All services related to Trasta are no longer available. Please note that Trasta products, features, or support are currently discontinued and no longer accessible through our platform.

TRASTRA Account with IBAN

Trastra is a trusted financial platform that allows you to buy, sell, and cash out cryptocurrency funds. This service has recently launched an IBAN account; it is available to all new users who use the Trastra web application or the mobile app. This functionality will soon be added to the accounts of existing users.

What Is an IBAN Number?

Before we dive into the meat of this article, we wanted to answer a quick question – what is an IBAN number? It is a standard, worldwide-recognized method of identifying a bank account when an international transfer is underway. The acronym stands for “International bank account number.” This number begins with 2 characters that identify your residential country, and then another 2 numbers showing the check number, 4 characters representing your bank, 4-6 digits for your sort code, and then a final series of digits for your account number.

Here is a sample IBAN code you might see if you are in the UK:

Now that you know the IBAN meaning, let’s take a look at the key features of a Trastra IBAN account.

Trastra IBAN Account

There are many benefits that come with using Trastra IBAN for employees and employers alike. With businesses, they can now do international transactions without having huge fees. Trastra IBAN for employers makes it easier and more profitable for companies to scale their products up to a global level.

Now, what about individuals? If you are an employee who wants to start using crypto, this is where Trastra’s IBAN account comes in handy.

The company’s bank can pay out to the employee’s Trastra account, and then the Euro salary can be converted to crypto without complications. You can decide whether you want to convert the entire salary or just a portion of it.

And, great news! It works the other way around too. If an employee gets paid in BTC or another form of crypto, Trastra’s IBAN account lets them immediately convert it to Euros when paying with a VISA card. Most international stores accept Trastra’s VISA card, making it easier for you to spend your crypto payments wherever you’d like.

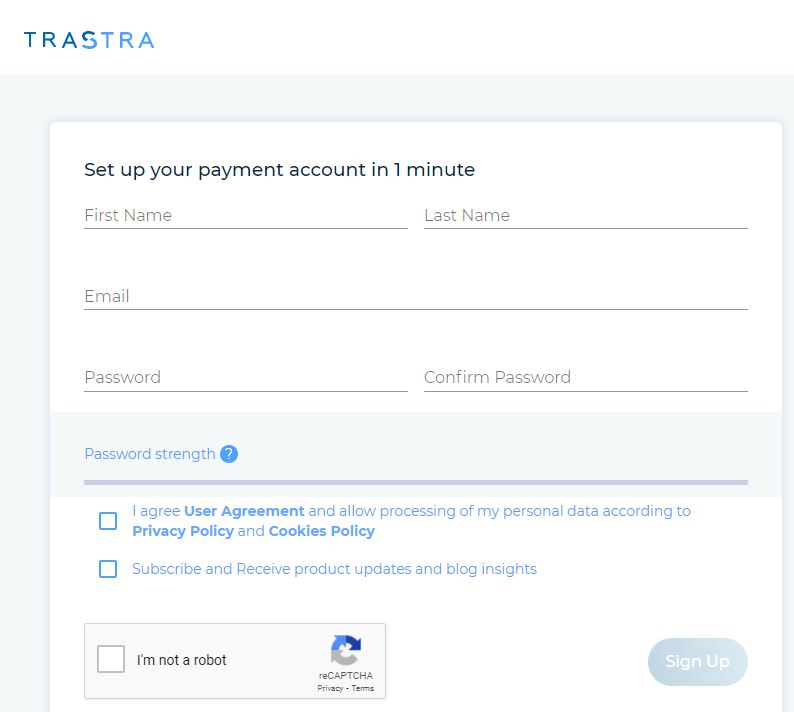

How to Get a Trastra IBAN Account

As mentioned before, only new users are able to get a Trastra IBAN account; however, this functionality will soon be added to existing user accounts.

So, how do new users go about getting one? All you have to do is verify your Trastra account and then order Trastra’s Visa card. After that, you’ll automatically receive an IBAN Payment account.

The verification process contains four steps:

- Verify your phone number

- Provide your address

- Upload ID document (passport, driver’s license, ID, etc.)

- Liveliness check (Selfie)

Now that you’ve taken care of verification, you can order a Trastra card. You’ll need to have enough funds in your account to cover the card order fee – this is typically 9 EUR, but it is free when you partner with Baxity! Next, you will find the “Cards” section of your online dashboard and click on “Order Card.” Double-check your shipping address and then confirm the order. You’ll receive the card in the mail in up to 10 shipping days.

IBAN Transfer to External Account

Currently, there is no feature allowing a Trastra user to make an IBAN transfer to an external account. However, according to Trastra’s FAQ section, this functionality is coming soon. Once it is available, Trastra users will have access to money transfer services across SEPA zone countries.

How to Top Up Trastra Account via IBAN Bank Transfer

Currently, this is only available with EUR currencies and is an option for SEPA-zoned countries. To top up your account with an IBAN bank transfer:

- Access your Trastra account dashboard and click the “Deposit Funds” tab – this is found in the upper left corner.

- Choose the “Deposit EUR” button.

- Copy your IBAN number. You can provide this IBAN number to your employer, and your salary payments will be added directly to your Trastra account.

For more topping-up options, check out our recent Trastra review!

Get Benefits in Trastra With Baxity

There are huge benefits to using Trastra as your primary online banking service – for instance, easily being able to spend crypto on-the-go, excellent limits, competitive fees, and attentive customer support. A Trastra account gives huge advantages, no matter what purpose: crypto, euro, or business usage. But, when you use our link to sign up for Trastra, you gain even more benefits! For instance:

There are huge benefits to using Trastra as your primary online banking service – for instance, easily being able to spend crypto on-the-go, excellent limits, competitive fees, and attentive customer support. A Trastra account gives huge advantages, no matter what purpose: crypto, euro, or business usage. But, when you use our link to sign up for Trastra, you gain even more benefits! For instance:

- FREE Trastra VISA Card

- Ability to use a card with no bank account

- 300 EUR daily ATM withdrawals

- Tiny fee of 2.25 EUR for ATM withdrawals

- FREE purchases with cards – no fees!

- FREE transfers of crypto to VISA card

You will also get a refund of 9 EUR from Baxity for ordering a Trastra crypto card! To get compensation for the card:

- Use Baxity link to create a Trastra account.

- Deposit 9 EUR to your crypto wallet.

- Use your account to directly order the Trastra VISA card.

- After the card arrives, activate it.

- Convert 1000 EUR worth of crypto to fiat money on your card.

.

.

After that, you’ll receive the compensation.

As long as you are ready to start using Trastra for quick and easy fiat and crypto payments, sign up for an account. And, since you will be a new user, you’ll be one of the first people to get their IBAN payment account!

What do you think of Trastra’s new IBAN feature? Let us know below. We’ll also be happy to answer any of your questions about Trastra’s other services.

Isn’t there a Mastercard option? Just Visa? Thanx

Andre, thank you for your question! Yes, Visa is now the only option for issuing a card. If something changes, we will definitely inform clients about it.

The Visa card is a more versatile choice, as it can be used to make deposits to gambling. Mastercard does not allow its clients to make such transactions due to the company’s internal policy.

I am very new to this so bear with me. I plan to use this mostly for gambling and I’m considering opening a Trastra account. Since fiat money is more prone to inflation I want to exchange it to crypto as soon as possible. I also want to get the Trastra crypto card.

The problem is this:

“Convert 1000 EUR worth of crypto to fiat money on your card.” – Does it have to be this much? Like I said I want to exchange fiat for crypto and not the other way around.

Helmuth, thank you for your question! To get a refund for a Trastra card you need to convert 1000 EUR worth of crypto to fiat. By the way, it’s quite convenient to pay via Trastra card for some goods or services. If you aren’t going to convert crypto into fiat, you won’t get a refund for the card, unfortunately.

I see…Can I pay in bitcoin with Trastra VISA online?

Helmuth, your Trastra VISA card designed exclusively for work in fiat. But if the store or merchant where you plan to pay accepts cryptocurrency, you can pay in it from your crypto balance of the Trastra account, without using a card.

Also, you can transfer fiat funds to the card, and then convert them into cryptocurrency to the account.

Hi mate, What country is the IBAN number from? I understand that it is from the EUR sepa zone, but what is the country code? Is it aligned to the country “fiscal tax residence”?

Hi Mike! Thank you for your question regarding the Trastra system. The IBAN number provided by Trastra has the country code ‘LT’, corresponding to Lithuania. This means that the IBAN number is tied to the financial system of Lithuania, a member of the SEPA (Single Euro Payments Area). Therefore, the Trastra IBAN number is linked to a Lithuanian bank. We hope this answers your question. Should you have any additional queries, please feel free to ask!