Choosing a Mastercard often comes down to one simple question: do you want to spend borrowed money, funds from your bank account, or money you’ve set aside in advance? This seemingly technical difference has a direct impact on financial control, online security, and how freely you can pay for digital services. For example, when it comes to safer online shopping or clear budgeting for subscriptions and entertainment, a Mastercard prepayment card is often the most practical option, as it allows card payments without exposing your main bank account. In this guide, we’ll clearly compare credit, debit, and prepaid Mastercard cards, explain how each type works in real scenarios, and help you choose the option that truly fits your daily goals. By the end, you’ll understand which card gives you convenience without unnecessary risks—and why many users turn to solutions available through Baxity Store.

Types of Mastercard Cards

Do you know which exact type of Mastercard card is in your wallet right now? Many people don’t, and it directly impacts their finances. Mastercard does not issue money—it’s a payment network, while banks and specialized services issue three fundamentally different products under its brand. To make a smart choice, you need to understand the key types of Mastercard cards.

The thing is, many problems with card payments arise not because of the bank or the store, but due to incorrect expectations about the card itself. Mastercard’s role in this system is only to process the payment—it doesn’t decide where the funds are taken from or under what terms. That’s why the same purchase might go through smoothly with one card and be declined with another—it all depends on how access to the money is organized.

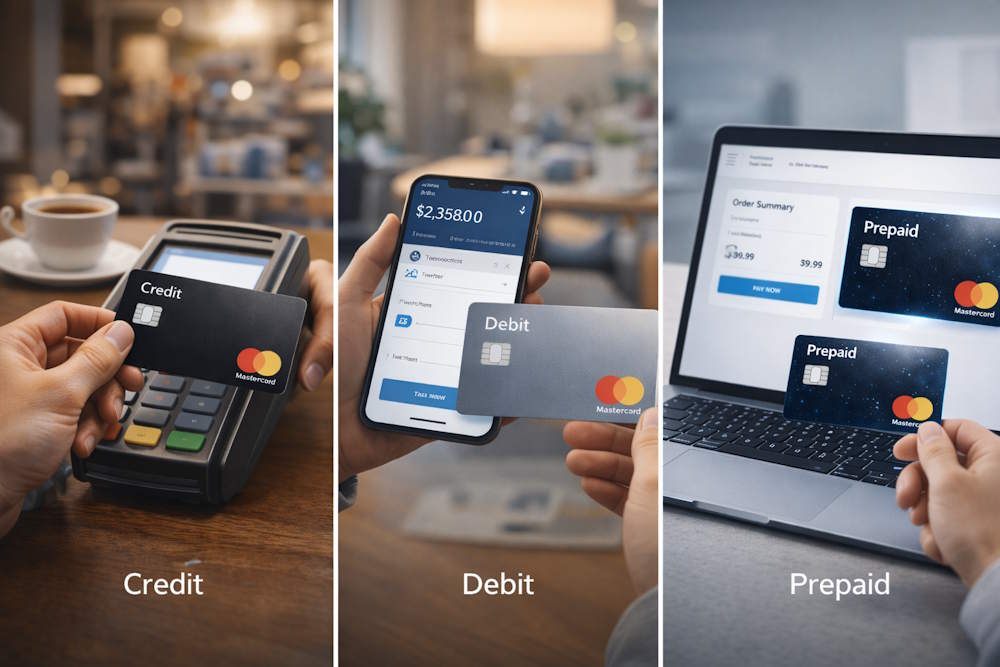

The key difference is where the money comes from. Essentially, there are three main types of Mastercard cards:

- A Mastercard credit card gives you access to a bank’s credit line.

- A Mastercard debit cardis a direct key to your main bank account.

- A Mastercard prepaid card operates as a separate, isolated account with pre-loaded funds.

Although they all bear the same logo, these are different types of Mastercard cards that operate on distinct principles. Your choice defines your financial control, security, and flexibility. Let’s take a closer look at each type so you can choose the ideal tool for your needs.

Credit Mastercard Cards

A Mastercard credit card is essentially a short-term loan tool. When you use it, you’re spending the bank’s money, not your own, up to a pre-approved limit. Its core promise is “buy now, pay later.” Understanding how Mastercard credit cards work is key: they operate on a billing cycle. You receive a statement detailing your purchases and have a grace period (typically 20-30 days) to pay the full balance without incurring interest. If you don’t pay in full, interest is charged on the remaining balance, which can accumulate quickly.

Beyond just credit, Mastercard credit cards offer significant advantages. When considering your options, look for the benefits a credit card can provide, such as:

- Rewards programs: Earn cashback, points, or miles on your spending.

- Purchase protection: Insurance against theft or damage for a specified period.

- Building credit history: Responsible use is reported to credit bureaus and helps build your credit score.

- Fraud liability protection: You are typically not held responsible for unauthorized charges.

However, these perks come with responsibility. The primary risk is debt accumulation due to high interest rates if you carry a balance. Other potential drawbacks include annual fees, late payment penalties, and the temptation to overspend. Therefore, good Mastercard credit cards are best suited for disciplined spenders who pay their balance in full each month to avoid interest, those looking to build or improve their credit score, and individuals who want to earn rewards on planned, regular expenses. They are a powerful financial tool when used strategically, not as an extension of your income.

📚 Related Articles

Debit Mastercard Cards

A Mastercard debit card allows you to spend your own money directly from a bank account, without credit or interest. Payments are processed only when funds are available, which makes a Mastercard debit card a natural choice for everyday spending where budget clarity matters more than borrowing flexibility.

The most common usage of a Mastercard debit card is handling routine financial tasks, such as:

- paying for groceries and in-store purchases;

- making online payments for services and digital products;

- completing offline transactions without using borrowed money;

- withdrawing cash from ATMs when physical funds are needed.

This is where debit cards show their practical value. The features of a Mastercard debit card that users appreciate most include immediate balance updates, clear spending limits based on available funds, and the absence of debt-related pressure. Thanks to this predictable setup, many people rely on a debit Mastercard as their primary financial “wallet” for daily life.

Prepaid Mastercard Cards

Prepaid Mastercard cards are a specific financial tool that works on a simple “load and spend” principle.

- Unlike debit cards, prepaid Mastercard are not linked to your bank account.

- Unlike credit cards, you are not borrowing money from a bank.

You simply load the card with your own funds and spend them until the preloaded limit is fully used. This makes a prepaid Mastercard similar to a debit card in everyday use, but with one key difference: your budget is limited to the card itself, not your entire bank account. You can spend exactly the amount you loaded onto the card — and nothing more. Depending on the specific card, this format may also allow cash withdrawal at ATMs if the function is supported.

What Is a Prepaid Mastercard Card

In essence, it is a separate electronic wallet bearing the Mastercard logo. Its defining feature is the prepaid debit on a Mastercard card — a fixed amount you load yourself. You control this sum and spend only what’s available. Using it does not require opening a bank account or passing credit checks. Topup is usually done online, via terminals, or with cash at partner locations.

Prepaid Mastercard cards exist in two main formats:

- Physical cards — classic plastic cards you can carry with you.

- Virtual Mastercard prepaid cards — digital counterparts that exist only as credentials (number, expiry date, CVV). They are ideal for secure online shopping.

You can track the debit or balance on your prepaid Mastercard card via a mobile app, SMS, or the issuer’s online portal. This complete control over the amount and the absence of risk of overspending beyond what is loaded is a key advantage. It provides the spending convenience of a card with the upfront budget control of cash.

Prepaid Mastercard vs Debit and Credit

To clearly understand the place of a prepaid card among other types of Mastercard cards, let’s compare all three main types in the table below. This table not only shows the classic credit card vs debit card Mastercard comparison but also visually demonstrates where the prepaid card becomes the best choice.

| Criterion | Mastercard Credit Card | Mastercard Debit Card | Mastercard Prepaid Card |

| Source of Funds | Bank’s credit funds (loan) | Your own funds from a bank account | Your own funds pre-loaded onto the card |

| Impact on Credit History | Yes (responsible use helps, late payments harm) | Usually no | No |

| Primary Risk | Debt accumulation due to interest | Overspending or overdraft fees | Losing the card or spending the full balance |

| Spending Control | Can be difficult due to deferred payment | Clear, based on account balance | Absolute, limited to the loaded amount |

| Ideal Use Case | Large purchases, emergencies, rewards | Daily expenses, salary payments | Budgeting, online security, travel, gifts |

| How to Get It | Bank approval and credit check | Open a bank account | Simple online purchase, usually without checks |

As we can see, the prepaid Mastercard card wins where maximum security and control are needed. When choosing a Mastercard credit or debit card, consider your need for credit versus direct access to your funds. The prepaid option, however, provides a unique third path. It won’t let you fall into debt, as there are no interest charges, and your potential loss is limited only to the card’s balance. It is the ideal choice for first steps in the world of finance, for parents who want to give a card to their child, or for any expenses you wish to isolate from your main account. To try this tool, you can easily order a prepaid Mastercard card from specialized services.

Where Can I Buy a Mastercard Prepaid Card

Prepaid Mastercard cards are usually searched for with a specific goal in mind: to pay for an online service, make a purchase without risk, or give someone a ready-to-use payment tool as a gift. The key point isn’t just where to buy one — it’s finding a card that works instantly and without surprises. What really matters is choosing a place where you can buy it quickly, securely, and without hidden fees. So let’s break it down step by step.

Offline: familiar, but limited

Physical prepaid Mastercard cards are sometimes available in supermarkets, post offices, or kiosks. This works if you specifically need a plastic card “right now.” However, you should expect fixed denominations, possible queues, and occasional activation issues.

Online: faster, more flexible, more secure

Buying online gives you far more freedom. You can choose the denomination that fits your budget without leaving home. The real question, though, is where to buy safely and avoid scams. A reliable seller guarantees that your card will work properly and that your personal data remains protected, which is essential for online security.

How to buy from Baxity Store: step by step

One proven option for customers in Europe — especially in the UK — is Baxity Store. Here you can purchase a prepaid Mastercard for the UK as well as for many other regions. The process is transparent and takes only a few minutes:

- Register on the platform and complete basic verification. This is a one-time procedure designed for your security.

- Go to the Prepaid Gift Mastercards

- Choose the denomination that suits you — from smaller amounts to larger budgets.

- Complete the payment using your preferred method.

- Receive your virtual card details instantly by email.

You can also purchase a gift card here — an ideal instant digital present for friends or colleagues. Simply forward your email from Baxity Store the recipient’s email address, and the card will be delivered directly to their inbox as a ready-to-use voucher.

Baxity Store also lets you send Mastercard prepaid gift cards as digital presents — perfect for friends or colleagues. Just enter their email for forwarding, and the recipient receives a Gift Card instantly, ready to use.

What else to know about Baxity Store

- If a specific denomination is temporarily unavailable, it can be delivered within 72 hours.

- Promotions and special offers are regularly available, allowing you to buy at a better price.

- Corporate clients can access a dedicated bulk order section with tailored conditions.

Getting the card is only the first step. The next important question is how to use it correctly so everything works smoothly and without interruptions. That’s exactly what we’ll cover in the next section.

How to Use a Prepaid Mastercard Card

A prepaid Mastercard card from Baxity Store works simply: you get a card with a fixed amount and use it until the balance runs out. It’s not a bank account and not a credit line — it’s a separate payment tool made for specific purchases and online transactions without the risk of overspending.

So, you’ve bought the card and received the details. But it’s too early to pay. First, you need to activate it — otherwise, it simply won’t work.

Activation: The Essential First Step

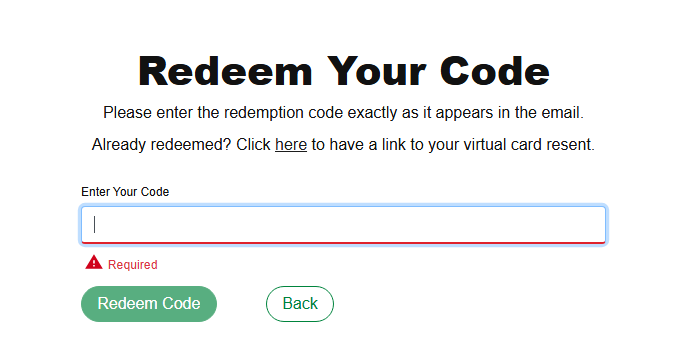

After purchase, you receive a unique activation code. To turn it into an actual payment card:

- Follow the link from your email.

- The code for redeeming will appear automatically. Click “Redeem code”.

- Enter the code, fill in your contact details (name, address, email, phone), and accept the terms.

Once done, you’ll see your 16-digit card number, expiry date, CVV code, and balance. That’s it — your card is ready to use.

Important: The activation code is tied specifically to your account. Refunds are not possible after activation — the card is considered used.

How to Check Your Balance

After activation, you get access to the issuer’s online dashboard, where you can always see:

- Your current balance;

- Your transactionhistory;

- The card’s expiry date.

No surprises — you always know exactly how much money is left.

Can You Top Up This Mastercard Card?

No. These prepaid Mastercard cards are not designed to be top up cards. You cannot add funds to an already activated card. Once the balance is spent, the card ceases to exist. But you can always buy a new one at Baxity Store.

This is precisely the main difference between prepaid Mastercard cards and credit cards — with prepaid, you cannot spend more than you have or accumulate debt.

Now the key question: what can you actually buy with this card, and where is it truly useless? That’s exactly what the next section covers.

What Can You Buy With a Prepaid Mastercard

A prepaid Mastercard is designed for one-time payments, not recurring billing. It cannot be topped up, so it doesn’t work for subscriptions, automatic renewals, or services that verify a card’s ability to handle future charges. But for everything else — it’s fast, secure, and not linked to your bank account.

If you’re trying to decide between Visa and Mastercard prepaid cards, the choice often comes down to where you shop. Both work similarly, but Mastercard is accepted in slightly more regions globally. Before you buy a Mastercard Prepaid Card, it helps to understand what it can and cannot do.

Shopping and Subscriptions

This is where it shines. You can pay for any order at merchants that accept prepaid Mastercard:

- Clothing, electronics, books — Amazon, eBay, ASOS, Zalando.

- Digital goods: Steam games, PlayStation or Xbox codes, software licenses.

- Smaller purchases on AliExpress or Etsy.

The process is simple: enter the 16-digit number, expiry date, and CVV — the transaction goes through just like any regular debit card. The merchant sees no difference.

SaaS, Streaming, and Services — With Caveats

Technically, you can pay once for a month of Netflix, Spotify, or ChatGPT Plus. But there’s a catch:

- The card does not support recurring billing. When the service tries to charge you next month, the payment will fail.

- Some platforms (like Adobe or Microsoft) run a pre-authorization check to see if the card can handle future payments. This check will almost certainly fail.

Bottom line: If you only need access for one month and are okay with losing it immediately after — you can try. But it’s a gamble, and we don’t recommend relying on it.

International Payments

This is where prepaid Mastercard truly wins. It works globally, with no blocks on cross-border transactions. You can:

- Pay at international online stores that don’t accept local cards.

- Buy hosting, VPN services, or domains from global providers.

- Pay in foreign currencies — conversion fees are transparent and fixed (up to 2% on weekdays).

A comparison of Mastercard card types — prepaid versus debit — shows that security is the main difference. Unlike a Mastercard debit card for international payments — which is still tied directly to your bank account — a prepaid card keeps your main funds completely isolated. Your spending limit is exactly what you loaded, nothing more. You also won’t get the benefits of a Mastercard credit card, like rewards or credit lines. What you do get is full control over your budget.

If you’re ready to purchase a prepaid Mastercard cards, Baxity Store offers instant delivery — no bank account required.

Prepaid Mastercard Advantages for Online Users

Why do experienced users choose prepaid cards for online payments? It’s not just about convenience — it’s about three specific advantages that traditional bank cards often lack.

Security First

When you pay with a credit card online, you’re giving fraudsters access to your bank’s credit line. With a debit card, the risk is even higher — your entire salary account could be drained. The benefits of a prepaid Mastercard card start here: your main funds never touch the transaction. Only what you deliberately loaded is on the card. Even if the card details are stolen, your loss is limited to a few dollars — not your life savings.

Budget Control Without Surprises

Many people believe the best Mastercard cards are the ones offering rewards or cashback. But the real mark of a good card is predictability. With a prepaid card, you can’t go negative, pay interest, or get hit with late fees. You spend exactly what you loaded — nothing more, nothing less. It’s the perfect tool for anyone tired of scanning statements and just wants to know: “I have $50 on the card, so I can only spend $50.”

Personal Data Protection

Every time you enter bank card details on a new website, you’re not just risking your money — you’re exposing your personal information. Your address, full name, transaction history — all of it becomes part of a digital profile that can be collected, sold, or stolen. A prepaid card doesn’t ask for your real identity. No account opening, no credit checks, no permanent link to your name. It’s simply a digital carrier of value — anonymous and independent.

This is precisely why even a standard payment with a Mastercard credit card now falls behind prepaid cards when it comes to privacy. Your bank sees every move you make. A prepaid card doesn’t.

Security, control, privacy — these are the three pillars behind the growing popularity of prepaid cards. But are they enough to make this your everyday payment tool? That depends on your habits — and that’s exactly what we’ll help you figure out in our final section.

Choosing the Right Mastercard Card

When we talk about types of Mastercard cards, it’s not about finding the “best” card overall. What really matters is understanding which one fits your spending habits, your level of financial discipline, and your actual needs.

We’ve already covered the three types of Mastercard cards: credit, debit, and prepaid. Each works differently. The difference isn’t about status or prestige — it’s about where the money comes from.

Who Should Choose a Mastercard Credit Card

A credit card makes sense if you need financial flexibility. For example:

- You plan large purchases and want the option to pay later.

- You value the grace period for interest-free payments.

- You appreciate rewards programs, cashback, or purchase protection.

- You’re confident you can repay the debt on time.

This is a tool for those who control their spending and are comfortable with the responsibility of borrowed funds.

Who Should Choose a Mastercard Debit Card

A debit card is the simplest format. You only spend your own money from your bank account.

It’s a good fit if:

- You receive your salary on the card.

- You regularly withdraw cash.

- You want to see your real balance and avoid dealing with credit.

This is a basic tool for everyday expenses — no interest, no debt, no obligations.

Who Should Choose a Prepaid Mastercard Card

A prepaid card is a separate budget for specific goals.

It works well if:

- You shop online often and don’t want to expose your main account.

- You’re budgeting for gifts, travel, or a shopping spree.

- You prefer to avoid bank limits and credit checks.

- You’re looking for a secure digital gift.

This is where the differences between Mastercard cards become clearest:

- A credit card gives access to the bank’s funds.

- A debit card gives access to your bank account.

- A prepaid card works with a separate, fixed amount you load in advance.

Once you understand these types of Mastercard cards, the choice becomes simple and logical.

Final Thought

If online payment security, spending control, and avoiding credit risk matter to you, a prepaid card is a practical solution. At Baxity Store, we offer fixed-value Mastercard cards that let you pay without linking to a bank account and without taking on debt.

Choosing a card isn’t about status. It’s about what fits your financial goals.

FAQ

Which is better: a prepaid Mastercard or a debit card?

It depends on what you need. A debit card is linked to your bank account — it’s convenient for everyday spending and receiving your salary. A prepaid Mastercard is not connected to your account. You load a specific amount and spend only that. It’s a better fit for secure online shopping, budgeting, or giving as a gift.

What’s the difference between a prepaid Mastercard and a credit card?

A credit card lets you borrow money from the bank. You pay it back later — and if you don’t pay in full, you pay interest. A prepaid Mastercard uses your own money. You load it first, then spend. No debt, no interest, no credit limit — because it’s not credit at all.

Can you give a simple example of how a prepaid Mastercard works?

Let’s say you buy a $50 virtual card at Baxity Store. After payment, you receive a link for activation. Once you’ve successfully submitted your information, you will be taken to a new page where you will be able to view your 16-digit card number, expiration date, security information. You go to an online store, enter those details — and the payment goes through. To the merchant, it looks exactly like a regular card payment. The only difference is you’re spending money you loaded beforehand, not credit or funds from your bank account.

What are the main differences between Mastercard credit, debit, and prepaid cards?

- A credit card spends the bank’s money — you’re expected to repay it.

- A debit card spends your money — directly from your bank account.

- A prepaid card also spends your money — but from a separate, pre-loaded balance, not your account.

No single type is “best.” It all depends on your spending habits and financial goals.

Where can I buy a prepaid Mastercard?

The fastest way is online. At Baxity Store, you choose a denomination, pay, and receive your card details instantly by email. No banks, no queues, no credit checks.

Does this card work internationally?

Yes. Prepaid Mastercard is accepted worldwide wherever Mastercard is displayed. For payments in foreign currencies, a standard conversion fee applies — up to 2% on weekdays.

Why is my payment sometimes declined?

The most common reason is 3D Secure (Mastercard Identity Check). Prepaid Mastercard does not support this technology, so payments may fail on sites with strict security requirements. Try another merchant or a different payment method.