Skrill and Wise (formerly TransferWise) are both excellent services used to make online purchases, store funds, and send and receive payments. The question is, though, which one is best for you? We’ll compare every facet of both Skrill and Wise (formerly TransferWise) – read on for information to help you make the best decision on which service to sign up for – Skrill or Wise.

- Overall rating:

- Fees:

- User experience:

- Security:

- Coverage:

- Customer support:

Pros:

- gives users the real mid-market exchange rate

- the user experience is exceptional

- has a very good reputation on Trustpilot

- transfer fees are affordable and clear

- provides virtual accounts with IBAN

Cons:

- You can only send funds to somebody’s email address or bank account; we’d like to see more options

- Overall rating

- Fees:

- User experience:

- Security:

- Coverage:

- Customer support:

Pros:

- almost instant and convenient transfer

- exchange rates and fees can be competitive when using Skrill money transfers

- offers a profitable VIP program

- can be used to purchase or sell “adult” services

Cons:

- the verification process is rather strict

Comparison of Skrill & Wise (formerly TransferWise) Cards

| Wise (formerly TransferWise) | Skrill | |

| Card Type | debit physical |

debit physical (+contactless) |

| Virtual Card | n/a | yes |

| Currency | any currency available in your account | only EUR |

| Card Provider | MasterCard | MasterCard |

| Countries | US, New Zealand, Australia, Singapore, and countries in the EEA | EEA countries only |

Card Loading:

The Wise (formerly TransferWise) Card doesn’t have a balance that’s separated from a user’s account. When you top up your borderless Wise (formerly TransferWise) account through the Wise (formerly TransferWise) login, it will load the funds onto the connected cards.

The Skrill Card can be deposited by adding funds to your corresponding Skrill Digital Wallet, since both of them have a direct connection.

Card Security:

Wise (formerly TransferWise) cards have a 3D secure payment protocol, meaning that some online purchases are followed up with a confirmation SMS or a call. The Skrill card also has this security feature enabled.

Comparison of Fees and Limits

Before diving into the fees and limits, we wanted to note that US and UK Skrill users have different fees associated with their accounts. However, for the purposes of this comparison, we will list fees that UK users must pay for Skrill.

| Wise (formerly TransferWise) | Skrill | |

| Deposit fees | 0,2% | 1-2,5% (depending on the country of residence) |

| Withdrawal of funds | Free | 5,5 EUR (bank transfer) 7,5% (VISA) 4,99% (MasterCard) |

| Transfers between accounts | Free | 4,49%* |

| Currency Conversion | 0,35-3% (depending on the currencies) | 1,99-3,99% (depending on VIP level) |

| ATM Withdrawal Fees |

Free** 1,75% (more than 200 GBP) |

1,75% (free – from VIP Silver level and above) |

| ATM Withdrawal Limits | 1 000 GBP (per transfer) 1 500 GBP (per day) 4 000 GBP (per month) |

900 – 5 000 EUR per day (depending on user’s VIP level) |

* In order to reduce fee on p2p transfers to 1.45%, you need to top up your account by Bank transfer or VISA/MasterCard.

** Note, that there are no Wise (formerly TransferWise) fees associated with withdrawals if you withdraw no more than 200 GBP per month.

Other things to note: With Wise (formerly TransferWise), your transfer limits are dependent on which currency you are sending, what currency it is being exchanged for, and the method in which you pay.

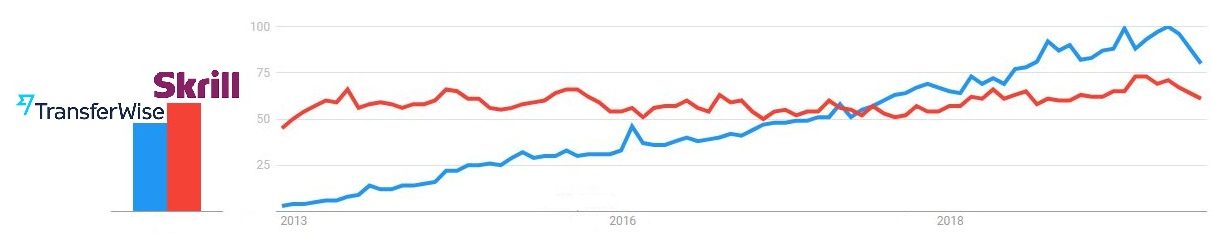

Dynamics of the popularity of Wise (formerly TransferWise) vs Skrill on the Internet for 7 years

For the period from October 2013 up until November 2020.

Comparison of Features

| Wise (formerly TransferWise) | Skrill | |

| Deposit Methods |

– bank transfer – transfer from another Wise (formerly TransferWise) account |

– credit/debit cards – bank transfer – PaysafeCard – Neteller – Bitcoin – other local services |

| Withdrawal Methods | – bank account |

– bank account – VISA/MasterCard – crypto wallet |

| Verification |

– up to 2 business days – ID + selfie with a document + proof of address (sometimes) |

– about 2-3 business days (up to 24 hours if registering via Baxity link) – ID/passport + proof of address + selfie via a web camera online |

| Services |

– convert fiat money into crypto – international money transfers – set up transfers with locked amounts – use Google Pay and Apple Pay – mass payout capabilities for businesses |

– international money transfers – payments online – Кnect loyalty program – cryptocurrency exchange – VIP program |

| Currencies | – keeping funds in the account + currency conversion: 50+ – topping up of the account: 19 |

40+ |

| Customer Service | – e-mail support – mobile phone support |

– e-mail support – mobile phone support |

| Mobile App | – yes (iOS and Android) | – yes (iOS and Android) |

| Security | – regulated under the FCA – uses KYC procedures – 2FA is available |

– regulated under the Central Bank of Ireland (previously – FCA) – SCA – 2-step authentication is available |

| Supported Countries | 50+ | 110+ |

Services: Skrill has more services than Wise (formerly TransferWise) – for instance, users can convert fiat monies into various kinds of cryptocurrency. There is also a Skrill loyalty program, Knect, in which users can amass points and trade them in for cash rewards and other prizes.

Customer Service: Both Wise (formerly TransferWise) and Skrill have a dedicated customer support team, but Wise (formerly TransferWise) customer service is generally known for having higher-quality assistance. Neither Skrill nor TransferWise doesn’t have online-chats on their web-sites for immediate solving of customers’ issues.

FAQ

Can I send money from Skrill to Wise (formerly TransferWise) and vice versa?

No, Skrill and Wise (formerly TransferWise) accounts are not compatible. Thus, you can’t send money from TransferWise to Skrill or the other way around.

Is Wise (formerly TransferWise) safe? What about Skrill?

Yes, both services are safe. For a full breakdown, check out Wise’s (formerly TransferWise) justification of their safety, as well as our review of Skrill’s security.

What other services can I use?

If you are still looking for an online financial provider, perhaps consider Revolut. Read our Revolut vs. Wise (formerly TransferWise) review.

I don’t understand. pls exlplain. If I have VIP Silver level with Skrill, the ATM withdrawal fee is 0? THX

Cameron, thank you for your question. Yes, if you have VIP Silver or higher, the fee for withdrawing funds from an ATM with a Skrill card is not charged. Sometimes the fee can be charged by the bank that owns the ATM itself, but not Skrill.

Ok, and what currency conversion fee do I have for Silver level? How about Gold level? THX

Upon receiving the VIP Silver, your currency conversion fee will be 2.89%, and with VIP Gold – 2.59%. You can find a complete list of Skrill fees in our article here – https://baxity.com/skrill-fees

Funny that you said customer support coz I had a few dealing with both. I can say that Skrill support was very slow. They didn’t answer me so long. I was waiting 4 days and sent them many e-mails, but it didn’t help to receive a reply faster 🙁

Fares, thank you for your honest feedback! Indeed, Skrill’s email support now leaves much to be desired in terms of speed, but this usually happens in large companies. When the number of customers increases, the level of service begins to decline. Have you tried calling their phone line? They will help you resolve the issue faster.

Skrill support:

International phone: +44 203 308 2520, +44 203 514 5562

It is cheaper to call from Skype – 2.3 cent / min.

Skrill seems to offer a lot more options for deposits and withdrawals, but why isn’t their card more widely available?

Nicolas, thank you for your question! The geographical restriction of the delivery of Skrill cards is due to the decision of the company that produces them, namely Mastercard. In fact, almost all plastic cards of international payment systems are limited in issue by country, not only Skrill. Unfortunately, neither we nor even Skril can influence this.

whys Skrill limiting themselves to only EUR? I’ve heard good things about them but I travel more and need something that works in countries that are out the EEA. TransferWise just does no inspire that same level of trust for me, for some reason. Any thoughts on what I is to be done?

ManoloCavalli, you can get Skrill Mastercard only in EUR, right. This is Skrill police, we can’t influence that. You can use Skrill card anywhere Mastercard is accepted, not only in EEA countries.