set-and-forget strategies, maximizing automation and efficiency.

- Track your earnings, view all transactions, and move between products seamlessly.

This structure makes it easy to compare each product, pick the best Binance Earn option for your risk tolerance, and start building real crypto passive income on Binance.

Step 4. Monitoring, Automation, and Managing Your Earnings

Income is credited automatically — daily or at maturity, depending on the product.

- All activity is visible in the transaction section of your wallet.

- Set up automated reinvestment or a recurring Binance Earn subscription for full automation.

- Switch between products, track performance, and withdraw at any time (according to product terms).

With Binance Earn — and rapid funding via Baxity Store Gift Card — anyone can earn money on Binance today: easily, quickly, and with no unnecessary barriers. It’s the ideal platform to build your own crypto passive income strategy, no matter your capital or experience level.

Is Binance Earn Profitable in 2025 – 2026?

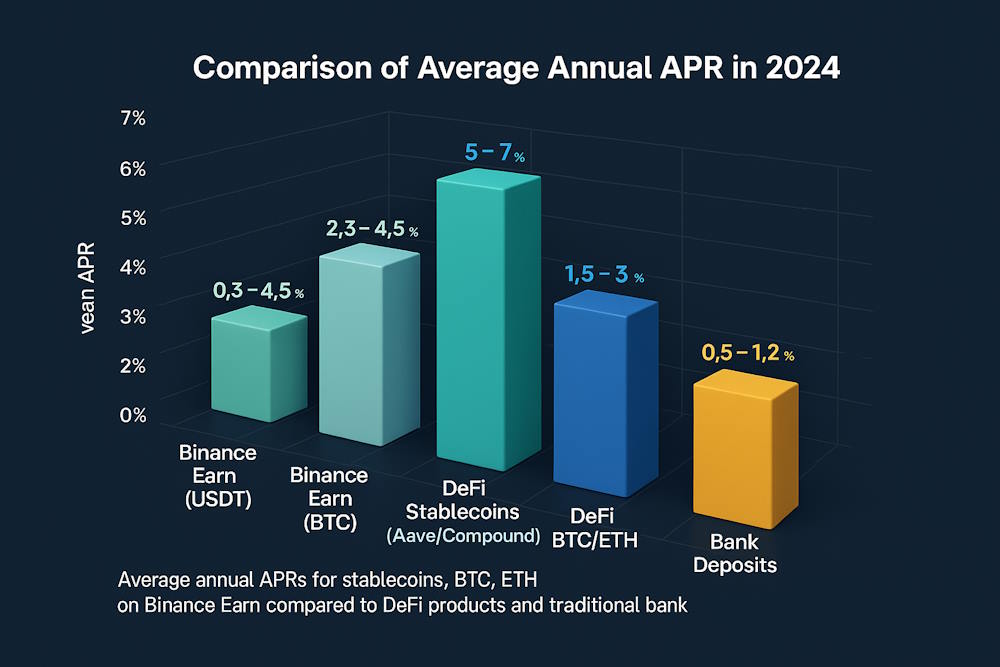

Earning passive income from crypto in 2025 – 2026 isn’t just a trend — it’s a smart finance strategy adopted by millions of users worldwide. According to CryptoCompare, the average yield on centralized earning products is now 3 – 4 times higher than on traditional bank deposits. But do Binance Earn returns really deliver — and which strategies offer the best balance of profit, liquidity, and risk?

Binance Earn Yield: Market Conditions, Returns & Trends

At the end of 2024, flexible Binance Earn products for stablecoins were offering 2.3% to 4.5% APR, while BTC and ETH saw yields from 0.9% to 2.7%. In comparison, DeFi pools for similar assets offered around 5 – 7% APR, but required higher risk and self-management (CryptoCompare 2024 Report).

In early 2025, Binance’s flexible stablecoin products averaged 3.9% APR, Locked Savings reached 6.1% APR, and Dual Investment campaigns (during promos) offered up to 20 – 35% APR for BTC and ETH (Binance Earn Stats). Some limited-time campaigns, such as “Stablecoin Summer,” pushed short-term yields to 13 – 14% APR, but rates later returned to market norms.

It’s important to note: Binance Earn interest rates depend on product, market demand, and promotions. Unlike traditional bank deposits, rates may change several times per year.

APR vs APY: Real Earnings with Examples

Understanding the difference between APR and APY is crucial:

- APR (Annual Percentage Rate): The “flat” yearly rate if you don’t reinvest your earnings.

- APY (Annual Percentage Yield): Includes compounding — meaning your profit gets reinvested and earns additional yield.

Example: If you invested $1,000 in Flexible Savings at 3.5% APR in 2024, you’d earn $35 in one year with no compounding. With auto-subscribe enabled, the APY would be around 3.56%, giving you $35.60.

Locked Savings products can offer higher APY if you roll over terms. For instance, $1,000 at 6% APR for 90 days with automatic rollover earns about $14.90 per quarter, or $61.50 a year.

Yield trends, 2022 – 2024:

- 2022: Flexible stablecoin products — 1.8 – 3.5% APR

- 2023: 2.8 – 4.2% APR

- 2024: 3.2 – 4.5% APR

This trend shows that Binance Earn’s yield has grown even during bear markets.

Risk vs Reward: Full Risk Overview

Binance Earn review for 2025 – 2026 shows that profitability depends on the earning product and your willingness to balance risk and liquidity.

| Product | Potential Yield | Liquidity | Main Risks |

| Flexible Savings | 2–4.5% APR | Instant | Lower rates, rates may drop, promotions may end |

| Locked Savings | 5–8%+ APR | Locked-in period | No early withdrawal, loss of earnings if redeemed |

| Dual Investment | 12–35%+ APR | Conditional | Market volatility, settlement may be in a different asset |

Detailed risk factors:

- Variable rates: Flexible product yields can drop due to market changes or expired promotions.

- Liquidity loss: Locked products restrict withdrawals — early exit means lost earnings.

- Settlement risk: With Dual Investment, your payout might be in a different asset (e.g., USDT instead of BTC).

- Platform & regulatory risk: Binance Earn is centralized, supported by SAFU insurance and strict security, but not immune to global regulation or platform disruption.

- Platform-level risks: Unexpected events (such as account freezes or regulatory actions) may impact functionality or access, as noted by top reviewers (WunderTrading Review, CoinBureau Review).

Is It Worth It? Balance, Profit, and Key Takeaways

Binance Earn returns have consistently outperformed bank rates in recent years. The platform’s low fees, transparency, and ease-of-use attract even experienced users. However, the Binance Earn risk grows with higher-yield products — a universal rule for any financial instrument.

The best way to earn money on Binance is to combine flexible products for liquidity, and Locked or Dual Investment for yield — if you understand the terms and accept the short-term risks.

Binance Earn safe? Binance is one of the most secure centralized earning platforms (with SAFU insurance, strict transparency, and no hidden fees), but no solution is fully immune to global market or regulatory risks.

How Does Binance Earn Work Behind the Scenes?

For the user, Binance Earn looks like a simple dashboard offering dozens of ways to earn passive income. But what actually happens to your assets after you subscribe? How exactly Binance Earn works, and what makes it possible for the platform to pay out yield even during a sideways market?

What Happens to Your Funds

After you activate a product (such as Flexible Savings, Locked Savings, or Dual Investment), Binance automatically moves your chosen amount into a dedicated Earn wallet. The mechanism depends on the specific product:

- Flexible/Locked Savings: Your coins are pooled together with other users’ assets and are then lent out to vetted Binance partners — crypto traders, market makers, or institutional clients. This lending activity generates interest, which Binance shares with you as a regular payout. This is the fundamental way to earn money on Binance — without the need for active trading.

- Dual Investment, staking, Launchpool: Funds may be allocated into options strategies or directly staked on blockchain networks, enabling you to earn extra Binance Earn crypto rewards while keeping full control within your account.

Security, Automation, and Utility

- Security: All customer funds are held in segregated wallets with multi-layer security (2FA, address whitelist, cold storage), and the SAFU fund provides a safety net in case of force majeure.

- Automation and utility: Subscriptions can be set to auto-reinvest or to distribute earnings across different earning products. The whole process is transparent: your dashboard shows the status of each subscription, expected yield, and payout schedule in real time.

Binance Earn isn’t just about “earning interest” — it’s a modern ecosystem for earning on crypto, running quietly in the background while you remain in full control of your key parameters.

How Much Can You Earn on Binance?

The real question for any investor is profit — how much can you actually make, and what are the trade-offs between risk, liquidity, and income? Unlike traditional bank deposits, Binance Earn products let you combine different strategies for Binance Earn crypto growth based on your preferences and market conditions. Let’s look at the numbers and run realistic simulations for a $1,000 deposit across the main products.

Realistic Income Scenarios

Potential Earnings from $1,000 on Binance Earn (2025, typical scenarios)

| Product | Rate (APR) | Yearly Income | Risk / Liquidity | Best For |

| Flexible Savings | 3.5% | $35 | Minimal risk, full liquidity | Beginners, those who value flexibility |

| Locked Savings (90d, with reinvestment) | 6% | $60 | Medium risk, funds locked until maturity | Users willing to “lock” funds |

| Dual Investment | 12–20% | $120–$200 | Higher risk, payout may be in other asset | Experienced users, max profit seekers |

Note: For Dual Investment, yield and payout asset depend on market performance and selected options.

- For beginners or those who prefer stability, the best Binance Earn option is Flexible Savings: simple, safe, and no lockup.

- For higher yields and those willing to wait, Locked Savings (6% p.a.) is ideal for steady “long holds.”

- For advanced users: Dual Investment offers up to $200 (20%) return per $1,000 a year, but payout may be in a stablecoin or another asset.

Binance Earn money isn’t just theory — it’s real math you can check with your account’s earnings calculator. Choosing the right product and combining strategies is the key to maximizing your Binance Earn crypto growth in 2025 – 2026.

How to Make the Most with Binance Earn

Getting the best results from Binance Earn is not just about picking a single product, but about combining smart strategies, automating your income, and diversifying your portfolio. Here’s how you can build a Binance Earn strategy for steady Binance passive income — regardless of your level of experience.

How Does Auto-Invest and Auto-Subscribe Work?

- Auto-Subscribe: If you use Flexible or Locked Savings, you can enable auto-renewal. When your subscription ends, your funds automatically roll over into a new subscription — so your interest keeps earning without interruption.

- Auto-Invest: This separate tool lets you, for example, buy $100 worth of BTC, ETH, or BNB each month and automatically deposit it into earning products. It’s a classic “dollar-cost averaging” (DCA) approach — and your crypto balance grows without constant monitoring.

Why does this matter?

With these features, your money doesn’t just sit — it works for you. Binance Earn auto invest ensures your assets are always compounding and earning, even if you’re busy or forget to log in.

Diversifying Across Products: Why Diversify Across Multiple Products?

No single product offers 100% certainty, and the market is always changing. That’s why it’s smart to combine several earning products at once:

- For flexibility and minimal risk — keep a portion in Flexible Savings.

- For higher yield — allocate some funds to Locked Savings for fixed terms.

- For maximum potential — use a share of your portfolio for Dual Investment, Launchpool, or staking.

A realistic example (strategy for $2,000):

- $1,000 — Flexible Savings (USDT): instant access.

- $700 — Locked Savings (90 days, USDT): higher yield.

- $300 — Dual Investment (BTC or ETH): chance for extra returns if the market moves in your favor.

Selection — the way you combine these tools — is your balance between safety, yield, and liquidity. That’s the core of a solid Binance Earn strategy.

Binance Earn isn’t a “one-and-done deposit” — it’s a full toolkit for modern passive income. Automate your process, diversify wisely, and you can build reliable returns without constant micromanagement.

Binance Earn Strategies for Passive Income

Passive income in crypto isn’t just about automation or diversification. Experienced users build their Binance Earn strategy by mixing different earning tools, adapting to market cycles, and taking advantage of opportunities that many beginners overlook. Here are several practical approaches for real results with Binance passive income in 2025:

1. Keep Liquidity, Hunt for Promotions

- Always keep a portion of your portfolio in Flexible Savings: it’s your “safety net” and lets you instantly grab promotional rates — Binance frequently boosts APR on USDT or FDUSD during special campaigns.

- Watch for new offers: short-term promotions like “Stablecoin Summer” can deliver outstanding returns if you act quickly.

2. Locked Savings + Auto-Subscribe: The “Lazy Maximizer”

- Use products with auto-subscribe (automatic renewal) for Locked Savings: when a term ends, your funds automatically restart in a new cycle — so you don’t miss a single day of yield.

- Perfect for those who don’t want to micromanage dates or track when to re-subscribe.

3. Dual Investment — For the Advanced

- Diversify not just by product, but by currency (BTC, ETH, stablecoins).

- Use Dual Investment for a small part of your portfolio, choosing “strike prices” where the real probability of execution is at least 60%.

Remember, this tool can increase yield, but also may change the asset you receive at payout.

4. Don’t Forget Launchpool & Staking

- During new token launches (Launchpool), you can get bonus coins — an extra boost to your Binance Earn passive income without extra risk.

- Staking ETH or BNB is a strong alternative for long-term holders who don’t want to park everything in stablecoins.

Pro Tip: Review your portfolio at least once a month: the market shifts, and yesterday’s optimal setup could underperform tomorrow. Key moves — switching between products, launching new subscriptions, joining promotions — take just a few clicks in your account. Binance Earn is a full ecosystem for dynamic passive income. The key: don’t settle for one option — experiment, mix products, and always stay open to new opportunities!

Most Popular Binance Earn Products in 2025

In 2025, Binance Earn continues to set the standard for passive income in crypto, offering a range of products to suit every type of user. Whether you’re looking to earn staking rewards, join liquidity pools, or access new token launches, Binance makes it easy to grow your assets with minimal hassle. Here’s a practical overview of the top Binance Earn crypto opportunities, what they offer, and who they’re best for.

ETH 2.0 Staking

With Binance Earn staking, you can participate in Ethereum 2.0 staking directly through your Binance account — no need for your own node or complex setup.

- How it works: Transfer any amount of ETH to Binance and choose to stake it. Your funds are pooled with others, and you start earning rewards (3.5 – 4.7% APY in 2025).

- What you earn: Regular staking rewards, with the option to compound earnings automatically.

- Why use it: No technical expertise or minimum 32 ETH required; Binance manages everything securely for you.

- Who it’s for: Anyone who believes in ETH’s long-term growth and wants a simple, secure way to earn extra crypto.

BNB Vault

BNB Vault is a unique “all-in-one” solution for BNB holders to earn Binance rewards automatically from multiple sources.

- How it works: Deposit BNB into the Vault. Binance allocates it across staking, Launchpool, DeFi products, and special bonuses — so you collect rewards from every available channel.

- What you earn: A combined yield from several products, plus extra perks during promotions.

- Why use it: No need to monitor every earning product; it’s all managed in one place with near-instant withdrawals.

- Who it’s for: BNB holders looking for effortless, diversified rewards without active management.

Launchpool & Launchpad

Binance Earn crypto users love Launchpool and Launchpad for early access to new projects.

- How it works: Stake your coins (BNB, USDT, etc.) in Launchpool to earn brand-new tokens, or participate in Launchpad for exclusive IEOs.

- What you earn: New coins before listing, often with substantial upside if the project succeeds.

- Why use it: Simple, no technical barriers — just stake or hold your assets and receive rewards in your Binance account.

- Who it’s for: Active users and early adopters seeking the next big thing in crypto.

Liquidity Farming

Liquidity Farming lets you earn Binance yield by adding pairs of coins (like USDT and BTC) to exchange-managed liquidity pools.

- How it works: Contribute your assets to a pool. You’ll earn a share of trading fees, plus bonus rewards in select campaigns.

- What you earn: Variable APR (5 – 15% typical for stablecoin pairs, higher for volatile pairs), plus possible extra tokens.

- Why use it: Lower impermanent loss risk than most DeFi pools, easy management via Binance, and transparent reporting.

- Who it’s for: Anyone comfortable with a little more complexity and risk, seeking higher returns than simple savings.

With these products, Binance Earn remains the go-to platform for both beginners and advanced users who want to maximize their crypto’s earning potential. Whether your goal is steady growth or high-yield opportunities, there’s a solution tailored to your strategy.

How Safe Is Binance Earn?

Security is the number one concern for anyone considering passive income products on a crypto exchange. Binance positions its earning solutions as some of the safest in the industry — but how Binance Earn safe are they really, and what risks should investors keep in mind?

1. Official Guarantees and Security Infrastructure

- SAFU (Secure Asset Fund for Users): One of Binance’s signature features is the SAFU fund — a reserve pool built from a portion of Binance’s profits. This fund is designed to compensate users in case of major incidents (like hacks or lost access to funds).

- Custodial Accounts: Funds allocated to Binance Earn products are stored separately from the exchange’s operational assets, protected with multi-layer security and transparent reporting.

- Advanced Security Technologies: Multi-factor authentication, cold storage, address whitelisting — these are standard protections across all earning products.

2. Transparency and Risk Management

- Public Statistics and Audits: Binance regularly publishes Proof of Reserves and detailed product-level data so users can verify how assets are managed and what interest rates are being offered.

- Early Withdrawal Flexibility: Most products (Flexible Savings, BNB Vault) let you withdraw your funds at any time. For Locked products, all terms and withdrawal conditions are clear up front — so the “lock-up risk” is known in advance.

3. What Risks Remain?

- Systemic Risks of a Centralized Platform: As with any CeFi system, you’re reliant on Binance’s reputation and overall security. Risks from hacking or regulatory intervention always exist, though SAFU provides a layer of compensation.

- Binance Earn risk: The main risk is sudden changes in the market, or withdrawal limitations during periods of extreme volatility or force majeure.

- Product-Specific Risks: Higher-yield products (like Dual Investment or Liquidity Farming) offer bigger rewards, but also higher risk — such as potential loss of part of your assets or payout in a different currency.

Bottom line: Binance Earn is among the safest passive income platforms, thanks to SAFU, regular audits, and flexible user controls. However, no platform can offer 100% guarantees. It’s smart to diversify, avoid “putting all your eggs in one basket,” and always consider potential risks — even with the most reputable earning products.

Binance Earn vs Other Platforms

The crypto interest market is growing fast, and users today can choose between several leading platforms. Binance Earn is still a top choice among the best crypto interest platforms, but it faces strong competition.

| Platform | Earn Products | Average APR | Min. Deposit | Withdrawal / Flexibility | Guarantees / Insurance | Features | Drawbacks |

| Binance Earn | Flexible, Locked, Staking, Launchpool, Dual, Vault | 3–20% | from $1 | Flexible (Flexible/BNB Vault), Fixed (Locked) | SAFU, Proof of Reserves | Largest selection, Launchpool, promos | Regional restrictions, KYC |

| Coinbase | Staking, Learn&Earn | 3–5% | from $1 | Varies by product | Insurance, Proof of Reserves | Simple, fiat integration | Fewer products, lower rates |

| Kraken | Staking | 3–12% | from $1 | Delayed withdrawal | Insurance, Proof of Reserves | High rates for certain coins | No flexible products |

| Bybit Earn | Flexible, Staking, Dual Investment | 3–18% | from $10 | Flexible (Flexible), Fixed (Locked) | Proof of Reserves | Frequent new user promos | Less transparent, less insurance |

As the table shows, Binance Earn offers the widest variety of earning products and extra safety guarantees. That’s why, for most users, it remains the optimal Binance online earning exchange for different crypto earning strategies.

Learn & Earn: How to Earn Crypto by Studying

Binance offers a unique way to earn money on Binance through its Learn & Earn program. This is a simple way to get your first crypto rewards — even if you’re not ready to invest your own money yet.

How does it work:

- Choose a course in the Learn & Earn section.

- Watch a video, take a short test or tutorial.

- Receive your reward: $2 – 5 in crypto (sometimes $10 – 20+ during special promos).

Your reward is credited directly to your Binance balance — usually in BNB, USDT, BTC, or new tokens.

What you should know:

- The program is open to all verified Binance users.

- “First come, first served”: courses and rewards often run out quickly.

- Bonuses are credited as soon as you pass the quiz.

Learn & Earn is a legit way to try out crypto in practice, follow a simple tutorial, and actually earn with Binance Earn.

How to Start Using Binance Earn with Baxity Gift Cards

Binance Gift Cards are the fastest and most convenient way to top up your Binance balance and jump straight into the world of passive income.

The official Binance partner — Baxity Store — allows you to buy Binance Gift Card online legally, with no extra fees or delays.

Step-by-step Guide: How to Buy a Binance Gift Card on Baxity Store

- Go to the Gift Cards section: Visit the Binance Gift Cards page on Baxity Store.

Select either a Binance Gift Card USDT or Binance USDC Gift Card. - Choose your denomination and add to cart: Pick the amount you need and add it to your cart.

- Register or log in to your Baxity account: If you’re new to Baxity, registration only takes a couple of minutes. For security and compliance, a quick KYC verification is required.

- Select a convenient payment method: Pay with a card, cryptocurrency, or a popular payment service — whatever works for you.

- Receive your Binance Gift Card instantly by email: The code arrives within seconds — no waiting, no manual processing.

- Redeem the gift card on your Binance account: Go to the Gift Card section on Binance, enter your code, and the funds will instantly appear on your spot balance.

- Spot to earn Binance: Once credited, you can start using Binance Earn right away: Flexible Savings, Staking, Launchpool, Dual Investment, and more.

Why buy through Baxity Store?

- Official Binance partner — guaranteed authenticity and security.

- Instant delivery — no delays or support tickets.

- Wide choice of denominations — perfect for any budget.

- Flexible payment options — cards, crypto, payment services.

- Promotions and bonuses — regular promo codes and special offers.

- No hidden fees — you see the final price up front.

Bulk Purchases and Special Pricing

If you want to buy Binance Gift Card in bulk—over 10 cards at once for business, giveaways, or teams — Baxity Store offers personal discounts and custom pricing. Just submit a request on the website or contact their manager for a tailored offer and fast service.

Bulk buying through Baxity means fast delivery, official security, and great prices every time!

Conclusion: Is Binance Earn Worth It in 2025 – 2026?

In the rapidly changing crypto market, flexibility, transparency, and reliability matter more than ever. Binance Earn offers a unique set of tools for both beginners and experienced users — whether you want to grow your portfolio steadily or take advantage of high-yield opportunities.

With a wide selection of products, competitive rates, powerful security features, and the convenience of official partners like Baxity Store, it’s never been easier to start earning with Binance. By choosing a Binance Gift Card from Baxity, you can top up your balance quickly, safely, and access every earn Binance product without limits.

Don’t miss your chance to earn passive crypto income — try Binance Earn with Baxity Store and unlock your financial potential for 2025 and beyond!

FAQ

What is the Binance best way to earn?

The best approach depends on your personal goals. For maximum flexibility, choose Flexible Savings or BNB Vault. For higher potential returns, consider staking or Dual Investment. Many users combine several products to balance profit and risk.

How can I earn passive income Binance?

Simply deposit your crypto in Flexible Savings, Locked Savings, start staking, or use Auto-Invest. Your assets will generate income automatically each day, with no need for active trading.

How much can you really make with Binance Earn money?

Earnings depend on the product and current market conditions. Flexible products typically offer 2 – 6% annual yield, while staking or Dual Investment can pay even more. Always check the latest rates in Binance Earn before investing.

Is earn Binance available for all users?

Yes, all you need is a verified Binance account. Some offers may be regionally restricted or require additional verification.

What is Binance Staking and how does it work?

Staking on Binance means locking up your cryptocurrency to earn rewards. You can choose flexible or fixed terms. Binance manages all technical aspects, and your rewards are paid to your balance automatically.

What are the main risks with Binance Earn?

Every investment product carries risks — both market and technical. The highest risks are found in high-yield products (like Dual Investment or liquidity farming), but Binance uses SAFU, reserves audits, and multi-layered security to protect users.

Can I start earning with Binance Earn using a gift card?

Absolutely. You can buy a Binance Gift Card on Baxity Store, top up your balance quickly, and immediately activate any earning product on Binance without extra steps.