Cryptopay is one of Europe’s most established and popular virtual currency services – and many of its services can be used worldwide. Cryptopay was created back in 2013 and has since created a hub where users can carry out many financial actions – such as B2B payments, managing an e-wallet, and investing.

Cryptopay also has its own debit card. In this review, we’ll take a look at Cryptopay’s e-wallet, its pros and cons, the verification process, how to buy crypto, and the Cryptopay prepaid debit card. By the end of the review, we hope to have equipped you with the knowledge to decide if Cryptopay can meet your digital currency banking needs.

What Can You Do With Cryptopay?

Let’s take a closer look at what kind of services Cryptopay offers.

- Buying Bitcoin with a Bank Card: You can use your debit card (or credit card) to buy various kinds of digital currency – Bitcoin, Litecoin, and so on. Fees are minimal, and the rates are fair.

- Use Cryptopay’s debit card: Cryptopay’s C.Pay card can be used in the same manner as any debit card, except it is loaded with cryptocurrency. You can use this C.Pay debit card for any POS transaction in a place that accepts VISA. This system lets you spend cryptocurrency in your day-to-day life.

- Virtual Debit Card: You can use Cryptopay’s virtual debit card to make a single transaction of up to 30,000 EUR worth of crypto. What’s more, the virtual debit card uses VISA’s verification system.

- Exchanging Currencies: Since you can hold crypto in your account securely, you can use Cryptopay’s exchange system to take advantage of value fluctuations. Convert from crypto to crypto, from crypto to fiat, and from fiat to crypto. No matter where the market stands, you can make advantageous choices by using this system.

- Use Cryptopay’s Wallet: You can use Cryptopay’s e-wallet to send and receive crypto; plus, you can transfer back and forth between the e-wallet and your bank. What’s more, you can set up 2FA for your e-wallet, in order to guarantee its security.

- Accept BTC Payments for Goods: If you open up a corporate Cryptopay account, you can let your customers pay for goods with BTC.

- Buy BTC without CPay Wallet: If you want to do so, you will need to enter the amount of currency you would like to spend on BTC and the address you’d like to get the funds at. Next, use SMS verification to verify your phone number. Enter your card details and, lastly, upload your ID to identify verification. After these steps are complete, you can finish up your BTC purchase.

Key Features of Cryptopay Wallet

Supported Cryptocurrencies

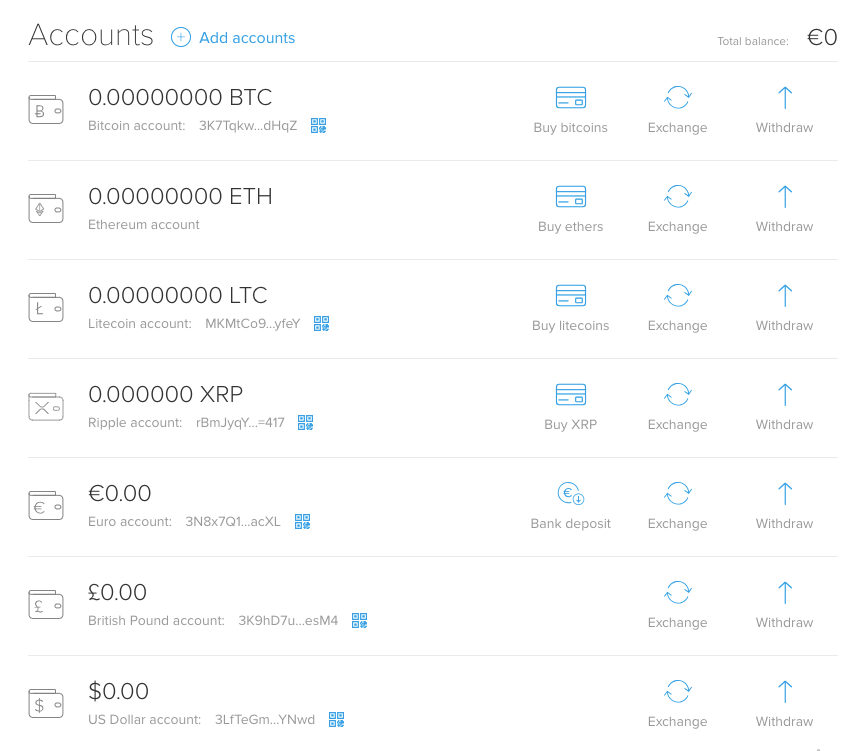

Currently, Cryptopay’s e-wallet supports Bitcoin, Litecoin, Ether, and Ripple (XRP). However, Cryptopay’s website says that there are more types of crypto that will be supported soon. They encourage their users to contact the support team with suggestions of which cryptocurrencies they would like to be supported by the e-wallet. You can use your debit card or credit card to buy one of the e-wallet’s supported currencies at a minimal fee.

Multiple Accounts in One Wallet

The e-wallet lets you immediately exchange money between your fiat and crypto accounts – you don’t have to place an order and wait for the transaction to be processed. Enjoy your money sooner!

You can also easily create new accounts for different kinds of currency. Simply press the plus sign button on the e-wallets accounts page to create a new currency account. You can use any of the 7 kinds of accounts to store funds and transfer funds whenever you desire. You can spread your currency throughout all of the accounts, if you so choose – thus, enabling you to minimize volatility.

You can also use the e-wallet to transfer money from your wallet to your bank account. This uses the SEPA system for EUR transfers and the Faster Payments system for GBP transfers.

Cryptopay’s Pros and Cons

Pros

- Simple and easily navigable user interface

- Multiple cryptocurrencies available, with more to be added soon

- Speedy transfers

- Excellent customer support

Cons

- No free trial

- Limited mobile banking actions

Cryptopay Verification

In order to use your CPay card to buy cryptocurrency, you need to have a verified account. To do so, you must input your billing address, upload a copy of a form of ID, and submit a selfie of you holding your ID. Valid forms of ID include a passport, an ID card, and a Driver’s license. Be sure to check that your ID will be valid 6 months from the date that you turn in the verification request. What’s more, the ID needs to have a photo of you. Documents with no photo (like Social Security Cards and Birth Certificates) will not be accepted.

Verification photos can be in PDF or JPEG format. The file size must be greater than 100 Kb, and the resolution must be above 300 DPI. Do not crop, resize, or alter the photo in any way.

Verification via the Cryptopay App

With the release of the Cryptopay app, it has become easier for users to go through the verification system. Navigate to the app’s settings, which is located in the top right corner of the screen. Press “Verification Status” and upload photos of the necessary documents. You can take photos of the documents from within the app.

How Long Does It Take?

When you submit your verification documents, the system will automatically mark the process as “Complete.” However, the documents will be checked by Cryptopay’s Compliance Team – this is typically done in 1 business day. You’ll receive an email once the Compliance Team has made a decision regarding your verification.

Verification Tiers and Limits

There are three tiers of verification. The verification process in the app will give you Tier 2 verification, which gives you access to most of Cryptopay’s services. If you choose not to complete Tier 2, then you will be at Tier 1.

In order to have the most rudimentary form of access to Cryptopay (storing, exchanging, sending, and receiving crypto), you would need to verify your email and then provide your full legal name, birth date and country of residence. Lastly, you would need to verify your phone number by inputting an SMS code.

Tier 2, as we mentioned earlier, requires you to submit a photo of a form of an ID and a selfie of you holding that ID in your hands. Once you have completed Tier 2 verification, you will have access to all of Cryptopay’s services – but with lower limits than a Tier 3 verified customer. Tier 2 users can make SEPA withdrawals and deposits to and from their banks. What’s more, they can use their card to purchase BTC, XRP, LTC, and ETH – that is, if their card supports 3D security measures.

Tier 3 requires users to upload one of the following proof-of-residence documents: a bank statement, a bill, or a residence certificate issued by their national government.

If you are a member of the EEA or EU, you also have the option of submitting a Debit card letter of delivery, a mortgage statement, or an EMI statement. Tier 3 Cryptopay members gain access to higher deposit and bank transfer limits. What’s more, if they are in an EEA country, they can buy a virtual or plastic C.Pay debit card. Furthermore, the GBP Faster Payment system becomes available.

Check the table below to see exactly what limits you will have for each tier of verification.

| Service | Tier 1 | Tier 2 | Tier 3 | |||

| Deposit | Withdraw | Deposit | Withdraw | Deposit | Withdraw | |

| Weekly Cryptocurrencies | Unlimited | 10,000 EUR | Unlimited | 50,000 EUR | Unlimited | Unlimited |

| Bank Transfers |

Daily: N/A |

Daily: N/A |

Daily: 5,000 EUR |

Daily: 5,000 EUR |

Daily: 50,000 EUR |

Daily: 50,000 EUR |

|

Weekly: N/A |

Weekly: N/A |

Weekly: 15,000 EUR |

Weekly: 15,000 EUR |

Weekly: 100,000 EUR |

Weekly: 100,000 EUR |

|

| Card Deposits |

Daily: N/A |

Daily: N/A |

Daily: 1,000 EUR |

Daily: N/A |

Daily: 20,000 EUR |

Daily: N/A |

|

Weekly: N/A |

Weekly: N/A |

Weekly: 5,000 EUR |

Weekly: N/A |

Weekly: 5,000 EUR |

Weekly: N/A |

|

Cryptopay Purchasing System

What benefits do you get by buying crypto with the Cryptopay system?

- Use crypto right away (they are credited to your Cryptopay account immediately after the purchase)

- Zero withdrawal fee

- Crypto is available to buy with a debit card/credit card

- Simple verification process

- Transparent fees

- Multi-functional wallet (with Cryptopay, you can send, exchange, buy, and store your currencies from one place)

- Customer assistance (Cryptopay’s support team can help you through every step of the process)

So, how can you get your hands on some crypto? In order to use the Cryptopay system to exchange cryptocurrency, you must follow these steps:

- Verify that you have the proper amount of funds in at least one of your Cryptopay accounts to make the crypto purchase. If not, then deposit funds.

- Go to the Accounts section of the Cryptopay e-wallet system. There will be a button that says “Exchange” next to each of the available accounts. Just click the button next to whichever cryptocurrency you want to buy another crypto with. For instance, if you want to buy BTC with LTC, click “Exchange” next to LTC.

- You will be directed to the intuitive, simple currency exchange system. You can enter either the total amount of crypto you are willing to spend or the total amount of BTC (or another crypto) you’d like to buy. There is a “Maximum” button, which will show you how much Bitcoin you can buy with your current funds. This will take fees into account.

- Lastly, complete the transaction by clicking Exchange and then Confirm. For this kind of transaction, there is a conversion fee of 1%.

This isn’t the only way to buy cryptocurrency through the Cryptopay system! You can also buy crypto with a debit card or a credit card. Keep in mind that this type of purchase scheme comes with a 4% fee per transaction, plus there is a minimum deposit of 10 units of your currency (EUR, GBP, or USD). To use this system, follow these steps:

- Ensure that you have completed the Cryptopay verification system and that your debit card (or credit card) supports 3DS (3D Secure) protocol.

- Head to the accounts page and click the “Buy *crypto*” button next to your cryptocurrency of choice. Enter the amount of funds you wish to spend, and then click on Proceed. On this page, you will see the total amount of crypto you will receive for the funds you had input. At the bottom, you will see the processing fee and the current exchange rate.

- If you don’t have a linked card, enter your card’s details and click the Register button. Otherwise, your already-linked card will be automatically chosen.

- Press Pay Now, and then you will be directed to your debit card’s bank 3DS page. Complete the security verification, and the transaction will be processed. The crypto will automatically be in your Cryptopay account.

Cryptopay Prepaid Card

The C.Pay prepaid debit card can be used to purchase goods both over the Internet and at physical stores. This C.Pay debit card supports contactless purchases and uses 3DS technology for ultimate security.

Currently, you can order a prepaid virtual debit card for free or a plastic debit card for 5 GBP. However, Cryptopay will change this in the future – the new prices will be 2.5 GBP for the virtual debit card and 15 GBP for the physical debit card.

You can use the C.Pay debit card to withdraw cash and to fulfill foreign currency transactions. However, you can’t use the card to gamble, invest, purchase travellers’ cheques, or top up your bookmaker account.

Please see the tables to check the fees and limits of the C.Pay card. Fees and limits may vary depending on whether you are working with GBP, USD, or EUR. Fees are not dependent on your verification level. However, you can only order a physical or virtual Cryptopay debit card if you are verified at Tier 3.

|

Fees |

|||

| GBP | EUR | USD | |

| Virtual card | 0/2.501 | 2.50 | 2.50 |

| Plastic card | 5.00/15.001 | 15.00 | 15.00 |

| Upgrading virtual card to plastic | 5.00/12.501 | 12.50 | 12.50 |

| Replacement card | 15.00 | 15.00 | 15.00 |

| Service fee (monthly, per card)2 | 1.00 | 1.00 | 1.00 |

| Inactivity fee3 | 5.00 | 5.00 | 5.00 |

| Transaction in the card currency | Free | Free | Free |

| Foreign transaction fee | 3% | 3% | 3% |

| Cash withdrawal in card currency | 2.50 | 2.50 | 2.50 |

| Cash withdrawal in currency different from card currency | 3.50 + 3% | 3.50 + 3% | 3.50 + 3% |

| Card load from the account4 | 1% | 1% | 1% |

| Card unload to the account | 1% | 1% | 1% |

| Rejected chargeback | 35.00 | 35.00 | 35.00 |

|

Limits |

|||

| GBP | EUR | USD | |

| Maximum card balance | 45,000 | 50,000 | 58,000 |

| Maximum value of a single transaction | 27,000 | 30,000 | 34,500 |

| ATM withdrawal limit per day | 400.00 | 450.00 | 500.00 |

| Number of ATM withdrawals per day | 5 | 5 | 5 |

| Card load limit per day | 8,000 | 8,800 | 10,000 |

| Card load limit per year | 2,920,000 | 3,312,000 | 3,650,000 |

| Maximum value of a single load | 8,000 | 8,800 | 10,000 |

| Number of loads per day | 5 | 5 | 5 |

| Number of unloads to wallet per day | 9999 | 9999 | 9999 |

- – This offer is time-limited.

- – This fee is charged at the first of the following month.

- – Applies after 12 months of inactivity. This fee is charged at the first of the following month.

- – It is charged if the load currency is different from the card currency.

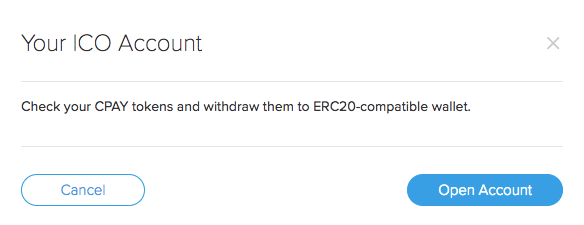

What is a CPAY Token?

If you participated in Cryptopay’s ICO system or if you were part of the CPAY Miner game, you can access an ICO account, which lets you view the status of CPAY tokens. You can also withdraw the tokens to compatible e-wallets.

Summary

While the services available on Cryptopay are limited, the ones that it does offer are easy to use and wonderfully designed. What’s more, Cryptopay uses 3DS technology to keep your financial information totally secure. You can enjoy instantaneous crypto exchanges for low prices.

Another service that we highly recommend is Trastra – a trusted banking service for buying and selling crypto. You can use the service’s payment card, which is linked to your crypto wallets, to make any offline or online purchases you desire. Plus, you can use it to withdraw funds at any ATM. There are 5 types of crypto available to purchase within the Trastra app, BTC, LTC, XRP, BCH, and ETH.

Only 4 kinds of cryptocurrency? I think I want to wait and see wat new kinds of crypto they will beginusing. You said they are having new ones soon, do you know what they are?

Dear Cupcake, thank you for your question! Indeed, the service will soon add new cryptocurrency options to the already existing four. So far, the list is unknown, but we recommend following the company’s social networks. Be sure that they will notify users of new available cryptocurrencies as soon as they are added to the system.

why there are so many verification requirements to use cryptopay? I just want to get started and not do all this. Billing address and id and selfie, it seems very unnecessary when all I want to do is buy some bitcoin. Isnt bitcoin supposed to be anonymous? i don’t want some company knoing my information! could I just skip verification? what account thigns can I do with no verification?

mandalorian! Thank you for your question! You don’t really have to pass verification to use your Cryptopay wallet. Let me describe Cryptopay verification just in few words:

Tier 1 requires entering personal information in your Cryptopay wallet (name, date of birth, country etc.) with no need to upload your documents. Passing this verification tier lets you store, exchange, send and receive BTC/LTC/XRP/ETH.

Ties 2 requires uploading the photo of your ID and a selsie and lets you make SEPA bank deposits and withdrawals in EUR and buy cryptocurrency with a bank card.

However, if it’s not enough for you and you want to get the highest limits, enable GBP bank transfers and access the option to order a C.Pay Visa card you have to verify your address.

Oh, nice, i did not realize i could get started without the documents. will sign up and use tier 1 account for now and then maybe do the verification if I like cryptopay service. is there a time limit for doing verification?

No, there is no timeline for verification, but there is a limit on the withdrawal of cryptocurrency. For Tier 1, the maximum weekly withdrawal amount is €10,000 while for Tier 2 this limit is already €50,000 per week.

how much cryptopay service cost?

alanLan, thank you for your question! Cryptopay does not charge any service fees for creating, maintaining or deleting account. But there is a service fee for your Cryptopay plastic card, if you have one. It is 1 euro per month.

Iv ben wanting to make money by buyin and sellin cryptocurrencies so Ill have to give it a try

GG, thank you for your comment! We wish you success in this area. Hope that after some time you will be able to give an honest review about the system on our website 🙂