The cryptocurrency market is famous for its wild price swings, which can be both thrilling and daunting for investors. These swings become even more challenging during a period known as “Crypto Winter,” when prices fall and stay low for extended periods. In 2024, understanding how to navigate Crypto Winter is crucial for both new and experienced investors. This article explores the strategy of Dollar Cost Averaging (DCA), a method that involves investing a fixed amount at regular intervals, and how Baxity’s cryptocurrency vouchers can provide a secure and easy way to invest during these uncertain times.

Understanding Crypto Winter

Crypto Winter describes extended periods when cryptocurrency prices decline and remain low, leading to widespread pessimism among investors. Unlike short-term dips, Crypto Winter can last several months or even years. This downturn affects everyone in the cryptocurrency space, from individual investors to businesses relying on blockchain technology.

What is Crypto Winter and How Does It Affect the Cryptocurrency Market?

Crypto Winter creates uncertainty and fear, impacting the entire market. Many projects struggle to secure funding during these times, while others may shut down entirely. However, understanding the market dynamics and having a solid investment strategy, like DCA, can help investors navigate these challenging times.

The term “Crypto Winter” became popular after the 2018 market crash, when Bitcoin’s value plummeted from nearly $20,000 to around $3,200. Despite the downturn, the market eventually recovered, highlighting the cyclical nature of cryptocurrency trends. Such cycles remind investors of the importance of strategic planning and patience during prolonged market downturns.

Historical Examples of Crypto Winter

Understanding past Crypto Winters can provide valuable insights into how to navigate current and future downturns:

- 2013-2015 Crypto Winter: The collapse of Mt. Gox, a major cryptocurrency exchange, led to a significant decline in Bitcoin’s value. The price fell from $1,100 in late 2013 to under $200 by early 2015. This period was marked by regulatory uncertainty and a lack of public trust in cryptocurrencies. Despite the challenges, the market eventually rebounded as new exchanges emerged and investor confidence was restored.

- 2018-2019 Crypto Winter: Following the bull run of 2017, where Bitcoin reached nearly $20,000, the market faced a harsh correction. By December 2018, Bitcoin’s price had dropped to around $3,200. This downturn was driven by increased regulatory scrutiny, security breaches, and a market correction. However, innovations in blockchain technology and the growth of decentralized finance (DeFi) helped the market recover by 2020.

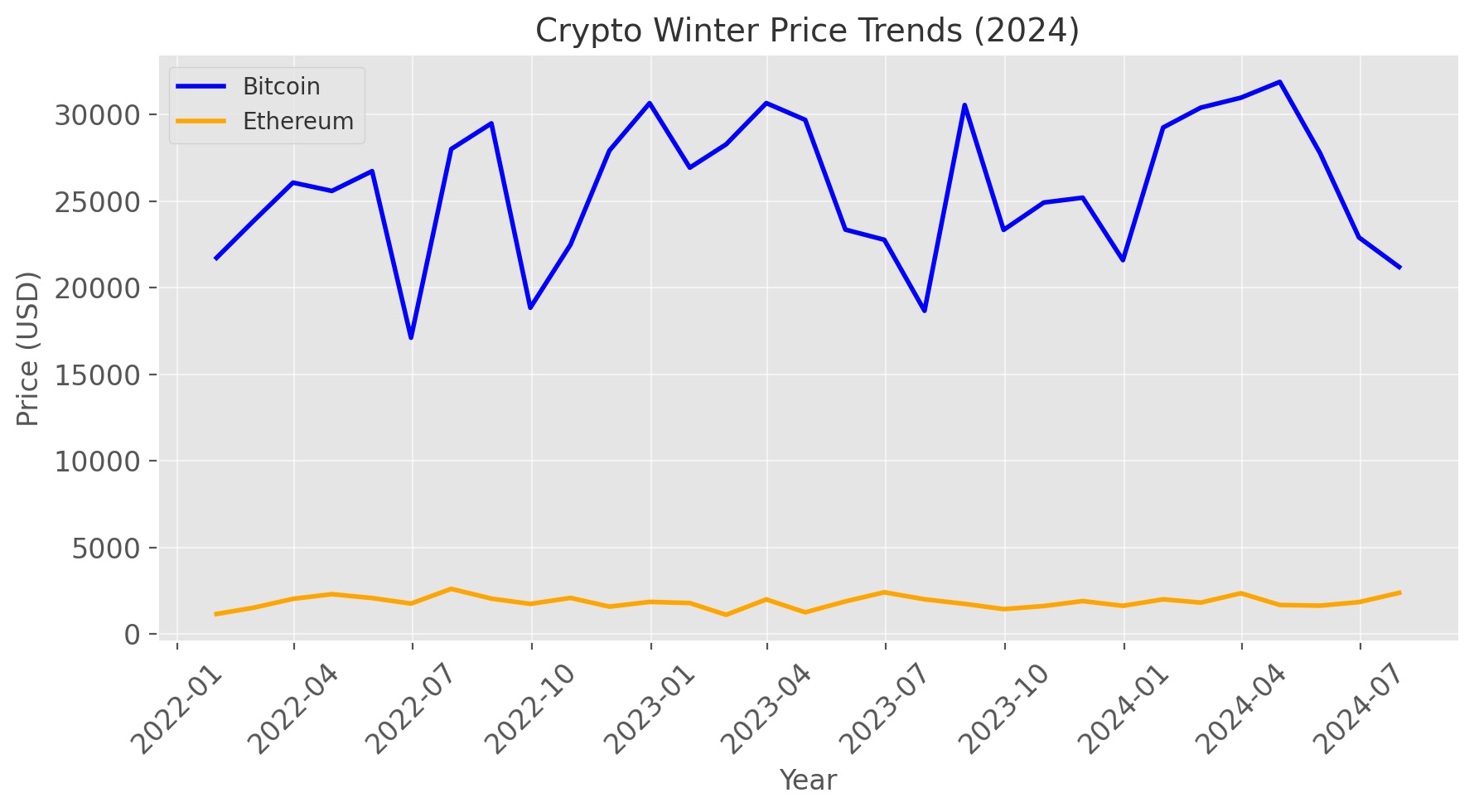

- 2022-2024 Crypto Winter: The most recent Crypto Winter was triggered by macroeconomic factors, including rising interest rates and geopolitical tensions, which led to a decline in risk assets globally. Bitcoin’s price dropped from $68,000 in November 2021 to around $18,000 by mid-2022. However, the adoption of Bitcoin by major institutions and countries, along with advancements in blockchain technology, set the stage for a gradual recovery by 2024.

These examples illustrate the resilience of the cryptocurrency market and the potential for long-term growth despite short-term challenges. Investors who remain patient and strategically navigate these downturns can position themselves for future success.

What is DCA and How Does It Work?

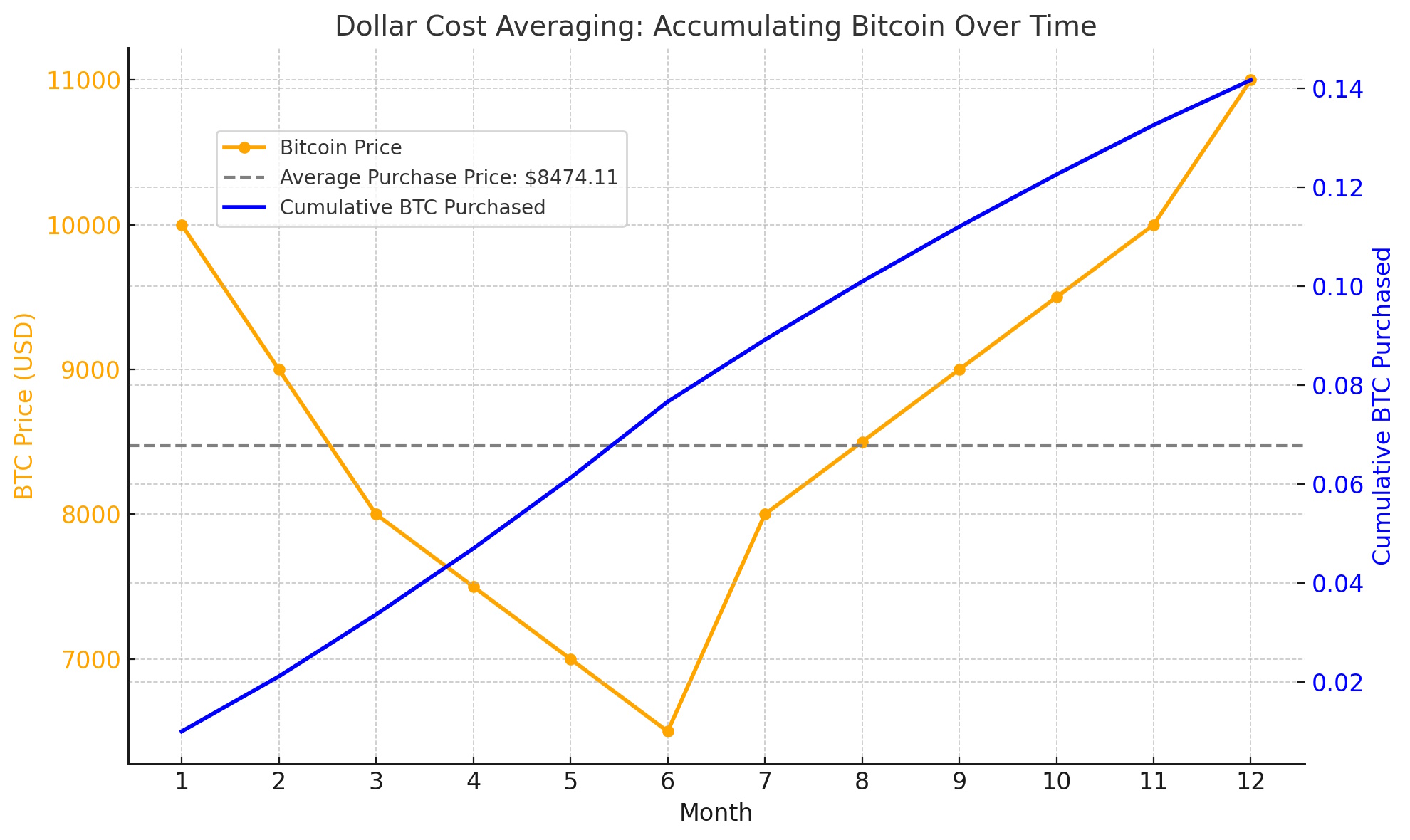

Dollar Cost Averaging (DCA) is a strategy where investors put in a fixed amount of money at regular intervals, regardless of market conditions. This method spreads out investment risk and can lower the average cost per unit over time. By investing consistently, investors avoid the pitfalls of trying to time the market perfectly and benefit from price fluctuations over time.

How Do I DCA?

Implementing a Dollar Cost Averaging (DCA) strategy involves a straightforward process. Here’s how you can start using DCA to invest in cryptocurrencies like Bitcoin:

- Choose Your Asset: Decide on the cryptocurrency you wish to invest in, considering factors like market potential and personal interest.

- Set Your Budget: Determine how much money you can invest regularly without affecting your financial stability.

- Pick Your Interval: Decide how often you’ll invest—weekly, bi-weekly, or monthly.

- Stick to Your Plan: Consistently invest the same amount at your chosen interval, regardless of market conditions.

Example of Dollar Cost Averaging

Imagine you decide to invest $100 every month in Bitcoin. When the price is $10,000, you buy 0.01 BTC; when it drops to $8,000, you buy 0.0125 BTC. As the price rises to $12,000, you acquire 0.0083 BTC. Over time, this strategy reduces the impact of price volatility on your investments, as you accumulate more units when prices are low and fewer when prices are high.

Benefits of Dollar Cost Averaging in a Bear Market

Dollar Cost Averaging is especially beneficial in a bear market or during Crypto Winter because it encourages disciplined investing and reduces the risk of making poor investment decisions based on emotions. By investing consistently, you can buy more when prices are low and less when they are high, potentially lowering your overall cost per asset.

- Simplicity and Consistency: DCA is straightforward to implement and promotes consistent investing, which can help investors remain focused on long-term goals without being distracted by short-term market volatility.

- Reduces Impact of Volatility: By spreading out investments over time, DCA helps smooth out the effects of market fluctuations, reducing the risk associated with investing a large sum at a single point in time.

- Emotional Detachment: Helps investors avoid emotional reactions to market volatility by sticking to a predetermined plan, which can prevent panic selling and other impulsive decisions.

- Potential for Lower Average Cost: Buying more units when prices are low can reduce the average cost of your investment, potentially increasing overall returns when the market recovers.

Dollar-Cost Averaging for Crypto Newbies

For those new to cryptocurrency, DCA offers an easy entry into investing without the stress of trying to time the market. It allows you to build your portfolio gradually while learning about market dynamics and the behavior of different cryptocurrencies.

Tips for Beginners:

- Start Small: Begin with amounts you’re comfortable investing to minimize risk while gaining experience in the market.

- Educate Yourself: Continuously learn about the market and the assets you’re investing in, staying informed about trends and news that may affect your investments.

- Be Patient: Understand that building wealth takes time and consistency, and avoid making impulsive decisions based on short-term market movements.

Managing Emotions

Investing can evoke strong emotions, especially in volatile markets. Here are some tips for managing emotions:

- Stay Informed: Keeping up with market trends can reduce anxiety and help you make informed decisions based on data rather than emotions.

- Avoid Impulsive Decisions: Adhere to your DCA plan to avoid panic selling and other knee-jerk reactions to market fluctuations.

- Focus on Long-Term Goals: Keep your financial goals in mind and stay the course, remembering that short-term volatility is a normal part of investing.

What are the Disadvantages of Dollar Cost Averaging?

While DCA offers many benefits, it is not without its downsides:

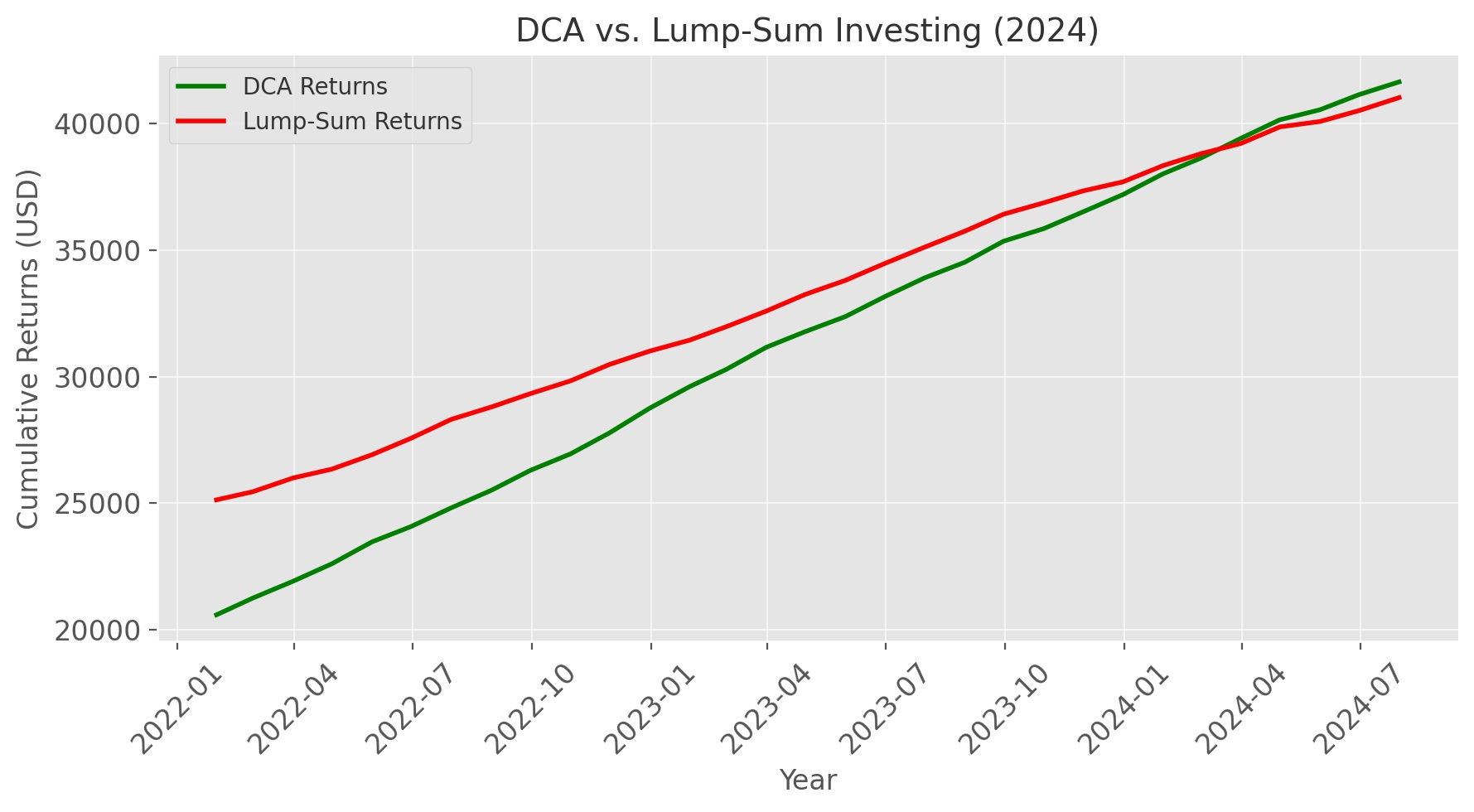

- Potential Missed Opportunities: In a rapidly rising market, lump-sum investing might yield higher returns if the market continues to increase after the initial investment.

- Requires Discipline and Patience: It takes time to see significant results, which might be frustrating for some investors who are eager for quick gains.

- Not Ideal for All Assets: Some assets may not suit a DCA approach due to extreme volatility or lack of liquidity, requiring careful consideration of which cryptocurrencies to include in a DCA strategy.

How DCA Can Help Minimize Risks During Crypto Winter

During Crypto Winter, market conditions can be unpredictable, making it challenging for investors to determine the best times to buy or sell. DCA helps mitigate these risks by encouraging a systematic approach to investing that reduces the impact of volatility. Here’s how DCA can help:

- Consistent Investment: By investing regularly, you eliminate the stress of trying to predict market lows or highs, which can often lead to costly mistakes.

- Avoids Emotional Traps: DCA removes the emotional component of investing, helping you avoid panic selling when prices fall or over-enthusiastic buying during brief rallies.

- Lowersthe Average Purchase Price: DCA allows you to buy more when prices are low and fewer units when prices are high, potentially lowering the average cost per unit over time. This can enhance returns when the market rebounds.

- Builds a Disciplined Approach: Consistency in investing promotes discipline, helping you stick to your long-term investment goals regardless of short-term market fluctuations.

- Reduces Timing Risk: Since it’s difficult to predict market movements accurately, DCA spreads your investment over time, reducing the risk associated with trying to time the market perfectly.

Using Dollar Cost Averaging to Supplement Other Investment Strategies

While DCA is an effective strategy on its own, it can also complement other investment strategies to enhance returns and manage risk:

- Diversification: Combine DCA with diversification by investing in a mix of cryptocurrencies to spread risk and potentially improve returns. Diversifying your investments helps mitigate the risk of holding a single asset that might underperform.

- Rebalancing: Periodically adjust your portfolio to maintain your desired asset allocation, taking advantage of market movements to optimize your investments. Rebalancing ensures that your portfolio remains aligned with your risk tolerance and investment goals.

- Staking and Yield Farming: Use DCA to accumulate assets for staking or yield farming, potentially generating additional returns through these passive income strategies. This approach allows you to earn rewards while holding your cryptocurrencies.

By integrating DCA with these strategies, investors can create a more robust investment plan that adapts to changing market conditions and maximizes opportunities for growth.

Baxity Store’s Role in Supporting Investors

Baxity Store offers a simple way to purchase cryptocurrency vouchers or gift cards, making digital assets accessible to everyone. With secure transactions, investors can focus on their strategies without unnecessary worries. Baxity Store’s platform is designed for both novice and experienced investors, offering a reliable solution for purchasing cryptocurrencies.

Baxity Store enhances the convenience of purchasing cryptocurrencies by offering easy-to-use payment solutions tailored for cryptocurrency investors. With Baxity’s digital goods, investors can ensure their transactions are secure and efficient, allowing them to focus on long-term investment goals without worrying about transaction security.

Cryptocurrency Products at Baxity Store

Baxity Store offers a range of cryptocurrency products that cater to different investor needs, making it a go-to destination for digital assets. One of the standout products is the Binance USDC, which can be purchased with flexible delivery options:

- Instant Code Delivery: When Binance USDC is in stock, customers can receive their digital codes immediately, allowing for quick and seamless transactions.

- 72-Hour Delivery: If Binance USDC is temporarily out of stock, customers can opt for a 72-hour delivery. This option allows customers to purchase the product without receiving the code immediately. Baxity Store will manually deliver the code within 72 hours, ensuring customer satisfaction even during high-demand periods.

For those interested in making larger purchases, Baxity Store offers a wholesale purchase option. Customers can fill out a form on the website to receive a personalized offer tailored to their needs. This feature is ideal for businesses and investors looking to buy in bulk, providing flexibility and competitive pricing.

With these options, Baxity Store ensures that all customers, from individual investors to large enterprises, can find the products and services that best fit their needs.

Benefits of Baxity Store Cryptocurrency Cards

Baxity Store’s platform offers several benefits for investors looking to navigate the complexities of the cryptocurrency market:

- Ease of Use: The platform is designed for simplicity, allowing investors to quickly purchase and redeem vouchers or cards for cryptocurrencies with minimal hassle.

- Wide Range of Payment Options: Investors can choose from a wide array of supported payment options, enabling diversification and flexibility in investment choices to suit individual preferences and risk tolerances.

- Reliable Support: Baxity’s dedicated customer support team is always available to assist with any questions or concerns, ensuring a smooth and enjoyable experience for all users, whether they are new to cryptocurrency or seasoned investors.

Conclusion

Dollar Cost Averaging (DCA) is a powerful tool for managing investments during Crypto Winter. By maintaining a disciplined approach and focusing on long-term goals, investors can mitigate market volatility and build robust portfolios. Combining DCA with strategies like diversification and risk management enhances investment outcomes, offering a balanced approach to navigating the cryptocurrency market.

DCA provides numerous benefits during Crypto Winter, including risk reduction, emotional stability, and the potential for significant returns. By consistently investing over time, investors can capitalize on lower prices and build a resilient portfolio for the future. The systematic nature of DCA helps investors stay committed to their long-term goals, even in the face of market volatility.

With Baxity’s secure and convenient cryptocurrency gift cards, investors can safely purchase digital assets and focus on their investment plans. Whether you’re new to investing or an experienced trader, DCA and Baxity can help you succeed in the ever-changing cryptocurrency landscape.