Cryptocurrencies have long outgrown their role as mere payment tools. Today, there are various types of cryptocurrencies — payment, gaming, DeFi, utility — each playing a specific role within the ecosystem. Understanding key categories of cryptocurrencies helps you navigate this space safely. Getting started is simple — purchase a crypto voucher directly from Baxity Store.

What are the different types of cryptocurrencies

The crypto market is evolving rapidly, and the number of digital assets keeps growing. To navigate this space confidently, it’s essential to understand the different types crypto and the roles they play in the blockchain ecosystem.

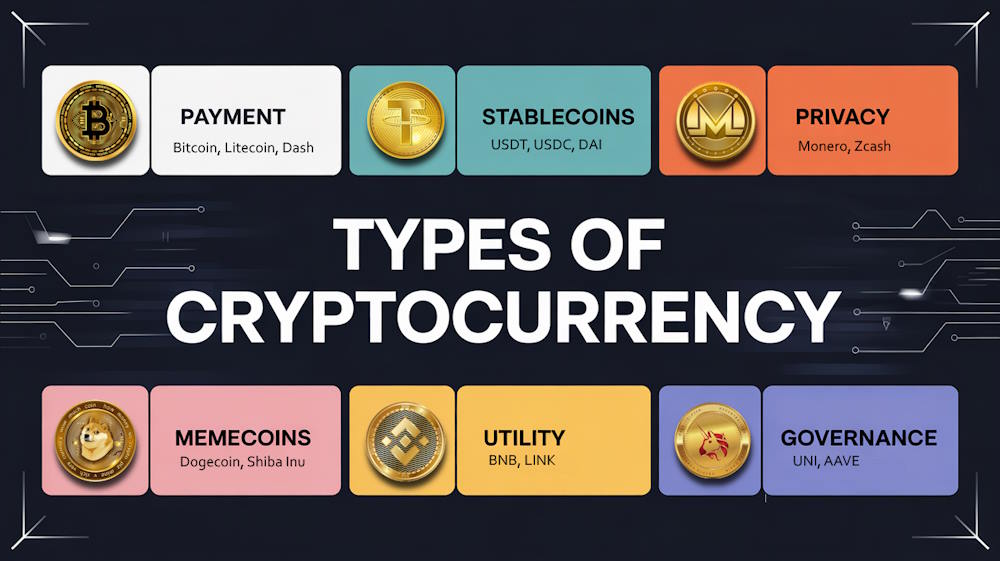

In practice, cryptocurrencies can be classified in various ways — by technology, issuance method, or storage mechanism. But in this section, we’ll focus on the most important approach: cryptocurrency classification by function.

This type of classification highlights the main cryptocurrencies — those that serve key roles in the Web3 infrastructure. These include payment coins, stablecoins, privacy-focused assets, memecoins, utility, and governance tokens.

Each group represents a distinct direction, with its own logic, technology, and risk level. And while there are dozens of kinds of crypto, these categories form the foundation for understanding the market and making smart decisions.

In the following sections, we’ll look at each type in detail. But first — a summary table with examples and use cases to help you get a practical overview of today’s most common types cryptocurrency.

| Type of Cryptocurrency | Key Examples | Primary Use Case |

| Payment Coins | Bitcoin, Litecoin, Dash | Digital payments and money transfers |

| Stablecoins | USDT, USDC, DAI | Price stability, storing value |

| Privacy Coins | Monero, Zcash | Anonymous transactions |

| Memecoins | Dogecoin, Shiba Inu | Community-driven hype, speculation |

| Utility Tokens | BNB, LINK | Platform access, service payments |

| Governance Tokens | UNI, AAVE | Voting and project governance |

Payment cryptocurrencies

Payment cryptocurrencies were the starting point of the digital asset era. Created as decentralized alternatives to fiat money, they became the foundation of the crypto market. The most prominent major crypto currency is Bitcoin — the ideological and technical core of the space. This coin category also includes Litecoin, Dash, and Bitcoin Cash, which offer faster transactions or improved technical flexibility.

These types of crypto coin are commonly used for transfers, online purchases, and even in physical stores that accept crypto. Their main value lies in speed, low transaction fees, and transparency. Most coins in this category operate on their own blockchains — a good crypto currency example is Litecoin, which offers faster block times.

It’s worth noting that each example of cryptocurrency in this group has distinct features: Bitcoin focuses on security, Litecoin on speed, and Dash on transaction privacy. This makes cryptocurrency coin types highly adaptable for modern financial needs.

Stablecoins

Stablecoins are a class of cryptocurrencies whose value is pegged to fiat currencies like the US dollar or the euro. They combine the benefits of blockchain technology with the price stability of traditional money. The most popular examples include USDT, USDC, BUSD, and DAI.

Unlike volatile assets, these different kinds of cryptocurrencies are designed specifically to maintain a stable value, making them attractive to traders seeking safety during market swings or for everyday payments.

Their key advantages lie in usability, transaction speed, and clear crypto currency features — one USDT token is always equal to one dollar. That’s why stablecoins are a core tool in most wallets and on nearly all exchanges.

Privacy coins

Privacy coins are a form of crypto designed to protect users’ personal data. Unlike most cryptocurrencies, where all transactions are visible on the blockchain, these coins use advanced encryption technologies to hide the sender, receiver, or transaction amount.

The most well-known examples include Monero, Zcash, and Dash (partially). Each represents a cryptocurrency different types with enhanced security features. For instance, Monero fully conceals transaction details, while Zcash allows users to choose between transparent and shielded modes.

These other types of crypto are especially popular among activists, journalists, private investors, and anyone concerned about privacy in the digital space. While not mainstream, their contribution to blockchain privacy is undeniable.

Memecoins

Memecoins are cryptocurrencies that began as internet jokes but unexpectedly gained massive popularity. They’re based on memes or social media trends, with the most well-known examples being Dogecoin and Shiba Inu.

These assets are known for their high volatility, as their value often depends more on community sentiment and celebrity tweets than on actual technology. They represent a crypto currency example with a distinctly speculative nature. While not fundamental assets, as other types of cryptocurrency, memecoins have become an integral part of digital culture.

Governance and utility tokens

Governance and utility tokens are a specific type of crypto token that serve not just as a means of payment but also as functional or administrative tools within blockchain projects. For example, tokens like UNI or AAVE allow users to vote, influence protocol decisions, and propose changes — a process known as governance.

Other utility cryptocurrency tokens, such as LINK or BNB, are used to pay for services within a platform, access discounts, or gain early access to features. These tokens belong to broader types of cryptoassets, as they are created through the tokenization of resources, functions, or user rights within a digital infrastructure.

Their value is driven not by speculation but by utility: the more use cases a token has, the more valuable it becomes — both to the project and the user.

What other cryptocurrencies are there

Beyond the core functional categories, there are also other cryptocurrencies designed for specific roles across various sectors — from financial protocols to virtual environments. These assets may not resemble classic coins, but they play a vital role in the growing digital economy.

In this section, we’ll explore different categories of cryptocurrency that serve as infrastructure for smart contracts, as tokens in DeFi protocols, or as in-game currencies within the metaverse and blockchain-based games.

Below is a quick table with examples of kinds of crypto currency that go beyond traditional digital money:

| Category | Examples | Primary Use Case |

| Smart Contract Platforms | Ethereum, Solana, Avalanche | Infrastructure for decentralized applications |

| DeFi Tokens | AAVE, COMP, SUSHI | Lending, staking, liquidity provisioning |

| Gaming & Metaverse Tokens | MANA, SAND, AXS | Virtual economies, digital in-game assets |

We’ll now take a closer look at each of these categories.

Smart contract platforms

Smart contract platforms represent a different type of crypto — not traditional payment tools, but ecosystems built to support decentralized applications.

Networks like Ethereum, Solana, Avalanche, and Cardano allow developers to create dApps, ranging from financial services to NFT marketplaces. Thanks to these platforms, blockchain has evolved from a simple payment network into a full-fledged technological environment.

These platforms typically use their native cryptocurrency to pay transaction fees, for staking, or for governance. That’s why smart contract networks are a core part of the crypto infrastructure and a major driver of next-generation protocols.

📚 Related Articles

- Getting Started with Binance: A Step-by-Step Guide

- Is Binance Safe? A Guide to Securely Storing Your Crypto with Baxity’s Gift Cards

- Gate Crypto Gift Card: A Simple and Secure Way to Invest with Baxity

DeFi tokens

DeFi tokens are a type of crypto token used in decentralized finance protocols. They form the backbone of an industry that operates without banks, intermediaries, or centralized control.

The main cryptocurrency use case in DeFi includes lending (AAVE, Compound), liquidity provision (Uniswap, SushiSwap), staking (Synthetix), and protocol governance. These tokens often reward users with yield, providing passive income in return for participating in the network.

Thanks to tokenization of assets and financial functions, DeFi enables transparency and access to services that were once limited to centralized institutions. In this space, liquidity often determines how efficient a protocol is and how attractive it becomes to users.

Metaverse and gaming tokens

Metaverse and gaming tokens are a unique class of digital assets used within virtual worlds and blockchain-based games. Examples include MANA (Decentraland), SAND (The Sandbox), and AXS (Axie Infinity).

These tokens allow users to buy and sell in-game items, own virtual land, participate in digital economies, and even create content. They act as next-generation in-game currencies and form the backbone of immersive, user-owned financial systems.

As metaverse ecosystems evolve, these assets introduce real financial incentives to virtual environments. While traditional gamers relied on prepaid cards, today it’s easier to use crypto cards that provide access to tokens from popular virtual worlds. A gift card cryptocurrency can be used to top up your in-game balance or send digital tokens as a gift.

How many types of cryptocurrency are there

In the crypto space, classification isn’t limited to function alone. There are also technological types of cryptocurrency, categorized by blockchain architecture, scalability mechanisms, and cross-network compatibility. This allows us to identify different types of currency that not only serve specific purposes but also shape how decentralized services are built. Some projects provide base-layer networks (like Bitcoin or Ethereum), while others focus on improving speed or interoperability between platforms.

Understanding these various types of cryptocurrency is essential not only for developers but also for users looking to evaluate the technical strengths of different projects. Below, we’ll explore these types cryptocurrency in detail — from Layer 1 and Layer 2 solutions to cross-chain and interoperability tokens.

Layer 1 vs Layer 2 solutions

In the cryptocurrency ecosystem, it’s important to understand not only what a token does, but also what level of blockchain architecture it belongs to. There are two main layers: Layer 1 (base network) and Layer 2 (scaling solution built on top).

- Layer 1 refers to full-fledged blockchain networks that handle consensus, security, and transactions independently. These networks are decentralized and serve as the foundation for decentralized applications.

Examples of Layer 1 cryptocurrencies include Bitcoin, Ethereum, Solana, Avalanche, Cardano, and Polkadot. Most Web3 infrastructure is deployed directly on these base-level chains.

- Layer 2 refers to additional protocols built on top of Layer 1 networks to solve performance and scalability challenges. These solutions process transactions off-chain and submit summaries to the underlying blockchain, which improves speed and lowers fees.

Popular Layer 2 projects include Polygon, Arbitrum, Optimism, zkSync, and StarkNet. They are all built on Ethereum and rely on it as their Layer 1 base. Even if a decentralized application runs on Optimism, it still depends on Ethereum for security and final settlement.

This layered architecture enables flexible infrastructure capable of supporting multiple cryptocurrencies, services, and applications. In such systems, efficiency is achieved through Layer 2 scalability without compromising decentralization.

Cross-chain and interoperability tokens

One of the biggest challenges in today’s crypto infrastructure is fragmentation. Different blockchains — like Ethereum, Bitcoin, or Solana — operate independently, and without additional solutions, it’s impossible to transfer assets between them. This is where cross-chain and interoperability tokens come into play. These are tools designed to enable asset transfers and data exchange between separate blockchains — bridging ecosystems that would otherwise remain isolated.

Notable examples include Cosmos (ATOM), Polkadot (DOT), and ThorChain (RUNE). Each project offers a different approach: some build networks of connected blockchains, while others create protocols for direct asset swaps without centralized exchanges.

These tokens represent a distinct segment of crypto sectors focused on making Web3 more connected and functional. Rather than fitting into traditional groups, they create entirely new categories that make complex decentralized systems possible.

What are crypto coins

In the world of cryptocurrencies, it’s important to distinguish between the two main types of digital assets: coins and tokens. While they may appear similar at first glance, they differ in architecture and function.

- Coins are cryptocurrencies that run on their own native blockchain. Examples include Bitcoin, Ethereum, Litecoin, and Dogecoin. These projects operate independent networks, validate transactions, and create new blocks — making them self-sustaining systems. Coins are most commonly used as a medium of exchange or a store of value.

- On the other hand, tokens are built on top of existing blockchains. For example, USDT, LINK, and UNI are all tokens that operate within the Ethereum network. Tokens don’t have their own blockchain — they rely on the underlying platform’s rules and security.

This is the key difference between crypto coins and tokens, and it’s central to understanding the structure of all types of cryptoassets. While every crypto project has its own purpose, the basic coin/token distinction helps users better navigate the variety of available cryptocurrency kinds.

A well-known example of crypto is Bitcoin — the original coin that has inspired many forks. Below, we’ll explore its variations and other major coins on the market.

Bitcoin and its forks

Bitcoin was the first cryptocurrency ever created, setting the standard for digital assets that followed. Over time, differences in opinion among developers and the community led to the emergence of forks — new blockchains based on Bitcoin’s code but operating under different rules.

These forks introduced several different kinds of Bitcoins, each with unique characteristics and goals. The most well-known are Bitcoin Cash (BCH), Bitcoin SV (BSV), and Bitcoin Gold (BTG).

Bitcoin Cash focuses on faster and cheaper transactions for everyday payments. Bitcoin SV aims to preserve what its developers see as Satoshi Nakamoto’s original vision. Bitcoin Gold was created to make mining more accessible to everyday users by changing the mining algorithm.

Each fork represents a specific type of Bitcoins, developed to address particular concerns while retaining Bitcoin’s original architecture. Today, these different types of Bitcoins vary in adoption and relevance, with Bitcoin Cash maintaining the most consistent support and utility across major exchanges.

Alternative coins (altcoins)

Altcoins, or alternative coins, refer to all cryptocurrencies other than Bitcoin. They cover a wide range of technologies, purposes, and approaches. Some aim to address Bitcoin’s limitations, while others focus on entirely different use cases such as smart contracts, scalability, privacy, or decentralized services.

Among the most widely known altcoins are Ethereum (ETH), Ripple (XRP), Cardano (ADA), BNB, and Tron (TRX). These are some of the most common crypto currencies, often appearing among the top names of crypto currency in terms of market capitalization and ecosystem development.

Each of these assets follows a distinct path:

- Ethereum introduced smart contracts and a platform for decentralized applications.

- Ripple (XRP) focuses on fast international payments and partnerships with financial institutions.

- Cardano (ADA) takes a research-driven, academic approach to blockchain development.

- BNB serves as a utility token within the Binance ecosystem.

- Tron (TRX) targets decentralized content and entertainment.

This diversity illustrates the different types of crypto coins that go beyond basic payment use. In fact, the types of digital coin available today span everything from finance and gaming to governance and identity.

That’s why it’s important to understand the different types of crypto currency — from architecture to use case — in order to navigate the market effectively.

What does cryptocurrency look like

For beginners, cryptocurrency might seem abstract or hard to visualize. Unlike physical money, it has no tangible form — it exists only as digital records on a blockchain. However, behind those records lies a system of technical concepts that are essential for safely using crypto.

Cryptocurrency isn’t stored “on your computer,” but in specialized programs or devices known as wallets. These manage your access to funds, ensure security, and allow for transfers. Each wallet represents a form of cryptocurrency that consists of a pair of cryptographic keys: one public and one private. The public key is used to receive funds, while the private key must be kept secret, as it grants full access to your assets.

These elements are part of the core features of cryptocurrency that differentiate it from traditional finance. Moreover, there are different forms of cryptocurrency, depending on how it is stored — including hot wallets, cold wallets, mobile apps, or hardware devices. To better understand how all types of crypto currency function in the real world, let’s explore the main methods for storing and managing digital assets.

Hot vs Cold Wallets

Cryptocurrencies require secure storage, and for that purpose, users rely on wallets — digital tools that allow them to manage and access their funds. Wallets generally fall into two main categories: hot wallets and cold wallets, depending on whether or not they are connected to the internet.

- Hot wallets are software-based and stay online. They are ideal for frequent transactions, quick access to funds, and interaction with Web3 platforms. Popular examples include MetaMask, Trust Wallet, and Coinbase Wallet.

- Cold wallets, on the other hand, are offline storage solutions. These can be physical devices or paper backups that keep your private keys disconnected from the internet. This setup provides maximum security. Examples include hardware wallets like Ledger and Trezor.

Each option reflects specific crypto currency features in the context of storage cryptos. Many users choose to combine both: cold wallets for long-term storage and hot wallets for daily use.

Comparison of Hot and Cold Wallets

| Wallet Type | Internet Connection | Convenience | Security |

| Hot Wallet | Yes | High | Medium |

| Cold Wallet | No | Limited | High |

Public and Private Keys

Every cryptocurrency, regardless of its purpose, relies on a pair of cryptographic keys: a public key and a private key. This technology is fundamental to securing transactions and giving users control over their digital assets.

- The public key is your wallet address — it can be safely shared with others so they can send you funds.

- The private key, on the other hand, must be kept secret. It grants full access to your wallet and everything in it. If someone obtains your private key, they gain complete control over your assets.

Across the landscape of different cryptocurrencies, the key management system remains the same, whether you’re using Bitcoin, Ethereum, or a lesser-known token. It’s a core part of how types of crypto currency function in any blockchain ecosystem.

That’s why protecting your private key is absolutely essential — if it’s lost or exposed, recovery is often impossible.

What are cryptocurrencies based on

Cryptocurrencies are built on several key technological and economic foundations. Understanding these elements helps users evaluate the security, functionality, and potential of different crypto projects.

Core components include:

- Blockchain – A distributed digital ledger that stores the history of all transactions. It ensures transparency, security, and data immutability.

- Cryptography – Used for data encryption, wallet address generation, and digital signatures that secure transactions.

- Consensus algorithms – These mechanisms allow decentralized networks to agree on a single version of the truth. The most common are Proof-of-Work (used for mining) and Proof-of-Stake (used in validator-based systems).

- Decentralization – No central authority controls the system. Every participant has equal rights, making the network resistant to censorship and single points of failure.

- Cryptocurrency sectors – Cryptocurrencies serve various industries such as finance, gaming, logistics, and healthcare. Each asset often has a specific use case within a particular sector.

- Types of cryptocurrency exchanges – Platforms that facilitate the buying, selling, and trading of digital assets. These include centralized exchanges (CEX) and decentralized exchanges (DEX).

How to Buy Crypto with Baxity Store

Looking for a fast and reliable way to buy cryptocurrency — without complex verifications, unstable exchange rates, or confusing interfaces? You can use a crypto voucher online — a digital voucher that can be redeemed for popular coins via the CryptoVoucher.io platform.

Baxity Store offers flexible denominations, discounts, instant email delivery, and even bulk purchase options with personalized offers. This method is suitable for beginners taking their first steps into crypto, as well as for experienced users looking for quick balance top-ups — with no hidden fees.

How it works:

- Choose the amount you want via crypto voucher online.

- Complete your purchase — the voucher code will be delivered to your email.

- Log in or register at CryptoVoucher.io.

- Enter the code, select your cryptocurrency (BTC, ETH, USDT, etc.), and provide your wallet address.

- Confirm the exchange and receive the funds instantly.

- Crypto gift cards aren’t just an alternative to traditional crypto purchases — they’re also a smart gift option.

- A gift card cryptocurrency is a convenient way to send digital assets without hassle.

- Many clients choose to buy crypto gift card for fast and practical top-ups.

- It’s a perfect example of crypto in everyday use — simple, accessible, and effective.

- Once redeemed, the funds are sent directly to your personal wallet, offering full control and an easy entry into the world of storage cryptos.

In addition to Crypto Voucher, Baxity Store also offers other cryptocurrency gift cards — including options for Binance, Gate.io, Gift Me Crypto, and more. Choose the one that best fits your needs.

Cryptocurrencies by industry

Cryptocurrencies are no longer just financial assets — many of them are designed for specific industries and real-world applications.

Different crypto categories reflect the diversity of use cases across growing crypto sectors, such as finance, gaming, and logistics.

In this section, we’ll explore cryptocurrencies by category based on their functional focus. This brief cryptocurrency types list highlights how crypto is being integrated into various industries.

Finance and banking

In the financial sector, crypto projects are rethinking payments, lending, and savings. Solutions like Ripple (XRP), Stellar (XLM), MakerDAO, and Aave enable fast money transfers, decentralized loans, and borderless financial operations.

These major crypto currency projects are building an alternative infrastructure, challenging traditional banking systems with speed, accessibility, and transparency.

Gaming and entertainment

In gaming, cryptocurrencies play a vital role in in-game economies, NFT trading, and the development of metaverses.

Tokens like AXS (Axie Infinity), SAND (The Sandbox), MANA (Decentraland), and GMT are used for rewards, asset ownership, and participation in digital ecosystems.

Players can easily access such tokens using crypto gift cards from Baxity — a fast and simple way to top up or gift in-game crypto without using traditional exchanges.

Supply chain and logistics

Blockchain has major implications for logistics — helping track shipments, verify authenticity, and automate documentation.

Projects like VeChain (VET), OriginTrail (TRAC), and IBM Blockchain are improving the reliability and transparency of global supply chains through decentralized technology.

Conclusion

Cryptocurrencies are more than just digital money. They differ in purpose, technology, and use case: some replace fiat, others provide access to games, governance, or financial tools. Understanding crypto types helps navigate the market more effectively, manage risk, and unlock real-world utility.

If you’re looking for a convenient way to get started, check out crypto voucher — a simple method to exchange funds without registration or extra steps. Or you can buy crypto gift card — a flexible option for topping up or gifting digital assets.

FAQ

Why are cryptocurrencies divided into different types?

Because they serve different purposes. Some act as digital money, others power decentralized services or blockchain games. Understanding these types helps users avoid mistakes when choosing assets.

Is there a “best” type of crypto for beginners?

Not really. It depends on your goals:

- for stability — try stablecoins;

- for long-term investment — major coins like BTC or ETH;

- for using DeFi or NFTs — look into tokens on Ethereum or Solana.

What’s the difference between Layer 1 and Layer 2?

Layer 1 is a base blockchain like Ethereum or Bitcoin.

Layer 2 solutions (like Polygon) are built on top of them to reduce congestion and fees while speeding up transactions.

Why do meme coins exist if they have no utility?

Meme coins started as jokes, but some gained real traction. They reflect crypto culture, attract communities, and sometimes evolve into real projects — like Dogecoin or Shiba Inu.

How is crypto used in the “real world”?

Crypto supports global money transfers, decentralized lending, supply chain tracking, NFT-based gaming, loyalty programs, and more. The list of real-world applications keeps growing.

Which cryptocurrencies should I avoid?

Avoid coins that:

- have no clear purpose or roadmap,

- don’t list a team or partners,

- promise guaranteed profits,

- are hyped in Telegram channels but have no site or whitepaper.

Can I start with a small amount and no prior experience?

Yes. Many services offer fixed-value crypto options like prepaid vouchers — no need for trading, KYC, or technical steps. It’s a safe way to begin using digital assets.

Where can I quickly and reliably buy crypto without overpaying?

One of the easiest options is using crypto vouchers. Baxity Store lets you choose the amount, pay conveniently, and receive a code to redeem for crypto. No hidden fees, no complex platforms — suitable for both beginners and experienced users.